In South Africa, buying on credit is closely linked to people’s credit scores, which are important for assessing their ability to borrow money.

A person’s credit score plays a significant role in their ability to obtain credit. It is determined by various factors, including payment history, outstanding debts, and credit utilisation. Having a good credit score can make a difference in your financial life. It gives you more opportunities to get better terms and lower interest rates, which means you can make big purchases with more flexibility.

So, what is considered a good credit score in South Africa? What are the indicators of a good credit score? While you are here, it is important to read to the end to understand the credit score criteria and how to fix a bad credit score within 6 months.

What’s a good credit score in South Africa?

A credit score is a measure of an individual’s financial behaviour and history. It takes into account various factors like payment history, outstanding debts, length of credit history, types of credit used, and recent credit applications.

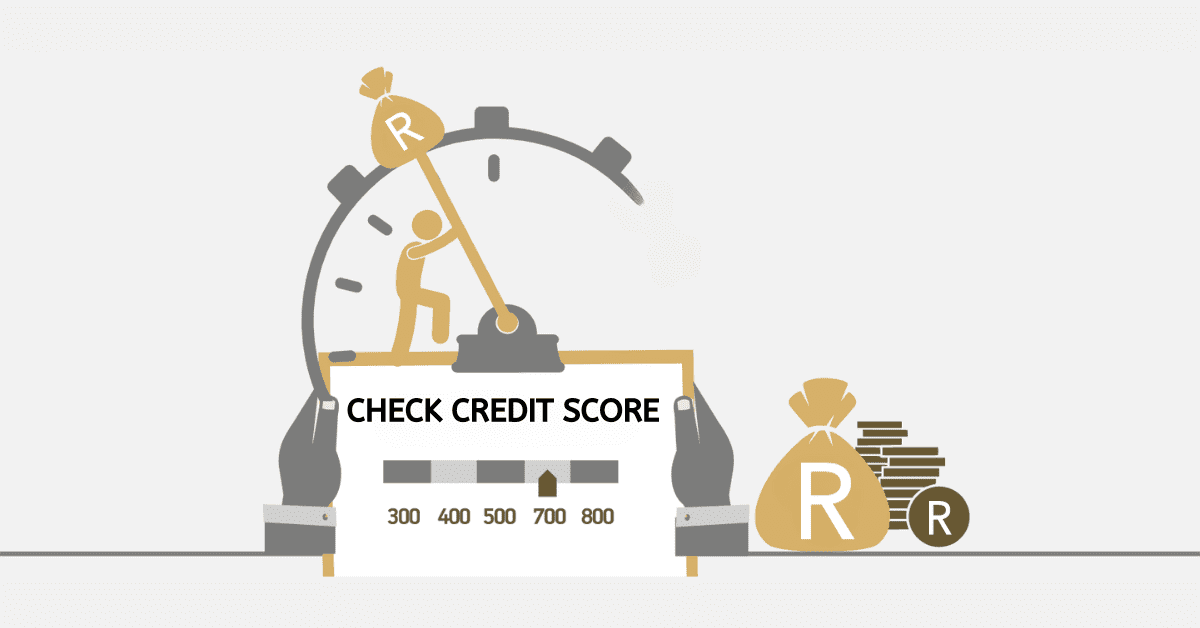

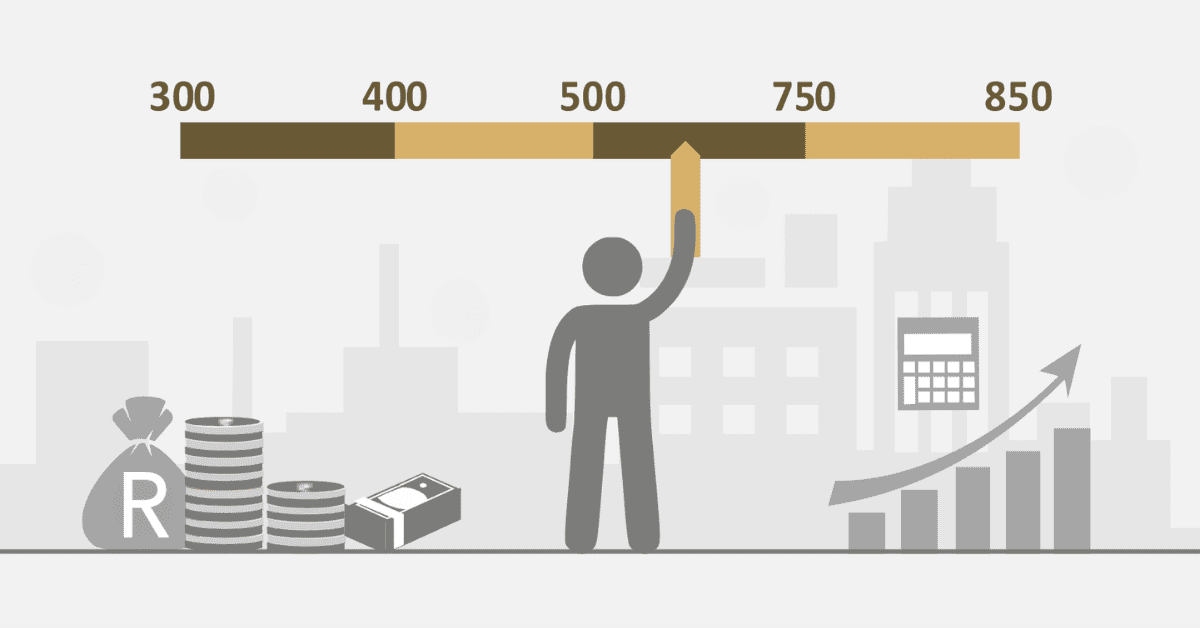

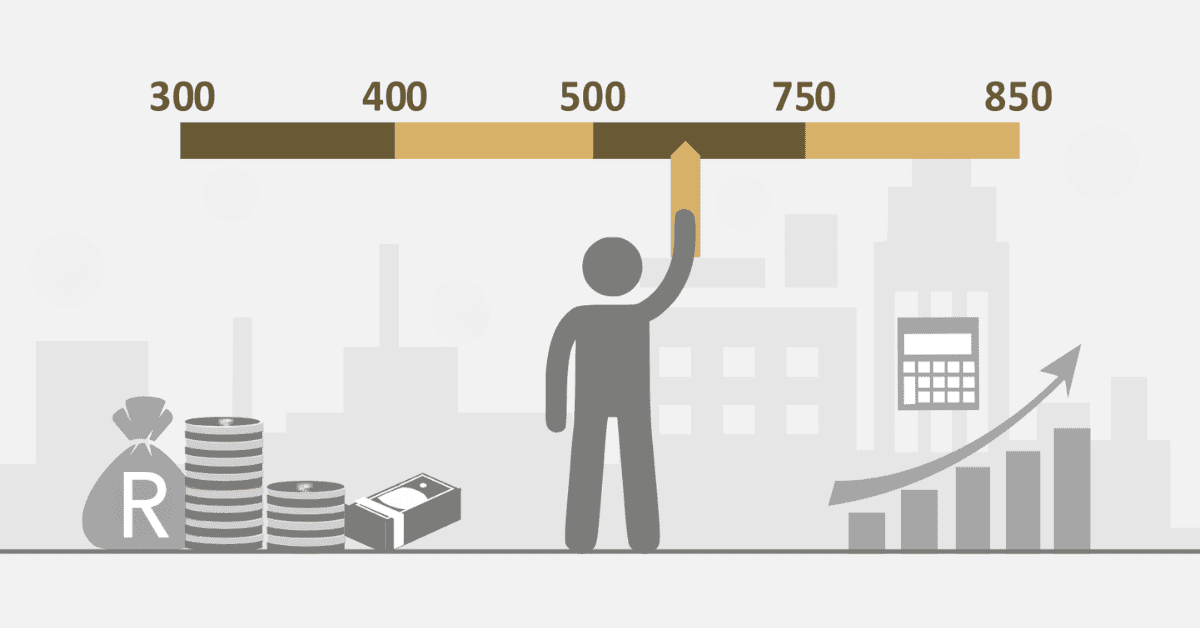

In South Africa, having a good credit score is extremely important in the financial world. It serves as a key measure of a person’s ability to borrow money and manage their debts responsibly. The credit score is a three-digit number, usually between 300 and 850, that plays a crucial role in determining whether someone is eligible for loans, credit cards, and other financial products.

Having a good credit score can provide you with various financial advantages, such as access to better opportunities like lower interest rates and higher credit limits. It helps individuals easily obtain housing loans, personal loans, and credit cards.

Having a good credit score is extremely important for maintaining financial stability in South Africa. Typically, a credit score that is above 650 is considered to be good, indicating that the individual has demonstrated responsible financial behaviour.

Lenders utilise this score to evaluate the potential risk associated with lending money, which in turn helps them determine appropriate interest rates and decide on loan approval.

To maintain a healthy credit score, it is important to make timely payments for your bills, handle credit responsibly, and keep a close eye on your credit report.

What is a poor credit score?

Credit scores in South Africa have their roots in the establishment of credit bureaus, banks, credit unions and other financial institutions. These entities are responsible for gathering and managing credit information about individuals. Credit bureaus like TransUnion, ClearScore, Experian, and Equifax have a significant impact on the calculation of credit scores. The data they collect is derived from credit agreements, payment histories, and public records, which together form a detailed profile of an individual’s financial habits.

