Many people believe the myth that checking their credit scores can lower them, but this is not true. Unless a lender requests a hard inquiry on your report, your credit score cannot be impacted by checking it, especially if you do it yourself. Developing a habit of monitoring your credit is the best option that can help you safeguard your score. This article explores everything you want to know about checking your credit history and its impact on your credit score.

Does Your Credit Score Drop When You Check It?

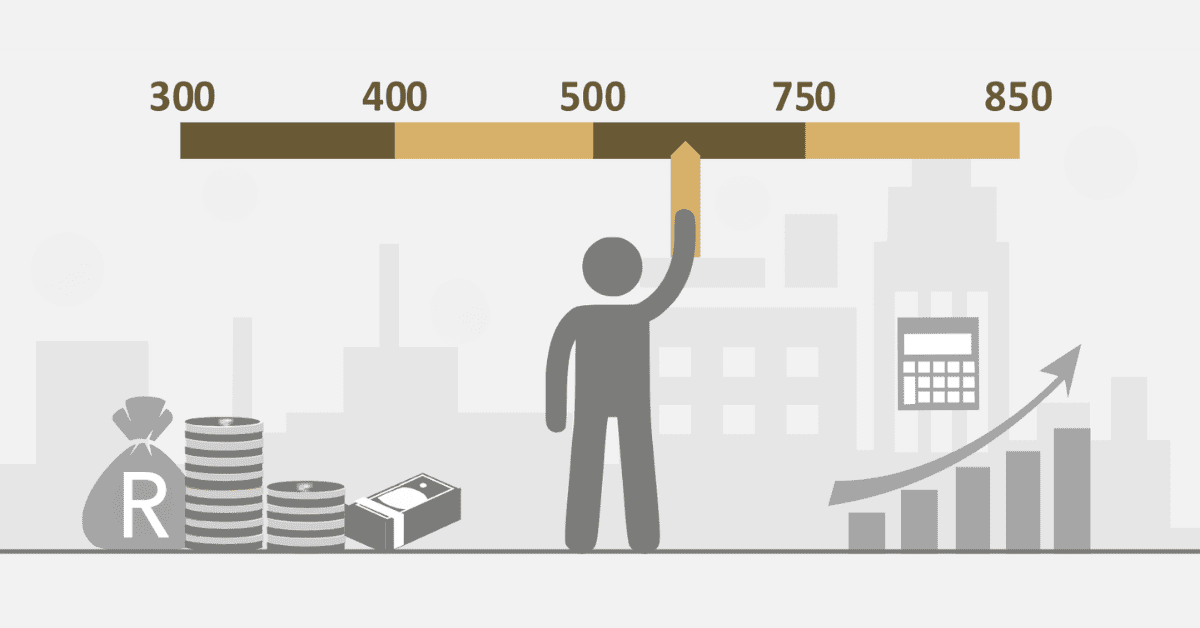

No. If you check your score personally, it will not drop. You can get free credit reports from different sources, and these have no impact on your account. However, your credit score can only drop if it is checked by a credit company or lender. A check by a third party is known as a hard inquiry. When you receive an “inquiry” on your report, you should know that someone has pulled your report.

Lenders and credit card issuers can check your credit score when you have applied for a new line of credit or a new card. They do this to assess your creditworthiness, but each hard inquiry will lead to a loss of a few points from your credit score. The only way to avoid third-party checks of your credit score is to avoid making multiple loan applications within a short period. Instead, you should do some research first before applying for a loan to identify lenders or credit companies with favorable terms.

Why Does Checking My Credit Score Lower It?

A hard inquiry on your credit lowers your credit score. If you check your report, this is known as “soft inquiry” and nothing will happen to your credit score. Lenders and credit card companies should first seek consent from the account owner before pulling hard inquiries, but this is not always the case. Therefore, you need to check your free credit reports provided by credit bureaus to ensure that your account is safe.

Why Did My Credit Score Go Down Without Doing Anything?

In some instances, you may be surprised to see your credit score going down without doing anything. This can be caused by different factors which you should know. If there are errors on your credit report, they can hurt your credit score. You can avoid this by checking your credit report regularly and disputing the errors to credit bureaus so you keep your credit report clean.

Your credit score can decline if you are a victim of identity theft. Someone can steal your documents and fraudulently open credit accounts in your name without your knowledge. If you experience this situation, contact a credit bureau to report and dispute the issues. Consider freezing your account until the problem is fixed, which usually takes up to 30 days.

If you share your credit card with someone, they may use it without your knowledge. You will end up experiencing unexpected balances that can lead to missed payments. You may only see this when you check your credit score. If you suspect credit card cloning, contact your credit card issuer immediately so the issue is resolved. Another step you can consider to protect your card is to avoid sharing it with anyone even the most trusted ones.

When you co-sign a loan on behalf of someone, you will be responsible for the debt when the individual involved defaults on their payment. While co-signing is not an issue, if the person fails to maintain their payments, your card will end up accruing a large balance. As a result, your credit score will drop. Talk to your relative about the issue and try to find an amicable solution so that your credit score does not continue to suffer. Alternatively, you can pay off the credit card balance and close it to preserve your credit score.

Applying for multiple credit lines within a short space can impact negatively your credit score. Prospective lenders and credit card companies will hard inquiries to assess your creditworthiness and this will affect your score. Instead of submitting several loan applications, do some research, so you choose the appropriate lender or credit company without compromising your credit score. When your credit score has been affected, stop applying for new credit until it rebounds.

Closing an old credit account can be another reason for a dip in your credit score even without doing anything. The age of your account significantly affects your credit score. If you have a long positive credit history, you should maintain it to enhance your score. Another reason for a drop in your credit score might be related to paying off your loan. You will get a lower credit score due to the inactivity of your credit account. To avoid this, make sure you have another functional credit account and pay your balances on time.

How Many Times Can You Check Your Credit Score?

You can check your credit score as many times as you want since this does not affect it in any way. Credit bureaus provide free reports, so you can utilize these. Signing up for a free site to get regular updates about your credit report can help you keep pace posted about your credit score. If there is an error on your report, ensure you dispute it to a credit bureau so it is rectified to safeguard your account.

Checking your credit score regularly is the best thing you can do to maintain it. Contrary to popular belief, this action does not affect your score in any way. Your credit score can only drop if a lender or credit card issuer performs a hard inquiry. Avoiding multiple applications of credit lines at the same time can help you avoid this challenge. Knowing your credit score status can go a long way in helping you to manage your financial affairs. Report any errors or suspicious activities on your account to the responsible authorities.