You have heard about the negative impacts of having a low credit score, but do you know the scoring system used to obtain it? Although the Fair Isaac Corporation (FICO) score is popular, other traditional scoring methods offered by credit agencies like Transunion can also used to track your credit score. It is important to note that a good credit score comes from good habits, regardless of the different scoring systems utilized by lenders. This article explores the key differences in credit scoring systems offered by FICO and Transunion.

Which Credit Score Is Better FICO or Transunion?

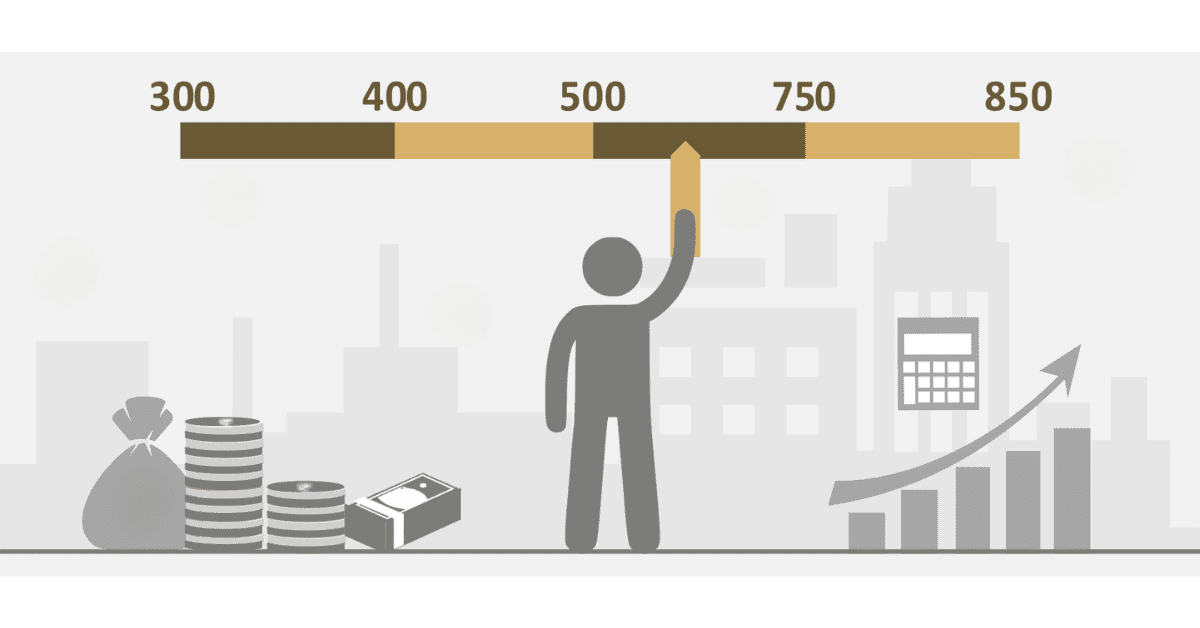

FICO is a reputable data analytics company that specializes in credit scoring and is popular for its FICO credit score. Most lenders use the FICO credit score to determine the borrowers’ creditworthiness since takes a holistic approach to analyzing data. The FICO score involves any number between 300 and 850 that is used to show your level of risk in terms of repaying your loan.

For instance, a good credit score is anything between 550 and 700 in South Africa, and it helps the borrower obtain a good loan deal with favorable conditions like low interest. FICO is trusted by many lenders because it provides a comprehensive image of the potential borrower. FICO considers aspects like a longer financial history, is more flexible, and considers mitigation due to medical circumstances.

