Credit can seem like a big mystery to many South Africans. So, we have this thing called a credit score, and that impacts not only how much credit you can access, but whether or not lenders will even consider you? What does that actually mean? Few people fully understand their credit score

When to Perform a Credit Check in South Africa

As an individual, you should regularly check your credit as part of your wider financial management activities. You should at least be taking advantage of your 1 free report, per bureau, in a 12-month period to make sure you know exactly how you ‘look’ to lenders. However, we also advise checking your credit report a lot more than just once a year! It is difficult to monitor for unanticipated changes and potential fraud if you only check in once annually.

You can use a free third-party service, from in-app banking widgets to services like Kudough and ClearScore, to get regular updates on your credit score. This will not only encourage you to take charge of your credit journey but also let you keep an eye on any sudden changes that don’t align with your current credit usage.

How Does a Credit Check Work in South Africa?

When you attempt to take out credit in South Africa, the lender will approach the credit bureaus to see what your credit score is. This is called a credit check as well. The credit bureaus receive reports and data on your financial history from financial institutions. They then use an actuarial formula to evaluate factors like:

- How well (or poorly) you pay your bills.

- How much debt do you already have?

- What your behavior with that debt suggests about your creditworthiness.

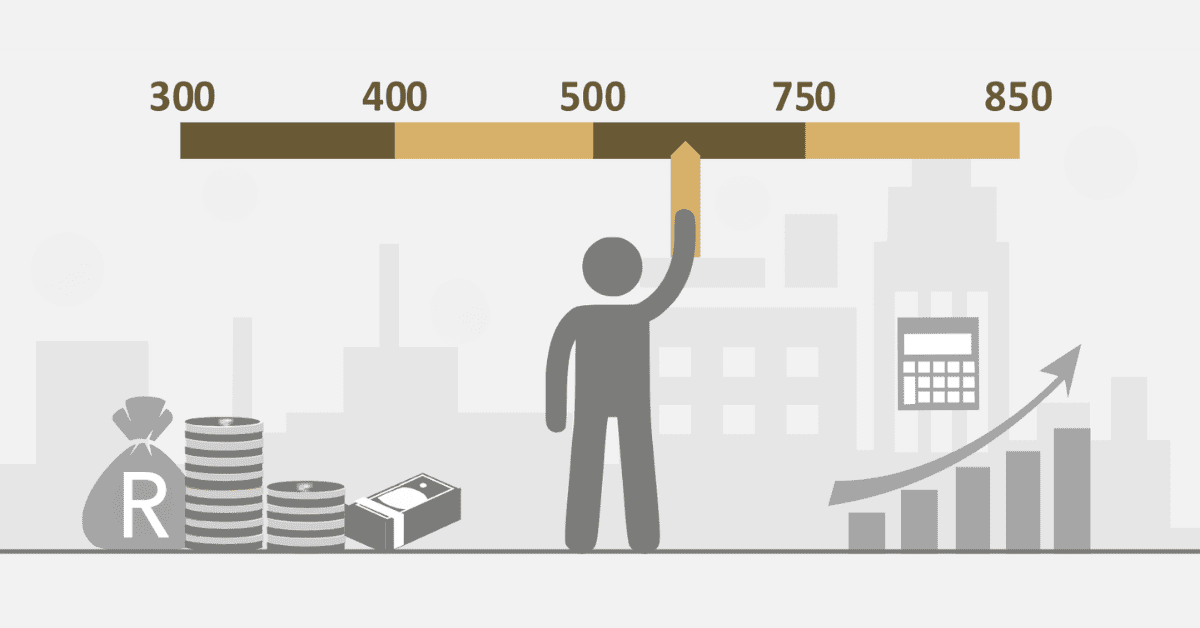

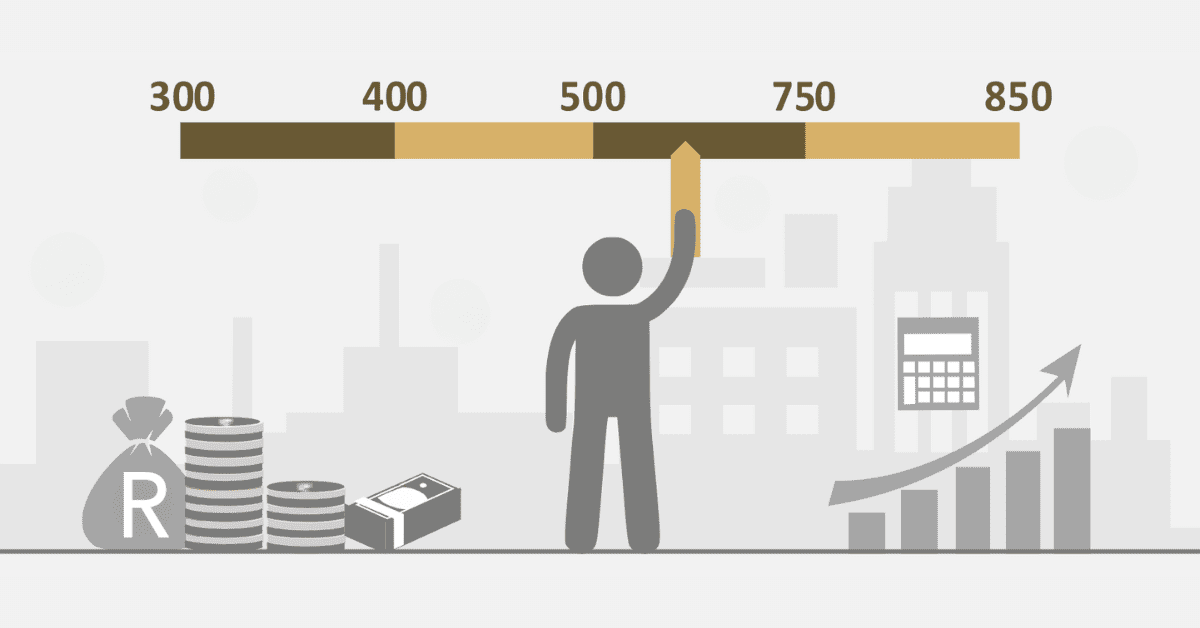

This is then compiled into a shorthand ‘score’, or number, that lets lenders know how good you are with the credit you already have. The lender will then compare this with other borrowers, and their perfect ‘borrower profile’, to decide if they will lend to you. Credit scores also aren’t just a ‘yes’ or ‘no’ thing. They will also impact how much the lender will offer, and the terms of the loan (e.g., your interest rate), so it pays to have the best cred it score possible.

How Much Does a Credit Check Affect Your Score?

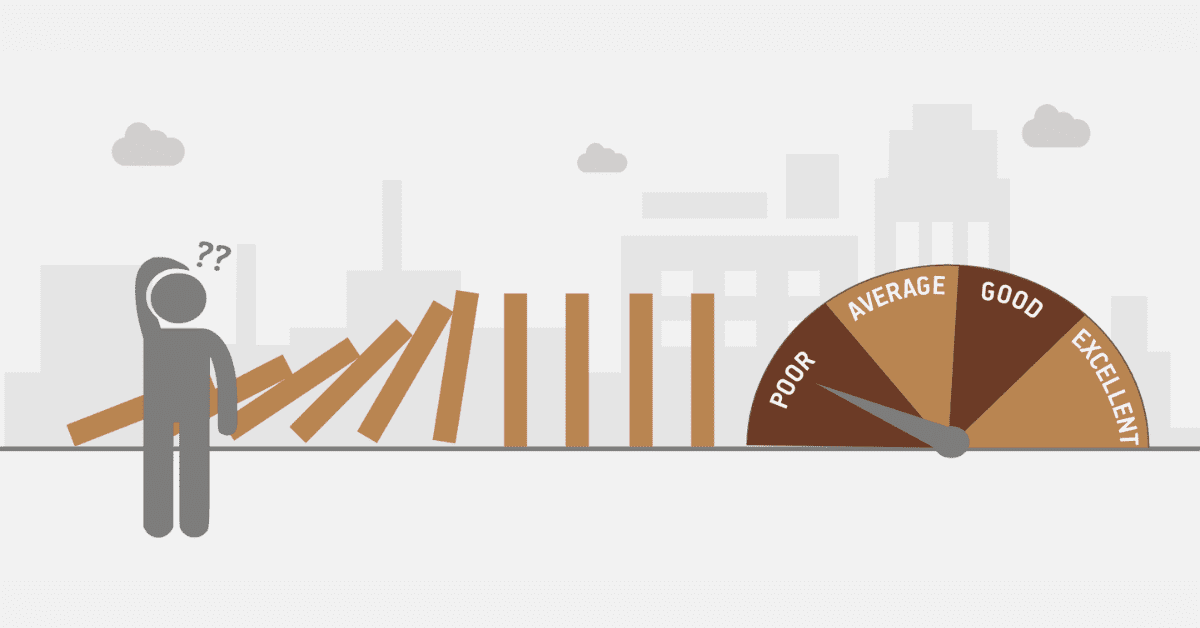

