Making smart decisions around borrowing, lending, and managing your overall financial well-being starts with having a good idea of your credit score and what has shaped it. Luckily, South Africans have a wealth of free and super-low-cost options to access their credit scores, even though few of us realize it! Today, we will walk you through everything to know about finding and accessing your credit score safely and for free. Let’s get started!

Where Can You Access Your Credit Score for Free?

So, let’s cut to the chase- where can you access your credit score for free? Firstly, know that you can access one free credit report directly from each of the major credit bureaus once in a 12-month period under SA law. After that, you are welcome to pull new credit reports as you please, for a rather small amount- most are in the R20-R30 region. You can also sign up for free alerts when things change on your credit profile.

However, you aren’t tied to just the credit bureaus to get your credit score free! There is now a wealth of financial institutions and third-party websites that also allow free credit reports. Many of these will send your score directly to your email every month, making them a super-convenient way to take charge of your credit history. Of course, as this is sensitive financial information, you need to be careful about who you trust. ClearScore, which aggregates data from Experian and a smaller credit bureau, is one of the most trusted and popular options. There is also Kudough.

Many South African banks are now offering credit score tracking directly through your banking app, too. Standard Bank was the pioneer, but several other banks now offer this option, too. While these will only give you your score through a widget, not a full report, it is a very convenient way to track changes in your credit score.

How Can I Check My Credit Score Without Harming It?

“Hang on,” you may be thinking, “Doesn’t checking your credit score lower it?” This is a common misconception and stems from a misunderstanding of the different types of credit checks that can be done.

When you access your credit score directly from credit bureaus or authorized platforms, it is considered a ‘soft inquiry’ and does not impact your credit score. Soft inquiries are inquiries made for information only and do not involve a review of your credit history by potential lenders or creditors.

This is different from the ‘hard inquiries’ which happen when you apply for credit products. Hard inquiries can have a temporary negative impact on your credit score, so it’s advisable to limit the number of hard inquiries on your report, especially within a short timeframe. This only happens when your credit report is viewed by a lender to assess your creditworthiness, not with routine monitoring or other ‘quick checks’, so don’t worry. Tracking your credit report over time is a valuable tool to boost your creditworthiness and help you take ownership of your debt position, and you can only gain by regularly monitoring your report. There will be no detrimental impact on your credit score.

Can I Check My Credit Score Through My Bank?

You can now access your credit score, although not a full credit report, through many of the major South African banks. This was first pioneered as a banking app widget from Standard Bank, and more banks are rolling it out as a feature now. If you’re not sure if your bank has this service, ask a customer service representative, and they will be able to help you out.

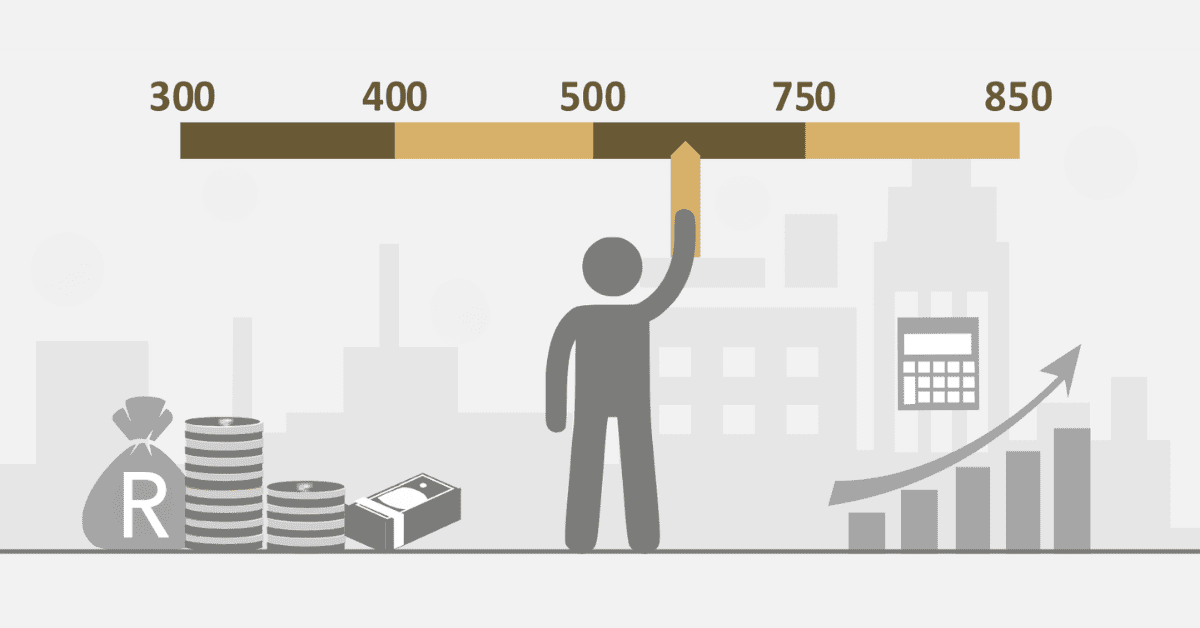

How to Calculate My Credit Score in South Africa?

Calculating your credit score in South Africa involves complex algorithms and data analysis that are typically performed by credit bureaus using information they receive from financial institutions. So there is no way you can calculate your own credit score.

However, taking proactive steps to understand what affects your credit score will help you take charge of your creditworthiness and have a great idea of where you stand in the eyes of the credit bureaus. Key factors that contribute to your credit score in South Africa include:

- Payment history: Timely payments on credit accounts, such as loans and credit cards, show responsible financial behavior and positively impact your credit score.

- Credit utilization: The amount of credit you use relative to your available credit limits will also affect your credit score. Keep your credit card and revolving loan balances under 50% of the available balance, and do not max out your credit to boost your credit score.

- Length of credit history: The length of time you’ve had credit accounts open and in good standing will also influence your credit score. Generally, a longer credit history with positive payment behavior will push your score up.

- Credit mix: Having a diverse mix of credit accounts, such as installment loans and revolving credit lines, can contribute to a higher credit score. However, you must manage these accounts responsibly, or they could turn into negative impacts.

We are sure we don’t need to add that debt abandonment- from falling behind on payments to defaulted accounts and actual legal proceedings- will have a massive negative effect on your score, too.

It’s now easier than ever to access your credit score for free, so take the first step to owning your financial future today!