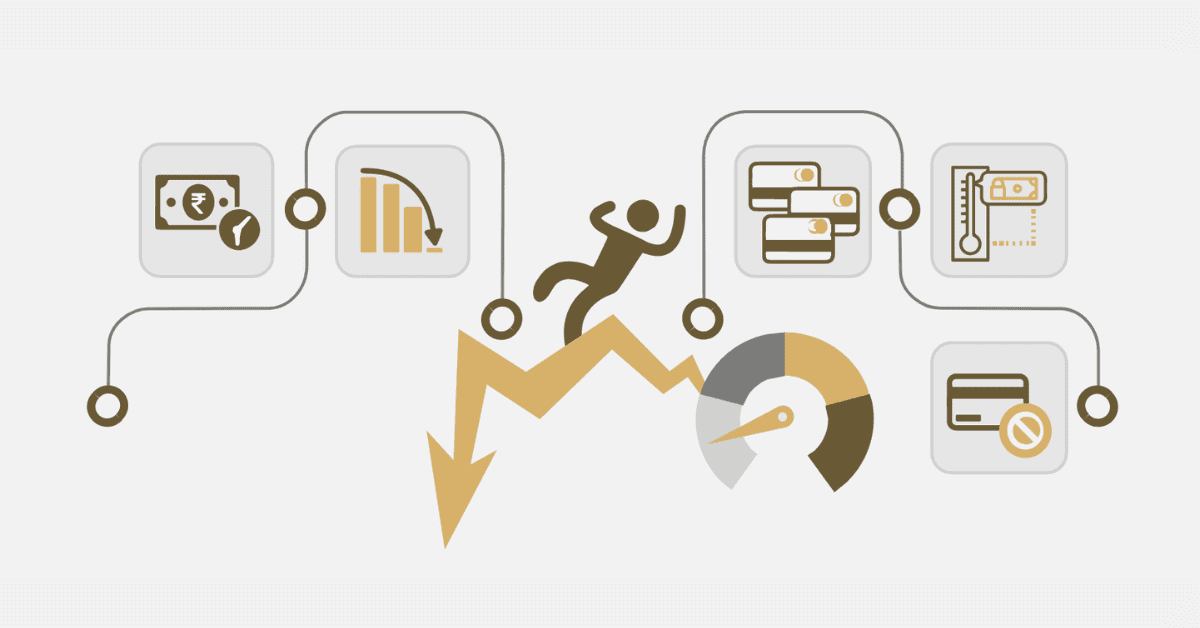

On the other hand, credit bureaus like TransUnion work with FICO, and they generate reports about individuals’ credit history by collecting information from lenders. TransUnion evaluates five categories to come up with credit reports, which include the following:

- Payment history

- Credit age

- Credit utilization

- Type of credit

- Hard inquiries

Individuals are expected to keep their credit utilization below 30% to show they are responsible.

Both FICO and credit bureaus assign the most weight to payment history since it shows that one is capable of meeting their repayment obligations. Diversity of credit refers to the types of credit accounts you have, and it receives less weight.

FICO score is based on your payment behavior and payment history. The calculation of FICO credit score is based on the five categories below:

- Payment history (35%)

- Amount owed (30%)

- Credit history and age (15%)

- Diversity of credit (10%)

- New credit accounts (10%)

The credit scoring system used by FICO is trusted by many lenders because it is transparent.

Why Is Transunion Score Higher Than FICO?

TransUnion and FICO use different credit scoring methods, and this can lead to differences in scores obtained. The likely reason why the TransUnion score is higher than FICO is that the two use credit information obtained from different sources. Therefore, one agency may have more up-to-date information than the other, and this contributes to the difference in the score.

Is Transunion and FICO the Same?

