Once you find yourself in a country that considers credit score as the criteria for lending and borrowing money, you must be ready to put in the effort for your credit.

The concept of credit score regulates and controls spending; whether huge or low amounts, it controls the spending habits of people.

Credit score signifies a lot about an individual financial abilities. These are clear methods of ensuring individuals understand what to buy, when and how.

The score is influenced by various factors, including payment history, credit utilisation, length of credit history, types of credit, and new credit. Late payments, high debt, or a limited credit history can lead to a low score, which can make it difficult to obtain loans and get favourable interest rates.

Having a high credit score opens up numerous opportunities when it comes to securing a mortgage, car financing, business loans, and much more.

The conversation surrounding credit scores keeps going on, and a series of questions come up to address the concerns of many people. Have you noticed any sign of a drop in your credit score?

Are you worried about why your score is dropping for no reason? Well, we are about to share some exciting and insightful information on credit score drop, fixing your credit score, what can hurt your credit score etc.

Why did my credit scores drop for no reason?

Ever seen your credit score drop for no reason? Sorry to burst your bubble, but this is a misconception, and it is not true.

There are no facts linked with credit scores dropping for no reason. Your credit can not just drop without any influence. There is always an obvious reason for your score dropping.

If you see your credit score dropping, you must thoroughly look into your account and ensure you understand what is happening.

There is always a factor that could trigger your score to drop. Always look into your credit score report to understand what may have caused your score to drop.

How do I fix my credit score drop?

Improving your credit score requires patience and dedication, but there are various measures you can take to address a decline in your credit score.

It’s important to keep in mind that there isn’t a single solution that works for everyone, and the effectiveness of these strategies can differ based on your unique financial circumstances.

If you open several new credit accounts within a short period, it can hurt your credit score. Opening new accounts has the potential to decrease the average age of your credit history.

Improving your credit score requires patience and time. By consistently practising good financial habits, you will gradually improve your creditworthiness over time.

Making timely payments is vital to fixing your credit score drop. This means ensuring that you pay your bills and debts on time, without any delays. Additionally, reducing your overall debt is another important step.

By actively working towards paying off your debts, you can demonstrate responsible financial management and improve your creditworthiness.

