Cell phone contracts were once seen as a good ‘starter line’ of credit for young South Africans looking to build their credit score. Once you had done some work with a small line of credit, like a store account or even a small balance credit card, a phone contract was the next step to help build that fantastic credit score we all dream about. However, as handsets have gotten more expensive and the risk to lenders is higher, cell phone contracts are no longer as easy to get as they once were. Today, we will be looking at this in more detail, and what you can do if you are on the market for a cell phone contract without a good credit score to back it.

Can You Get a Cell Phone Contract with No Credit Score?

If you are hoping to directly approach the big South African cellular networks- Telkom Mobile, MTB, Cell C, and Vodacom- you will not get a cell phone contract with no credit score. In fact, many people with decent credit scores are still struggling to get these contracts! The cellular companies use not only your credit score but an in-house scorecard that takes into account other factors. They are now very stringent. Frustratingly, they are also opaque, with none of the companies being upfront about what goes into these ‘scorecards’.

However, it all comes down to the concept of ‘creditworthiness’. You are asking the operator to hand you not only ‘free’ airtime and data every month, but also a rather pricey handset to use it. Make sure that you look like the best possible candidate, with the strongest possible credit score, before you apply to ensure you have a favorable result.

Which Phone Company Does Not Check Credit

That doesn’t mean you can’t get a cell phone in South Africa without a credit score, however! There are some specialized third-party brokers, like aptly named nocreditchecks.co.za, that will try to get cellular contracts for those with poorer credit scores. These are not as simple to use as going directly to the operator, of course, and you must do your due diligence to make certain they are legitimate and trustworthy entities. Additionally, just because they aren’t using a credit check as their primary decision doesn’t mean you will be automatically approved! These places typically use other factors, like your employment history and salary data, to decide whether or not you will qualify. You will still need to meet their benchmarks.

Alternatively, you can also step outside the credit mobile cycle completely. Prepaid sim cards and devices you purchase outright through stockists like Takealot.com, Pep stores, and brick-and-mortar cell phone stores do not need any credit checks at all, as no credit is involved. So they are always an option if you are struggling to find a cell phone contract that will take your credit score. You may not be able to afford the flashiest flagship handsets, but this is a very viable option for those whose credit history is already poor.

What Cell Phone Company is the Easiest to Get Approved For?

In South Africa currently, all of the major cell phone operators are equally difficult to get a cell phone contract for. Even people with objectively strong credit scores are finding their applications denied thanks to those mysterious in-house scorecards. While MTN was once seen as the ‘people’s’ operator, and easier to deal with, this is no longer many South Africans’ experience.

What is the Minimum Credit Score for a Mobile Phone Contract in South Africa?

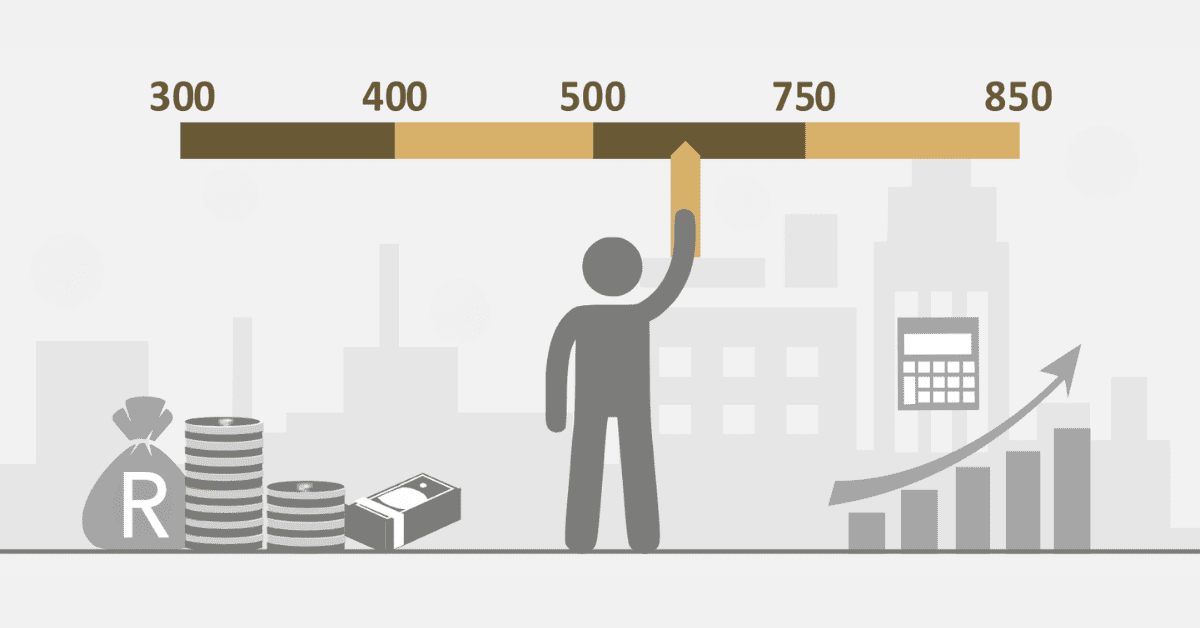

Technically, there is no minimum credit score for a mobile phone contract in South Africa. However, lenders in general do not easily offer credit to those with a credit score below the 640 point mark. Given the current difficulties in getting approved for mobile phone contracts South Africans face, it is a smart idea to have your credit score in that range, at a minimum, before applying for a cell phone contract.

Remember that lenders don’t just robotically hand out credit if your credit score hits a certain benchmark. They will look at many other factors to also assess your risk and trustworthiness, including how much debt you already have and your income to service it. These are, no doubt, part of those mysterious ‘scorecards’ mobile phone operators use, too.

While getting a cellular phone contract in South Africa is no longer as easy as it once was, many South Africans still rely on contracts to stay connected. So it is well worth doing everything you can to make yourself look like an attractive risk before you apply for your contract. This includes ‘tidying up’ your credit score as much as possible to make yourself look like the best possible credit candidate. Always remember that something as simple as paying your existing accounts on time every month will have a positive effect on your credit score. It’s never too late to start improving your creditworthiness!