Investment is one of the good ways to generate wealth, plan a secure financial future, and achieve your long-term goals. In South Africa, this can be expanded to include other advantages than just money returns: overcoming inflation, earning capital, and profiting from the diverse economy. Understanding why one should invest helps a budding investor or one looking to expand his portfolio make personally informed decisions. This article examines why South Africans should invest, what they should invest, and what constitutes a good investment.

Why Should People Invest in South Africa?

Given the country’s vibrant economic perspective, one may want to invest in South Africa for several reasons. The primary reason people invest is to increase their money over time. Inflation in South Africa can assuredly shrink the purchasing power of your money, especially if it just sits in some ordinary form of savings account. When you venture, you stand a good chance of beating inflation, ensuring that your capital retains and hikes in value.

It is also home to the Johannesburg Stock Exchange, one of the universe’s oldest and most liquid stock-based exchanges. With it, capitalists can indulge in opportunities ranging from local equities and bonds to exchange-traded funds. In addition, various fields in the country’s economy also ensure potential opportunities: mining, finance, technology, and retail.

Other reasons it is essential to invest include taking advantage of tax-efficient investment vehicles, such as Tax-Free Savings Accounts. These will enable South Africans to grow their money without taxes on interest, dividends, or capital gains against them. This explains why these accounts are an excellent place to begin investing.

What Areas Are Worth Investing In?

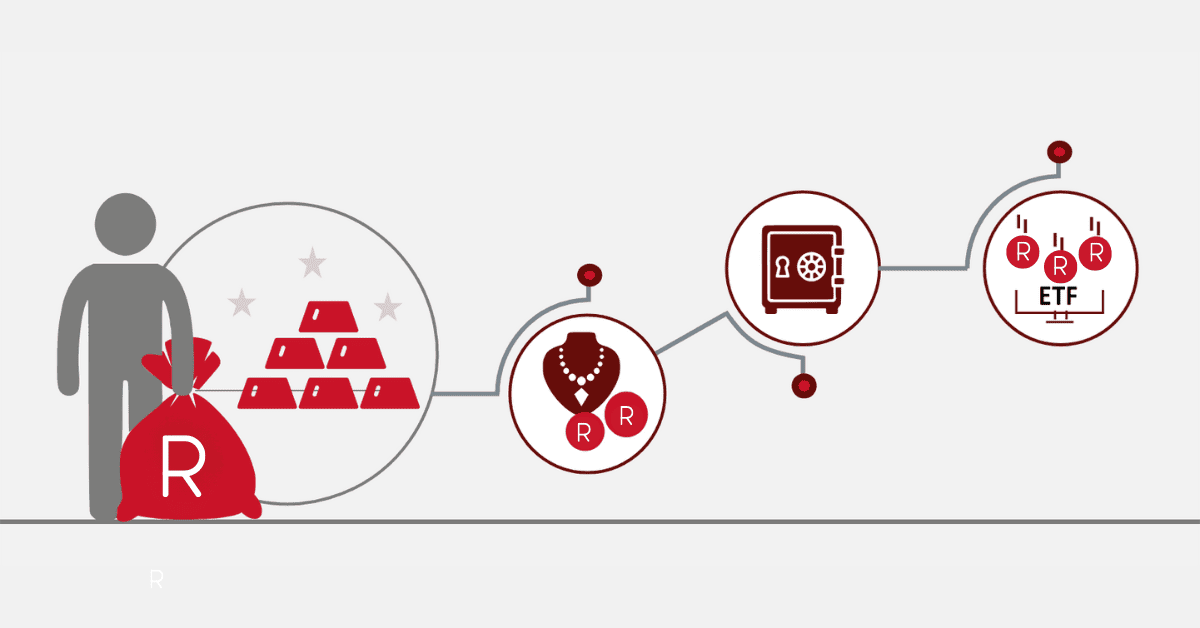

The SA market has many options for different risk profiles and financial goals. Some key investment types that add value to South Africa are highlighted below.