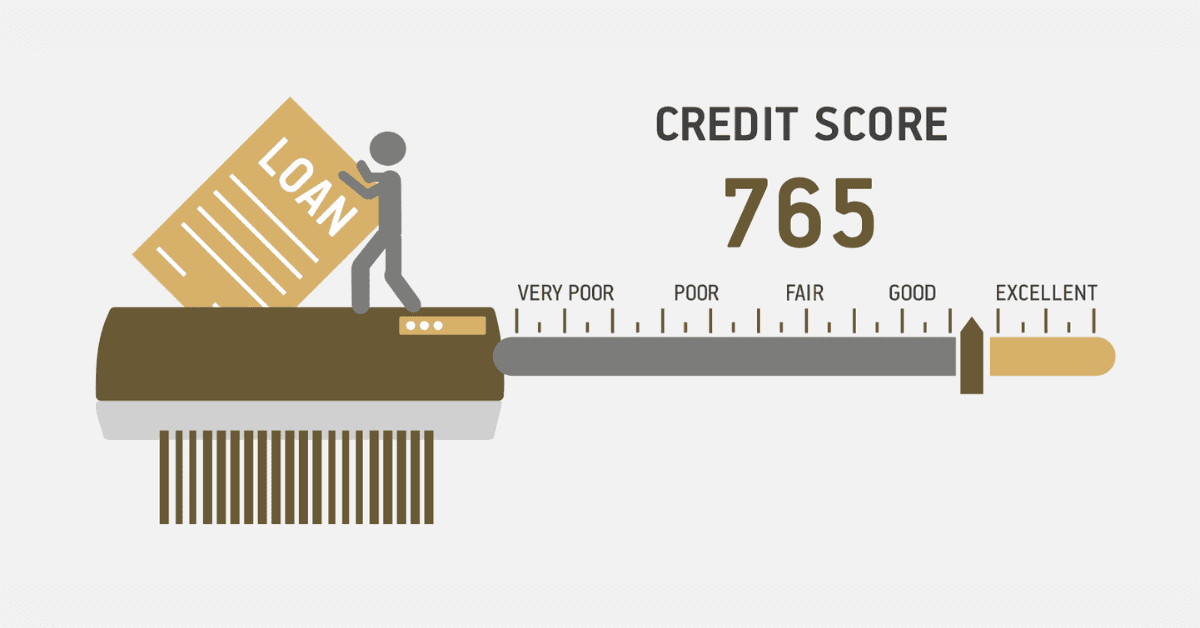

A poor credit score is typically a result of a damaged credit history, which occurs when someone defaults on various credit products from different lenders. Filing for bankruptcy has the potential to significantly harm your credit score and can remain on your credit report for seven years. Having a low credit score can make it quite challenging to obtain new credit. In South Africa, a poor credit score typically falls within the range of 300 to 579.

What is a good ClearScore credit score?

ClearScore is among the few platforms in South Africa that distinguishes itself from traditional credit reference agencies by offering users a complimentary overview of their financial status, including their credit score. The platform is committed to empowering individuals across the financial spectrum to effectively manage their money and enhance their financial well-being.

ClearScore enables users to access a snapshot of their finances, specifically their credit score, without any cost. The primary objective is to provide people with the tools they need to make informed financial decisions.

ClearScore in South Africa extends its services to not only provide a comprehensive financial history but also offer valuable insights and recommendations. Users can receive personalized suggestions for loans and credit cards based on their credit score. Additionally, the platform keeps users informed about upcoming offers tailored to their unique financial situation.

ClearScore acknowledges the varied definitions of a good credit score among different lenders. Lenders often assess multiple factors, such as income and debt levels, when evaluating creditworthiness.

A good ClearScore credit is typically above 605. Once you reach over 725, it is considered excellent. If you are looking to achieve a good ClearScore credit score ensure to be financially disciplined to attain a score between 605 and 724.

Is Experian better than ClearScore?

Before we provide insight into the question of Experian being better than ClearScore, let us understand what the word “better” in this sentence stands for.

“Better” in this context could simply look at the features of Experian and Clearscore. In other ways, it may also look at the majority of users for this platform.

However, it is important to understand your buying behaviours to know which one is better.

Experian is more inclined to individuals looking for personalised financial tips and product price comparisons.

On the other hand, if you are someone who prefers a simple interface and easy navigation, then ClearScore could be a much better choice for you.

Experian could be better than ClearScore when it comes to financial advise, strict financial audits, reporting and many more.

How can I fix my credit score in 6 months?

A credit score in South Africa is a constantly changing measure that indicates how responsible someone is with their finances. Maintaining a positive credit score is crucial for effectively managing personal finances in South Africa. It is a fundamental aspect that helps individuals navigate the complex financial landscape.Below are some tips to help you fix your credit score in 6 months. Remember, it does not take a short period to fix your credit score, but using these tips consistently can help fix your credit score within a few months.

- Repay any overdue debts on time.

- Keep your credit usage below 35%.

- Resolve and close unnecessary accounts.

- Minimize applying for new credit.

- Encourage your partner to do the same.

- Review your credit reports for mistakes.