When you need to access a line of credit, the last thing you want to find out is that your credit score is too poor to qualify you for it. While most of us are faced with issues like an unfavorable credit score, or one which is too low for what we need, some have an even more awkward problem. That precious score that determines our creditworthiness in the eyes of lenders is missing entirely! If you’ve recently applied for credit and had the nasty shock of seeing a zero, or if you are monitoring your credit report and are puzzled as to why you seem to have no records at all, this is the article for you.

Why Is My Credit Score Zero in South Africa?

A zero credit score may be a perplexing situation, but it’s more common than you may think. Let’s start with some good news! Unless you have some major credit history skeletons in your closet, that 0 is more likely to show that you haven’t used credit than that you are that bad at it.

Of course, if you already know that you have had serious and major issues with credit in the past, including a bunch of court judgments and massive defaulted debt, you can stop reading now. You know exactly why your credit score is so low! It’s the good-old ‘actions have consequences’ life lesson. Now you need to focus on rebuilding it. Don’t worry, it can be done, no matter how poor your credit use was in the past. Start by reviewing your credit report to identify any derogatory marks or discrepancies that still show and are affecting your score negatively.

For everyone else, the most likely reason for that 0 is a lack of credit history. If you haven’t engaged in credit-related activities, such as taking out loans or having a credit card, credit bureaus may not have enough data to generate a score. Additionally, if you’ve recently entered the financial system or are new to credit, this could result in a zero credit score. So this is very common to see among young adults taking their first steps in the credit world. It might also be an issue for widowed or divorced people who relied on their partner’s credit history to access loans in the past. Even if it was your money paying the loan, the record (and the kudos) would have gone to the person whose name was on the loan.

How Do I Recover From a Zero Credit Score?

Do you need to recover from a zero credit score? We have some good news, at least for those whose 0 rating comes from their lack of credit history. You haven’t done anything bad or wrong. The credit bureaus simply have no record of you. So instead of starting from a ‘bad’ place, you have a very neutral profile. If you maintain good financial habits and work on building your credit profile, you will soon see it rise. It will just take some time to establish your credit history.

If your low credit score comes from a history of bad use of credit, your journey will be a little tougher. Unlike the person with no credit history, you are starting in the negative. Historical data counts towards your credit score, and you will need to wait for some of that to pass off your report to get the full impact of your future good behavior. However, it can be done, and in less time than you may think.

No matter which scenario applies to you, here is how to recover from a zero credit score.

- Check Your Credit Report: Get a copy of your credit report from one or more of the major credit bureaus in South Africa. Carefully review the information to identify any errors or inaccuracies that might be contributing to your zero credit score. Knocking off a false or erroneous item will give your score a quick boost (if they exist).

- Establish Credit Accounts: If you don’t have any credit accounts, consider applying for a secured credit card or a small personal loan. Secured credit cards are backed by a cash deposit, making them accessible even for individuals with no credit history. Responsible use of these credit accounts can help you build a positive credit history. You will need to start small, with low-risk lending, to establish your record. So look to items like store cards and then low-balance credit cards at first. No one will give you a 20-year mortgage right out the gate!

- Make Timely Payments: Consistently making on-time payments is crucial for building a positive credit history. Whether it’s a credit card, loan, or utility bill, ensure that you meet all payment obligations promptly. Paying on time and consistently accounts for up to 35% of your credit score, so being diligent is worth it.

- Diversify Your Credit Types: Having a diverse mix of credit types, such as credit cards and installment loans, will positively impact your credit score. However, it’s essential to manage these accounts responsibly, or you will just damage your credit profile. Try not to take credit simply for credit’s sake, especially if you are easily tempted.

- Keep Credit Utilization Low: Aim to keep your credit card balances low relative to your credit limit. High credit utilization (above 50% of what you qualify for) will negatively impact your credit score.

Treat recovering your credit as a marathon, not a sprint. It won’t happen overnight, but every positive step you take will build towards a better credit score and financial future.

How Long Does It Take to Get a Good Credit Score from 0?

If you are starting with no credit history whatsoever, then you will need three to six months to start seeing the benefit of your hard work. This won’t be your final score, but just the first volleys. If you continue good habits, it will continue to rise over time. Experts believe it will take about 8 months to a year to get into the mid-500s, which is the first ‘good’ credit score there is.

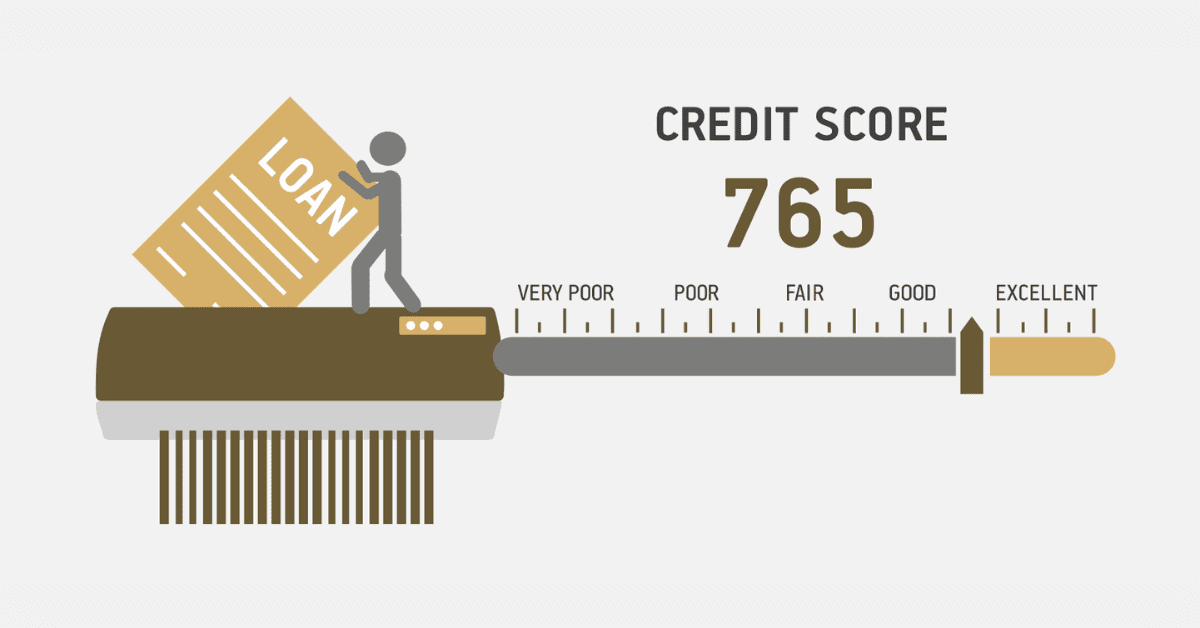

How Fast Can You Go From 0 to 700 Credit Score?

You can make positive changes to your credit report pretty easily. It does take time to build up, however. On average, people need about a year to 18 months to go from nothing to 700, which is a very good credit score indeed. However, it isn’t a race, but rather a collection of good credit habits. How much credit you have, and how well you treat it, will have a big impact on how fast it improves. Additionally, if you start with bad credit instead of no credit, it will depend on how fast the worst credit behavior (like defaults and judgments) take to expire on the report.

Seeing a zero credit score is a shock, but don’t panic. Time and steady progress on good credit habits will soon rehabilitate you.