If you are an immigrant, asylum-seeker, or foreigner in South Africa, you may be wondering how you can access your credit report and credit score. Is the process different because you are not a South African citizen? With so many foreign nationals contributing positively to our society, this is a rather important question. Today we are here with all the answers.

Where to Check My Credit Score as a Foreigner?

There is essentially no difference between accessing your credit score as a foreigner or a national. Remember that your credit score is tied to your financial behavior around credit in a specific country and nothing more. The bureaus receive reports from local financial institutions and create your credit profile based on that.

So if you are legally in the country, you are essentially just another ‘citizen’ in their eyes. The bureaus do not differentiate based on residency. However, if your residency status is forcing you to live ‘off the books’ with only informal financial sources, you will not have a credit profile built up. Most lenders won’t work with people who do not have legal residency and the trappings that come with it, such as the ability to be formally employed, have a permanent residence, open a bank account, and apply for loans. Without lending behavior, there can be no credit profile.

This means you can follow the same route as South African nationals to check your credit score. Once in a rolling 12-month period, you have the right to pull a full credit report from each of the major bureaus, and you can opt to pay a token fee for more should you need to. There are also third-party sites that offer monthly credit profile tracking for free directly to your inbox. Many banks now offer a credit score widget tied to your banking app, and there are options like using the Money Market kiosk in Checker’s stores, too. Plus, most credit bureaus allow you to sign up for notifications if there are changes or inquiries on your credit status.

How to Check Your Credit Score with a Passport Number in South Africa?

All of the major credit bureaus in South Africa will accept a valid and recognized passport number as an alternative to an SA ID card. You will simply use your passport number in place of an ID number, and choose the ‘passport’ option when prompted to.

Should you have any issues doing so, you can reach out to the bureaus themselves for some guidance on what to do. Often, it will simply be a matter of proving your residency status in the country.

How to Check if You Are Blacklisted for Credit in South Africa?

There is a prevailing idea in South Africa that there is a secret ‘blacklist’ lenders keep among themselves. If you are on it, people believe you will be immediately declined for credit anywhere you go. This is, however, a complete fiction based on the days when credit bureaus only tracked negative

This common misconception has introduced the term ‘blacklisting’ to marketing-speak for companies that cater to people with poor credit scores. If you are applying for credit with a poor credit score (or no credit score- they are different), most other lenders will turn you down. So today, we see the term used as a catch-all descriptor for people with bad credit.