- Tax-free savings accounts: These options are suitable for beginning and seasoned investors. With the TFSAs, there will not be taxes that will be levied against interest, dividends, and capital gains. Further, the maximum contribution per annum is R36,000, making the TFSA scheme even more robust for citizens to make an effective, long-term investment toward retirement or any other goals they want to achieve in South Africa.

- Fixed-Term Savings Accounts or Fixed Deposits: Almost every bank in South Africa has fixed-term savings accounts or fixed deposits with guaranteed returns over a certain period for the conservative investor. Although realized returns may be lower, their certainty and security make them attractive for risk-averse investors.

- Money Market Funds: These funds represent a trade-off between security and liquidity. They are generally less hazardous than equity investments but yield, on the whole, a higher income than ordinary savings accounts. Money Market accounts are suitable for individuals who wish to have their money at the shortest possible notice while earning a reasonable rate of return.

- Exchange Traded Funds: These are among the most popular options for investment in South Africa. They are all set to track an index, such as the JSE Top 40, and offer cheap diversification. Investors can buy ETFs using a stockbroking account, through which they have multi-asset exposure with minimal hassle of portfolio management.

- Government Bonds – RSA Retail Savings Bonds: Government bonds in South Africa are among those good investment options operating safely, with a return over time. People in retirement use these sorts of bonds: RSA Retail Savings Bonds for a regular income stream. They also provide inflation-linked, meaning your money will grow with the rising cost of living, thus value protection.

- Property: Real estate is one of South Africa’s most common and lucrative investment avenues today. Property is a good long-term venture. It has excellent potential not only for rental income but also for capital appreciation. Owning residential, commercial, or industrial properties could yield high returns.

- Retirement Annuity: A Retirement Annuity is an efficient vehicle for retirement savings based on income tax. The premiums paid to an RA are allowance deductibles within specific limits, and growth within the fund is tax-free. It forms one of the best long-term investments that will ensure one’s retirement in style.

What Is a Good Investment and Why?

What constitutes a good investment in South Africa touches on individual financial goals, risk appetite, and time frames. However, some general key characteristics define a good investment:

- Growth Potential: A good investment also has the potential for growth in your capital over time. To illustrate this, stocks listed in the JSE, as well as property investments in high-growth areas, are capable of yielding substantial capital appreciation. Similarly, since they have exposure to a range of underlying assets, the ETFs also hold good growth potential over a long-term horizon. More so, companies involved in sectors like technology, finance, and mining often portray excellent long-term prospects for growth.

- Low Costs: Good investments must also have affordable costs. High management fees, transaction fees, or even hidden charges could nibble into your returns over time. In SA, the ETFs look especially attractive since they have meager management charges compared to actively managed funds. Keeping your fees low ensures you retain more of your venturing gains.

- Tax Efficiency: An excellent investment is also tax efficient. As mentioned earlier, TFSAs are a promising investment avenue for tax-efficient investment in South Africa. They will accrue without necessarily being subjected to income tax returns, thus offering an easy way of capitalizing on long-term gains. In the same context, investment in retirement annuities reduces your taxable income, thus allowing your savings to accumulate without taxes until retirement.

- Liquidity: A good venture should also give you this feature- the freedom to access your cash when you need it. Certain ventures, such as property and fixed-term deposits, can increase your capital for an extended period. Other venturing classes can be liquid quickly, such as stocks, ETFs/ETCs, money market funds, etc. You should balance between illiquidity and liquidity depending on the necessity.

- Return for Risk Taken: A good investment should align with your level of risk tolerance while bringing in reasonable financial returns. Government bonds, for instance, have lower returns but very low risks attached. On the other pole, stocks offer higher returns but with increased risks. Suitable investments mean that the two balance each other so that you can get rewarded for the level of risk taken.

Final Thoughts

Your investment in South Africa can be used for many things, each of which could be put in pursuit of growth or your financial future. Whether you want to retire, defeat inflation, or simply spread your portfolio, there is something for everyone. The secret to successful investing is to make sense of the South African market, choose investments that will meet your financial objectives, and adopt a long-term view. Investing can be one of the most rewarding methods of achieving financial independence, provided proper and intelligent planning exists.