When receiving Unemployment Insurance Fund (UIF) benefits in South Africa, having a bank account with a financial institution that the UIF accepts is essential. This article provides an overview of the banks accepted by the UIF, the process and timeline for bank verification, changing banking details, submitting bank details to the UIF, and activating a UIF account.

Which Banks Are Accepted by UIF?

The UIF accepts bank accounts from various reputable financial institutions in South Africa. These include but are not limited to, major commercial banks such as:

- First National Bank (FNB)

- Standard Bank

- Absa Bank

- Nedbank

- Capitec Bank

These banks have established networks and infrastructure to facilitate secure and efficient payment processes for UIF benefits. When applying for UIF, individuals must provide their valid bank account details from one of these accepted banks to ensure the seamless transfer of funds.

How Long Does UIF Bank Verification Take?

The process of bank verification by the UIF typically takes a few weeks. Once an individual submits their UIF claim, including their bank account details, the UIF initiates the verification process. This involves confirming the authenticity and accuracy of the provided bank details.

The verification timeline may vary depending on various factors, such as the volume of claims being processed by the UIF and the efficiency of communication between the UIF and the respective bank. On average, the bank verification process takes approximately two to four weeks.

During this period, it is crucial to monitor communication from the UIF and respond promptly to any requests or queries. Timely and accurate submitting the required information can help expedite the bank verification process and ensure that UIF benefits are paid out without unnecessary delays.

Can I Change My Banking Details on UIF?

Individuals can change their banking details on the UIF system if they need to update their account information. This may be necessary in situations such as opening a new bank account, closing an existing one, or switching to a different one.

To change banking details on UIF, individuals can follow these steps:

- Contact the UIF: Contact the UIF through their helpline or visit their website to find the appropriate contact details for banking-related inquiries or changes.

- Provide necessary information: When communicating with the UIF, be prepared to provide personal identification details, the current UIF reference number, and the new bank account information.

- Follow UIF instructions: The UIF will provide specific instructions on the required documentation and process for updating banking details. Follow these instructions carefully to ensure a smooth and successful change.

It is important to note that changes to banking details may require verification, which can add additional time to the process. It is advisable to make necessary changes to avoid any disruptions in receiving UIF benefits.

How Do I Submit My Bank Details to UIF?

Submitting bank details to the UIF is a crucial step in the UIF application process. To provide your bank account information, follow these steps:

- Complete the necessary forms: Fill out the UIF application form accurately, ensuring that the section for bank details is properly completed.

- Attach supporting documents: Include any required supporting documentation, such as a certified copy of your identification document (ID) or passport.

- Apply: Submit the completed UIF application form and supporting documents to the designated UIF office. This can typically be done in person or online, if available.

- Keep copies for reference: Make copies of all the documents submitted for your records. These copies can serve as proof of your bank details submission.

By following these steps and providing accurate and up-to-date bank details, individuals can ensure that their UIF benefits are paid into the correct bank account.

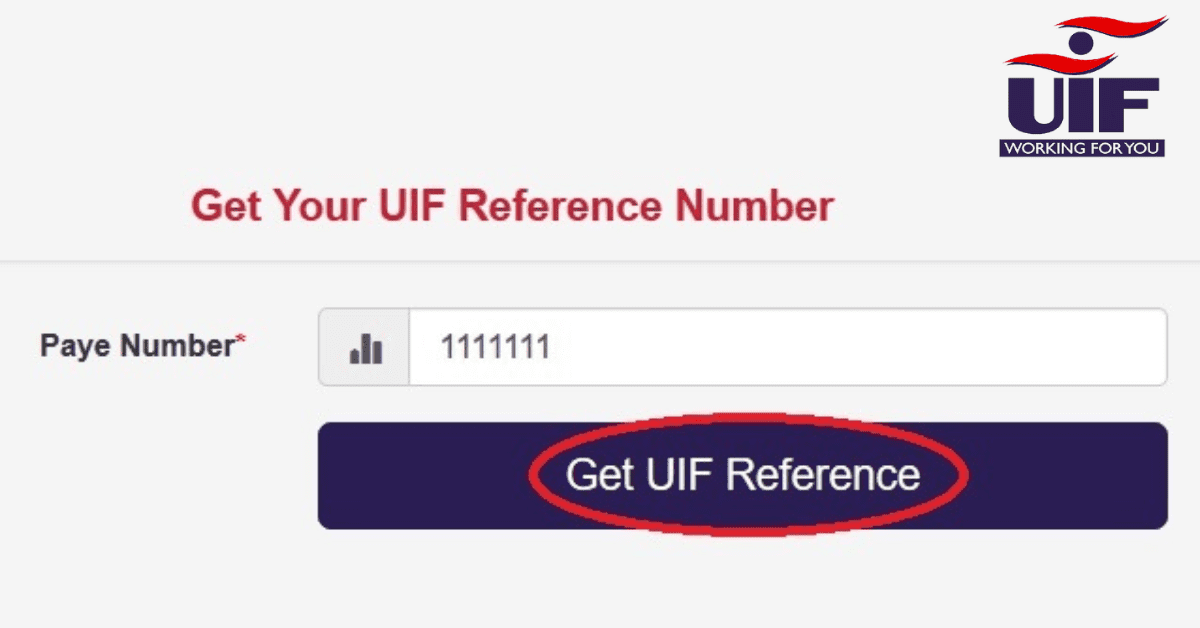

How Do I Activate My Account on UIF?

To activate your UIF account, follow these steps:

- Visit the UIF website: Go to the official website of the UIF and navigate to the relevant section for account activation.

- Provide necessary information: Fill in the required fields with accurate personal information, including your UIF reference number, identification details, and contact information.

- Create a username and password: Follow the instructions to create a unique username and password for your UIF account. Ensure you choose a strong password that includes letters, numbers, and special characters.

- Complete the activation process: Follow the prompts to complete the account activation process. This may involve verifying your email address or mobile number through a verification code sent by the UIF.

- Access your account: Once the activation process is complete, you can log in to your UIF account using your username and password. You can manage your UIF benefits, update information, and access relevant services.

Activating your UIF account enables you to access important information, track the status of your UIF claims, and manage your UIF benefits efficiently.

In conclusion, having a bank account with one of the accepted financial institutions is crucial for receiving UIF benefits in South Africa. It is important to provide accurate bank details, follow the necessary procedures for bank verification, and activate your UIF account to ensure the smooth processing and payment of UIF benefits.