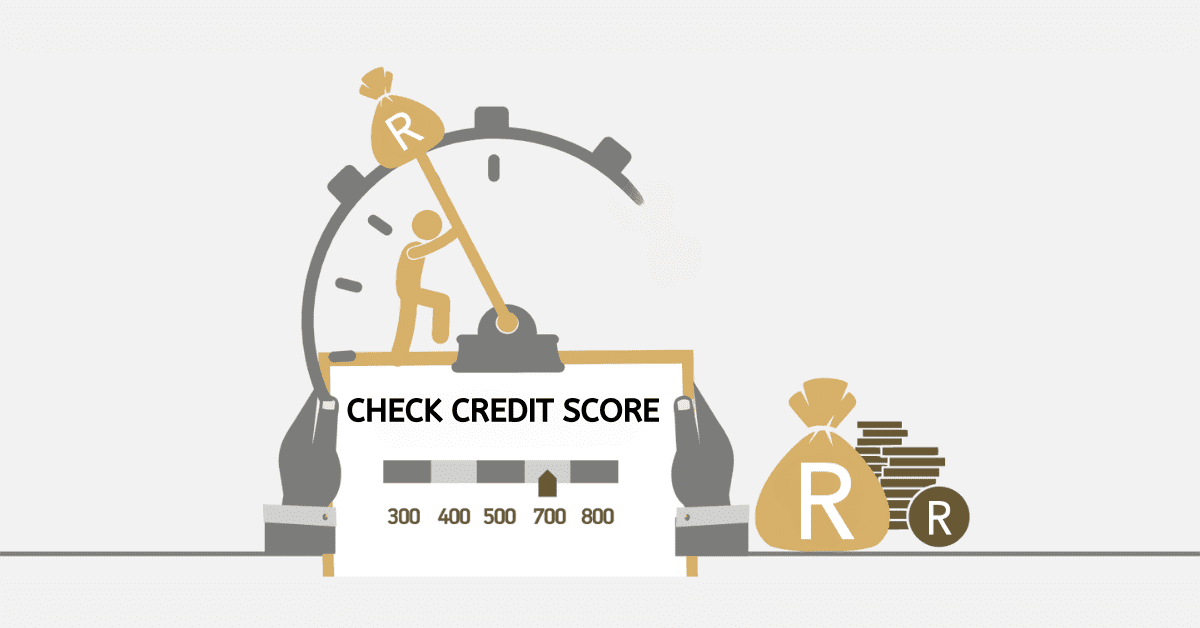

FICO is a data analytics company responsible for creating credit scores that are commonly used by lenders to determine the borrowers’ creditworthiness when they apply for loans. FICO scores range from 300 to 850, and they help lenders make informed decisions when evaluating different loan applications.

On the other hand, TransUnion is one of the credit bureaus in South Africa, and it is responsible for compiling information about borrowing habits of different consumers. It uses the data to create credit reports, which are in turn used by lenders to check if the borrower qualifies for the loan.

Although FICO and TransUnion generate information used in the credit and lending process, they are different. For instance, FICO uses a numerical scoring system, which is popular among many lenders. TransUnion is a credit bureau that creates credit reports, financial information, and credit scores for lenders, consumers, and businesses. TransUnion mainly focuses on creating credit reports used by lenders to evaluate the borrowers’ creditworthiness.

Do Lenders Use FICO or Transunion?

Most Lenders in South Africa use FICO credit scores to assess borrowers if they qualify for different loans. FICO score is more detailed, and its calculation is based on the following factors.

- Payment History (35%)

- Amounts Owed (30%)

- Length of Credit History (15%)

- New Credit (10%)

- Credit Mix (10%)

Lenders can choose FICO scores to use when conducting credit checks. However, for detailed credit reports, lenders can use TransUnion. In some instances, the lender can use both FICO and TransUnion depending on the type of credit they would be dealing with.

Why Is My FICO Score So Low Compared to Transunion?

Your FICO score may be low compared to TransUnion depending on the credit scoring model used. Since different scoring methods are used, the scores from various providers will vary. TransUnion obtains data used in the calculation of credit history from different sources including individual credit history, details from lenders, and others. This can contribute to the difference in scores. FICO mainly focuses on the five variables that include payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and credit mix (10%).

What Is the Most Reliable Credit Score Check in South Africa?

FICO is the most reliable credit score check in South Africa since it is utilized by more than 90% of lenders. Experian is another trusted credit bureau that offers different credit services like free credit scores and credit reports. It also provides consumers with the necessary tools they need to improve their credit scores and manage finances.

Although different credit scoring methods are used to determine the borrower’s eligibility for a loan, FICO is more popular and commonly used by lenders in South Africa. TransUnion provides detailed credit reports to lenders so they can make informed decisions when handling loan applications. These two entities provide information used in credit and lending processes, but they are different.