How much a credit check will affect your credit score depends on who is doing the checking. If you access your credit report to monitor it, it will have no impact on the score at all. If a lender intending to offer you a loan makes a serious inquiry, however, this is called a ‘hard’ credit check. They will have a small impact of around 10-20 points on your credit score.

What’s the difference? So-called soft credit checks, like you checking your own score, are not seen as a serious intent to get credit access. They are mostly just monitoring checks made for your financial well-being. However, hard credit checks, the ones initiated by lenders looking at you as a borrower, have a small impact as they signify to lenders that you are actively seeking credit. Initiating many hard inquiries in a short time is seen as a potential red flag, as there may be changes in your creditworthiness and financial behavior coming if they are granted. This is why it is never a good idea to apply for multiple credit lines in a short space.

How Many Times Can You Check Your Credit Score a Year?

If you simply want to monitor the health of your credit report, you can check your credit score as many times as you would like in a year. It will have no impact on your credit score. While you are only entitled to one free credit report per bureau each year, they are available whenever you need them for a very low cost- under R30 per report, usually. You can also use the third-party credit score tracking sites we mentioned above to get very similar data for free. Plus, the convenience is a great way to make checking your credit score part of your wider financial management.

How to Check if you are Blacklisted for Credit in South Africa?

We have good news- you don’t need to check if you are blacklisted for credit in South Africa. You aren’t! There is no longer something called ‘blacklisting’. This is a holdover from the time when only negative credit behavior was tracked in South Africa. Today, both negative and positive behavior is tracked. While some people still use ‘blacklisting’ as a term for a very bad credit score, it is no longer a ‘thing’ you need to worry about. Even the worst credit score can be rehabilitated with time, patience, and financial diligence, and small positive behavior will shift your score upwards faster than you think. You don’t have to wait to be ‘un-blacklisted’. You can start today, by paying on time and making arrangements to settle any outstanding debt or judgments you have.