Credit scores are very important in South Africa when it comes to finances. They affect people’s ability to get loans, housing, and even sometimes jobs. Most people see credit scores as a sign of how responsible and trustworthy someone is with their money.

A good credit score means you are likely to pay your bills on time, while a bad score could mean you are risky or financially unstable. From the information gathered, the national average credit score in South Africa is based on the average of most people who use credit. People try to keep or raise their credit scores by paying their bills on time, being smart about how much debt they have, and keeping their credit records clean.

But there are a lot of concerns about what is considered average and how people perceive it. Our focus will be on credit score in South Africa highlighting key areas like; how to boost your credit score, what is considered a normal credit score, credit score used by banks etc.

What is the national average credit score?

Many people who may want to find out about the national average credit score may wonder if there is any agenda towards this. Some may be curious about this national average credit score because of its numbers and the numerous platforms used.

The national average credit score looks at the masses in South Africa; with what most people have as their credit score.

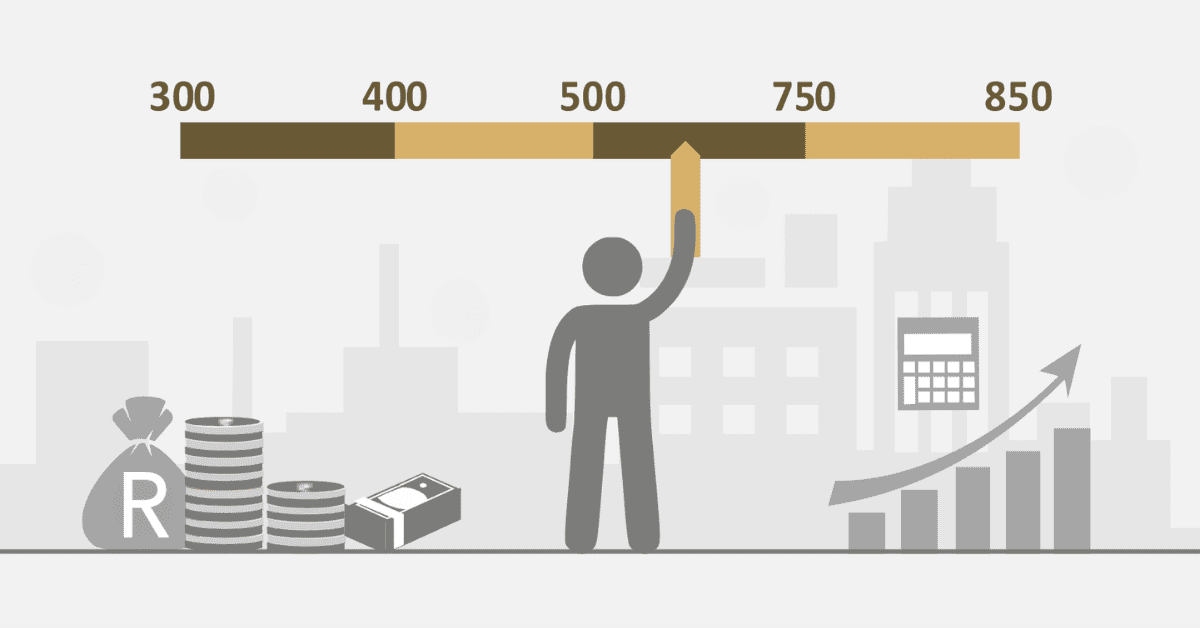

However, the credit bureaus already have their performance remarks for every range of credit scores.

South Africa has a credit score that is considered to be the national average, which is somewhere around 600. Being in the 600 range is therefore neither considered to be a good nor a bad thing. Furthermore, if you are inside this range, you have reason to rejoice; this means your credit score is neither bad nor good.

The national average credit score is from the population and the benchmark the credit bureau has set which is usually around 600.

Which credit score is used by banks?

Banks in South Africa use credit score provided by the existing credit bureaus in the country. This credit score is generated based on the data gathered from individuals.

The banks do not generate credit score but look up to the credit bureau to provide them with data.

In South Africa banks use Experian and TransUnion credit score.

How to boost your credit score?

