Do you know that your credit score will affect your life in one way or the other? For instance, a good credit score determines the kind of loan you qualify for and the interest you will be charged. Therefore, you need to maintain it at a favorable rate to make your life easier. Understanding credit scores can go a long way in helping you shape your financial status. Read on to learn why it is important to maintain a good credit score.

Why Is It Important to Maintain a Good Credit Score?

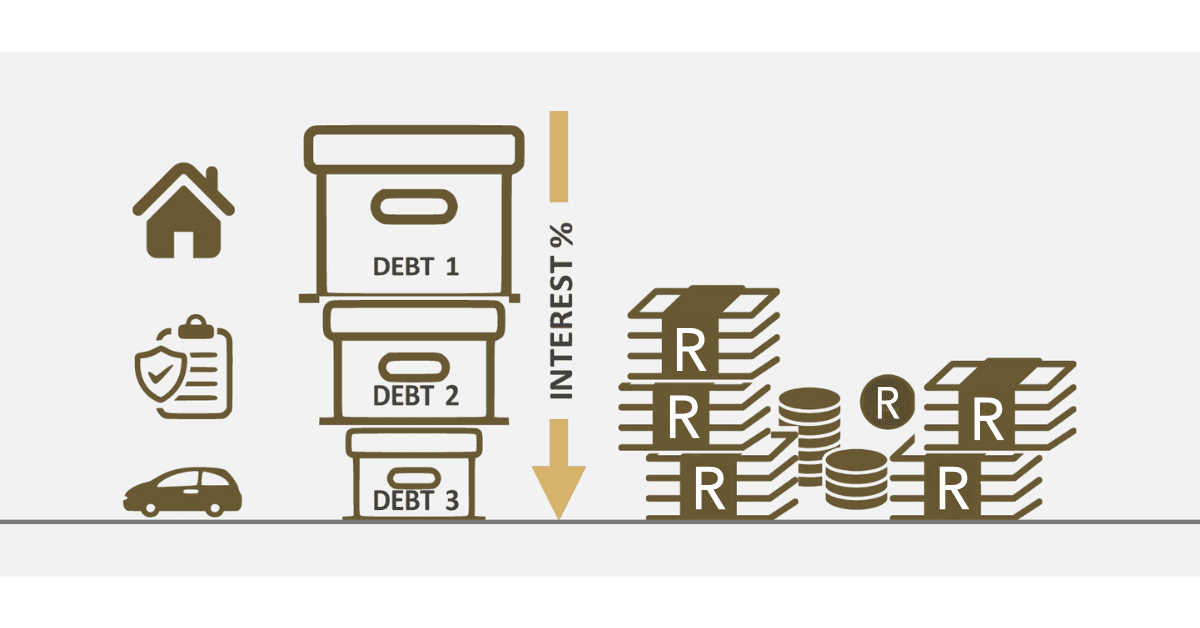

At some point in life, we all need to borrow money to pursue studies, cover other immediate needs, or obtain loans to buy things like homes, cars, and others. When you decide to apply for a loan, the first thing your prospective lender will consider is your credit score. With a good credit score, you will qualify for different types of personal loans at lower interest rates.

In South Africa, a good credit score ranges between 550 and 600. When you have this credit score, the chances of getting loan approval from lenders will be high when you apply for credit. If you want to apply for a business loan, an auto loan, or credit to remodel your home, you will qualify for lower interest rates and fees on different credit lines. If you have bad credit, your loan application may be rejected, or you will be charged high interest if you are lucky to get approval.

A good credit score makes it easier for you to qualify for renting any apartment of your choice. Landlords and property managers usually consider your credit score to determine your capability to pay your monthly rentals. You will not need to pay a huge security deposit or find a cosigner to apply for an apartment when you have a good credit score.

Having a good credit score helps you save money on your homeowners or car insurance. In most cases, insurance companies assess your risk based on your credit score. This is used as a measure to determine how good or bad you handle your finances. When your credit score is good, you’re likely to get fair premiums.

A good credit score is good for your life in general. Whenever you want to borrow money for different purposes, you are likely to meet the lending requirements set by various lenders. You can also enjoy various perks, incentives, and rewards offered by lenders to attract clients with good credit scores.

A good credit score shows that you are trustworthy. This will help you develop a good reputation. When you want to upgrade your credit card, apply for a personal loan, or refinance your existing debt, you will not face big challenges because of your good credit score. Your credit habits can also determine employment decisions made by employers. If you have good credit habits, you’re likely to get promotions or other special preferences at work.

What Is a Good Credit Score and How Do You Improve It?

A credit score refers to three digits used to measure your creditworthiness. It determines whether you qualify for credit or not and the interest you should pay. If you have a high score, it means you are a low-risk borrower while a lower credit score implies that you are a high-risk borrower. Financial institutions use different methods to calculate credit scores, but their scoring systems are based on individual credit records.

The following are the credit score ranges in South Africa:

650 +: Excellent credit. This score allows you to get credit easily and enjoy low-interest rates.

600 – 650: Very good credit. You can get the best loan at a good rate.

550 – 600: Good credit. This score allows you to get good loan deals at acceptable rates.

490 – 550: Sub-prime. With this score, you may face challenges in getting credit and are likely to be charged higher interest rates.

490 and below: Poor credit. People with this credit score usually do not qualify for loans.

A good credit score ranges from 550 – 600. If your credit score is poor, you can improve it by taking the following measures:

- Pay up all outstanding debts

- Avoid late payments or missed payments. Be sure to pay your debts on time.

- Avoid several credits at the same time.

It is vital to exercise financial discipline if you want to improve your credit score.

What Can You Do With Good Credit and No Money?

The main benefit of a good credit score is that it allows you to get loans at lower interest rates. The lender considers your credit score when you apply for a mortgage, auto loan, or other types of personal loans. Therefore, a good credit score helps you borrow money in time of need. Even if you don’t have money but have a good credit score, you will qualify for a personal loan.

Why Is a Credit Score Important in South Africa?

A credit score is important in South Africa since it determines whether you qualify to get a loan or not. Lenders base their decisions to approve or reject loan applications on credit scores. If you have a high credit score, it shows that you are trustworthy, and the lender will approve your application. The interest rate on loans in South Africa is determined by your credit score. When you have a poor credit score, you’ll be considered high-risk by lenders and likely to be charged high interest.

A good credit score also helps you get favorable terms when you upgrade your mobile phone. For instance, you can finance your phone at zero percent when you have good credit. Your credit score will improve your chances of renting a home in South Africa. Landlords usually check your credit history to see if you are reliable when it comes to fulfilling your monthly rental obligations. Additionally, insurance companies also consider credit scores to determine your premiums on car and home insurance.

How Can Your Credit Score Affect Your Life?

Your credit score affects your life in several ways. It is used to measure your creditworthiness and overall financial health. The following are some of the benefits of having a good credit score.

- Access to affordable loans with favorable interest rates.

- Approval for bigger loans and credit card limits.

- Helps you qualify for specific jobs.

- Makes it easier to get rental properties.

- Favorable insurance rates.

- You will not be charged security deposits on utilities.

- Power to negotiate loan terms.

If your credit score is poor, try to improve it to make your financial life easier.

A good credit score is crucial since it impacts almost all facets of your financial life. In South Africa, most lenders use credit scores to determine whether you qualify for a loan or not. A good credit score means you will enjoy several benefits, including lower interest rates, acceptable loan repayment terms, and access to different rewards offered by lenders. You can use the tips above to improve and maintain a good credit score.