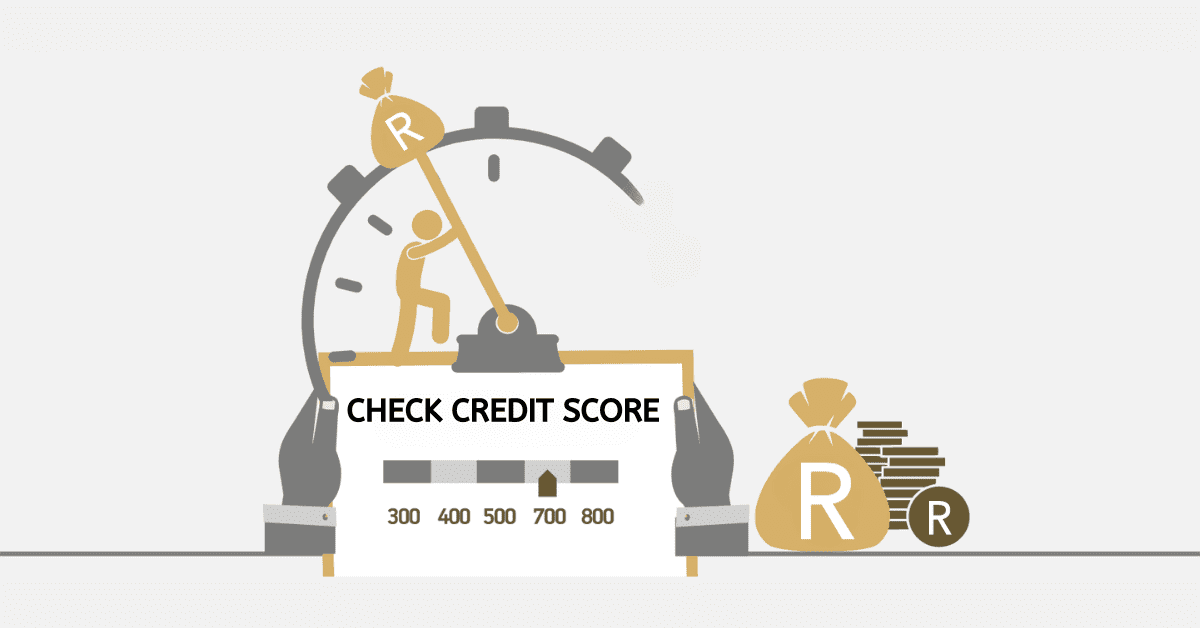

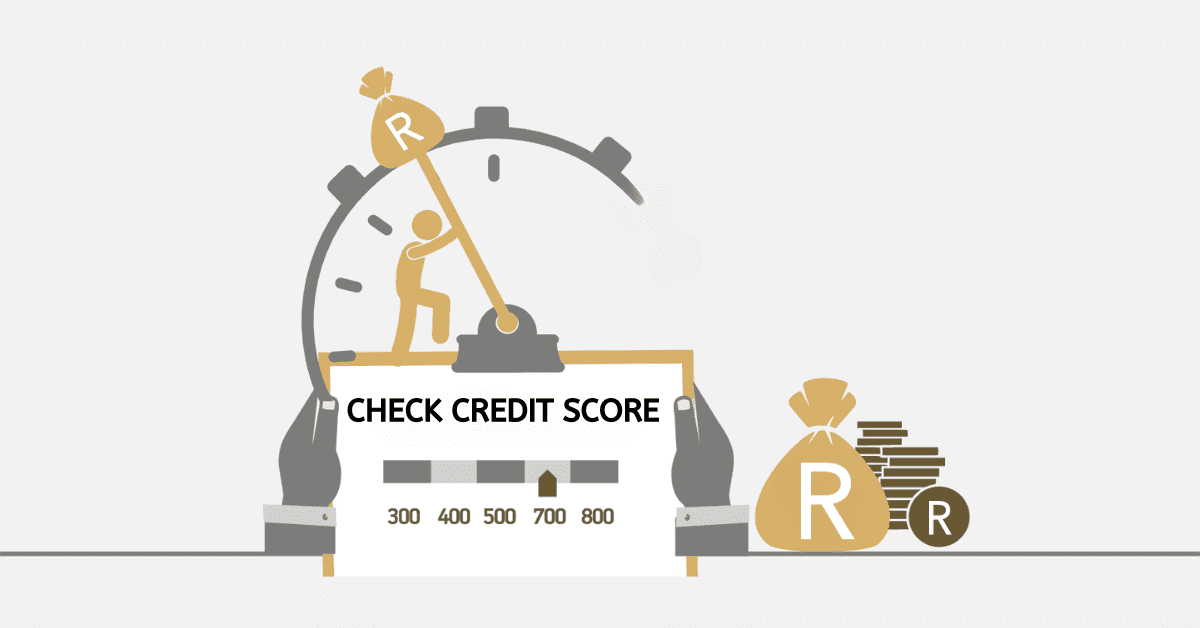

Diversifying the types of credit you have can also have a positive impact on your credit score. This means having a mix of different credit accounts, such as credit cards, loans, and mortgages, which shows lenders that you can handle various types of credit To help manage any difficulties with your credit score, it’s important to regularly check your credit report and take action if you find any errors. This can be an effective way to minimise any negative impact on your score. Maintaining a healthy credit score is extremely important when it comes to securing financial opportunities and ensuring long-term stability.

Should I be worried if my credit score drops?

The last thing you should do is to be worried about your credit score but rather look into how to fix it. Worrying about your credit score drop can not change the status of your credit score.

While you may be concerned about your credit, a low credit score can indeed affect your financial plans.

What can hurt your credit score?

Credit cards have a major impact on your credit history and, as a result, your credit score. Although credit cards can be beneficial for managing finances wisely, There are negative factors that can hurt your credit score.

Here are some key points that can hurt your credit score.

- One important factor that can significantly hurt your credit score is failing to make payments on your credit card. When you make late payments, you may be subject to penalties and it can negatively impact your credit score. If you consistently fail to make payments, your card issuer might decide to send your account to collections, which can negatively impact your credit scores. It is crucial to pay credit card bills on time to avoid any negative consequences.

- Your credit score is influenced by your credit utilisation, which refers to the amount of credit you use compared to your credit limit. Having high balances on your credit cards can hurt your credit scores because it increases your utilisation ratios. Ensure credit utilisation is at a minimum of 30%.

- When you apply for a credit card, most credit card issuers typically conduct a hard inquiry on your credit report. Having one hard inquiry on your credit report may not have a significant impact on your credit score.

However, if you have multiple inquiries within a short time, it could raise concerns among lenders and potentially lower your credit score.

How do I clear my credit history clean?

If you are referring to the process of “clearing” your credit history by removing negative items or all items, it is important to note that this is generally not legally possible in most cases. A credit account can stay on your credit reports if it is accurate, verifiable, and complete. If not, you have the right to dispute it, and it may be removed through the credit repair process. While it is true that some negative items may have accuracy and verification issues, not all of them can be removed.

Unfortunately, it is not possible to completely clear your credit history. One option available to you is to obtain a new, complimentary credit report. You are entitled to receive one free report annually. Take the time to carefully review the report and examine its contents. If you want to challenge the information in the report, make sure you have proper documentation to support your claims. This includes evidence for every item you are disputing, as you are contesting everything mentioned in the report. Ensure that you have paid off and resolved all the disputed matters before proceeding.