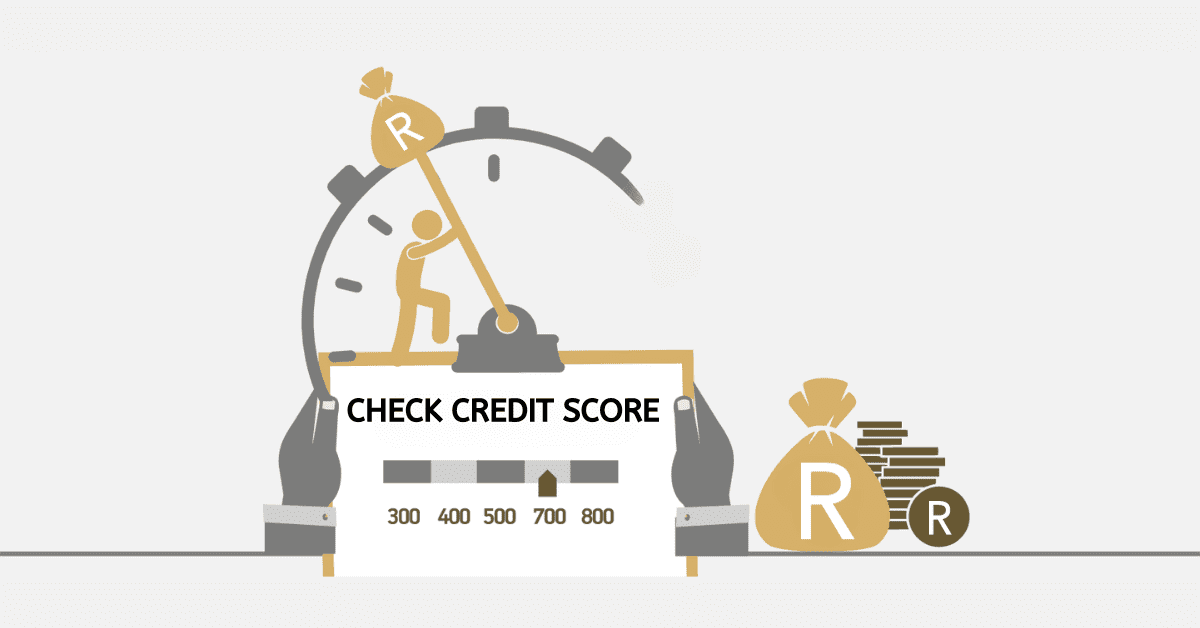

Improving your credit score is important if you live in South Africa and want to get loans and credit cards with good terms. Here are some practical ways for people to boost their credit score without putting their finances at risk.

- To get a better understanding of your current situation, you should begin by acquiring a free credit report from a credit bureau such as TransUnion or Experian.

- Make sure you pay your bills on time because late payments can have a big influence on your credit score. To ensure that invoices are paid on time, you can set up reminders or automatic payments.

- To reduce your credit usage ratio, you should want to maintain low balances on your credit cards and pay off your bills as promptly as feasible.

- Diversify Your Credit: Having a variety of credit accounts, including retail accounts, loans, and credit cards, can have a good impact on your credit score. Responsibly manage them, however.

- You should limit the number of new applications you submit because each credit application leaves a trace on your credit record. By just applying for credit when it is necessary, you can avoid making queries that aren’t necessary.

- It is important to check your credit report regularly for any errors and to dispute any errors as soon as possible.

- It takes time to build up a strong credit history, so be patient. To observe modest changes, you will need to be patient and consistent with your efforts.

What is the average credit score in South Africa?

The average credit score for South Africa is around 600, which can be considered normal. Because of this, being in the 600 level is not seen as either good or bad.

Aside from that, if you fall in this area, you should know you are in good standing. once you have your credit score at an average point, you should know that you are not far from good.

In South Africa, it is common to find new creditors to have the average credit score. Any score from 600 to 649 is considered to be an average.

What is considered a normal credit score?

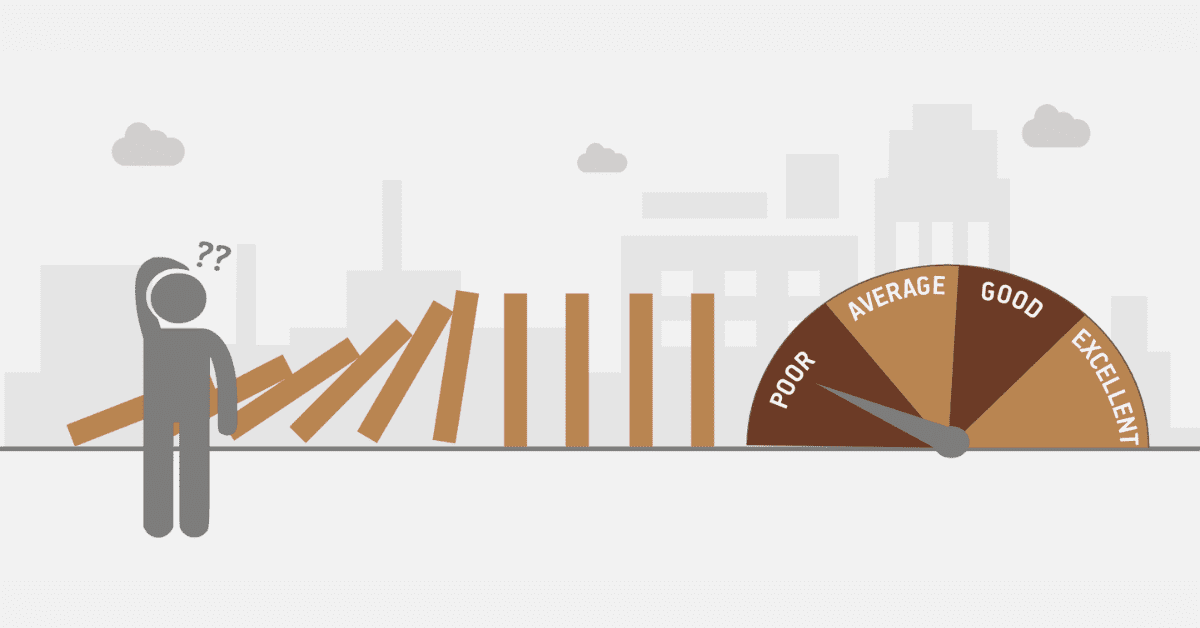

Any credit score that does not make you vulnerable when applying for a loan can be seen as normal. The word “normal” can be ambiguous. This is because the normal credit score of another credit bureau may slightly fall into bad or good.

It is important to monitor your credit score and know the bureau you are with before considering your credit score as normal.

Based on the consensus, data and credit score range, a normal credit score can range from 580 to 669.

However, in South Africa, any credit score which is above 600 but not more than 649 is considered normal.