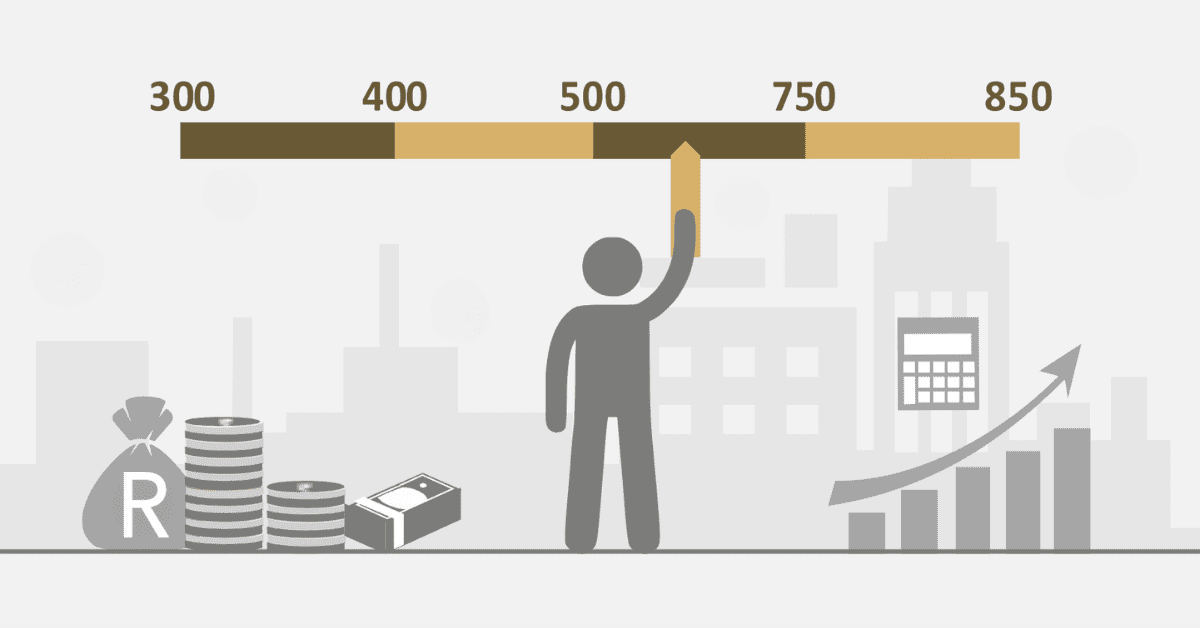

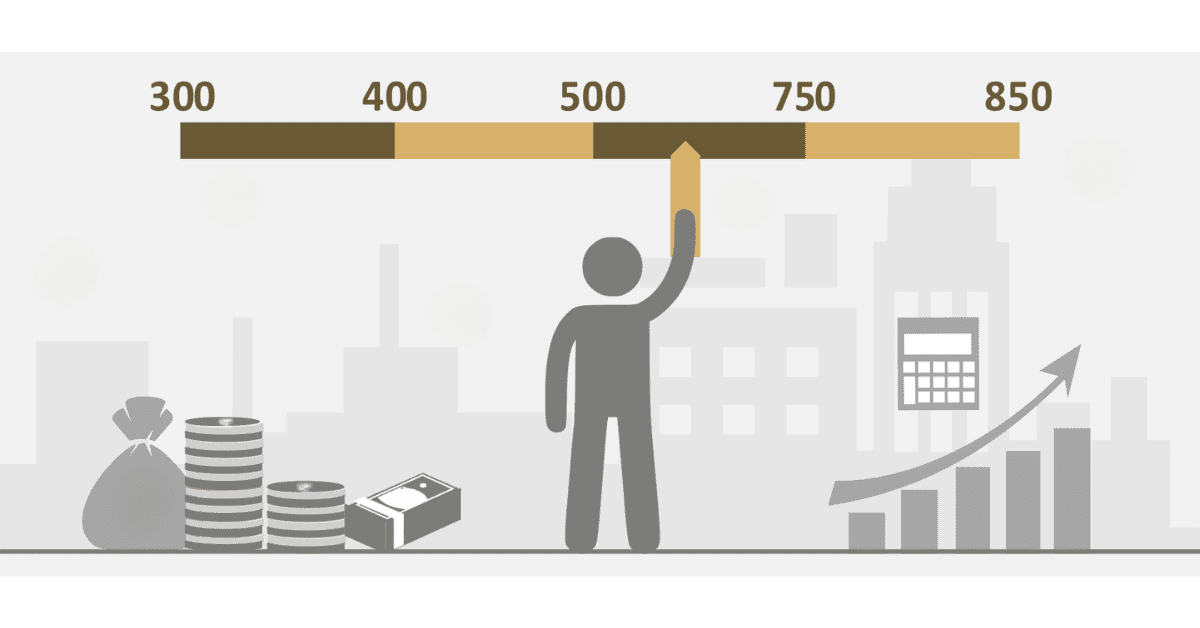

To check if you have a bad credit score, you need to pull a credit report from the bureaus or use one of the new third-party options to track your credit score. The South African average credit score is currently in the 560-600 range, which isn’t very good at all! Anything less than that, and you will struggle to access credit. Even lenders who specialize in ‘blacklisted’ people will turn down anything below the mid-400s, and the score bottoms out at 300.

Luckily, your credit score is never set in stone. Proactively take steps to address outstanding debt, pay on time, and use credit responsibly, and you can rehabilitate even the worst credit score with time.

Is My Credit Score International?

No, your credit score is not international. This is often an issue for newly-arrived foreigners or foreigners who have been working ‘under the table’ for a long time. You could have a perfect credit score back home, but South African bureaus don’t know who you are! This can only be addressed with responsible credit use over time inside your new country. For this reason, it pays to start building a local credit history with some low-stakes credit lines long before you need it for major purchases like cars or homes.

Some newer cross-border credit agencies specifically cater to foreigners for this reason, allowing them to bring some of their credit record at home ‘along for the ride’. One of these is US-based Nova, focused on immigrants to the U.S. There is not yet a cross-border credit bureau in SA, however. Even though most of our big credit bureaus, including TransUnion and Experian, operate in many countries, there is no data sharing due to confidentiality issues and the different privacy laws per country.

Checking your credit score as a foreigner is not much different than doing so as a citizen, although you could hit some of the usual snags based on their residency status and legality.