When credit score is mentioned, a lot of minds are tuned to personal credit score.

In South Africa, where credit plays a huge role in the financial landscape, it is common for most people to be much concerned about personal credit score rather than business credit score.

Of course, business credit may exist but the numbers comparing it to personal credit will be at a low number. Hence, there is always a concern about business credit scores.

In a much better way, businesses are prone to have huge debt, and bigger risk and therefore may have a huge department to manage their credit score for them.

Others who have the resources may consult third-party companies to look into their business credit score.

But what at all is a business credit score? Is a score meant for only business? Does it look at the nature of the business?

Here we are, with you, to take you through a great journey and discovery about business credit score. We will delve into more branches of business credit score to learn how to check business credit score and many more.

What is my business credit score?

Your business credit score is a number that shows how creditworthy your company is. Businesses have credit scores too, just like people do.

This score is very important in South Africa for getting loans, lines of credit, and other banking services.

It depends on a lot of things, like how well you have paid your bills in the past, how much credit you use, and how long your credit history is.

Lenders see a better score as a sign of lower risk, which makes it easier to get good terms and rates.

Regularly checking your business credit score is important to find mistakes or issues that could make it harder for you to get financing.

Keeping up good money habits, like paying your bills on time and handling your debts wisely, can also help your score over time. To keep your business’s finances stable and help it grow in a competitive market, you need to know and take care of your credit score.

Do businesses have their own credit scores?

In South Africa, businesses do have their credit scores. Once you have registered your business and are ready to operate, you may need that financial support.

Businesses do request credit from their banks to pre-finance their operations and pay it off in instalments.

Any business in South Africa that has been registered can have their credit scores should they apply for credit.

How do I check my business credit score in South Africa?

To check for your business credit score in South Africa, you must have registered the business and applied for the credit.

Once your details have been captured, you can have access to the online platform of the financial institution you chose.

Checking your business credit score is easy, all you need is to have your login access to the credit platform to check your credit score.

These financial institutions in South Africa are powered by credit bureaus and therefore have systems to help you check your credit score anytime.

What is a good credit score for a business?

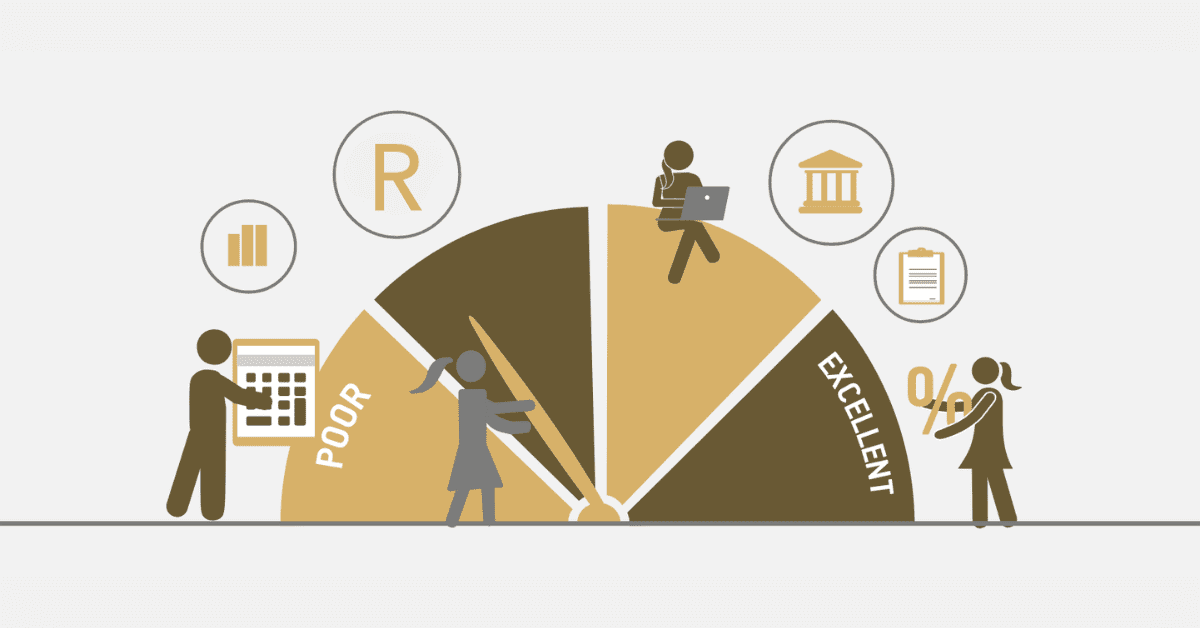

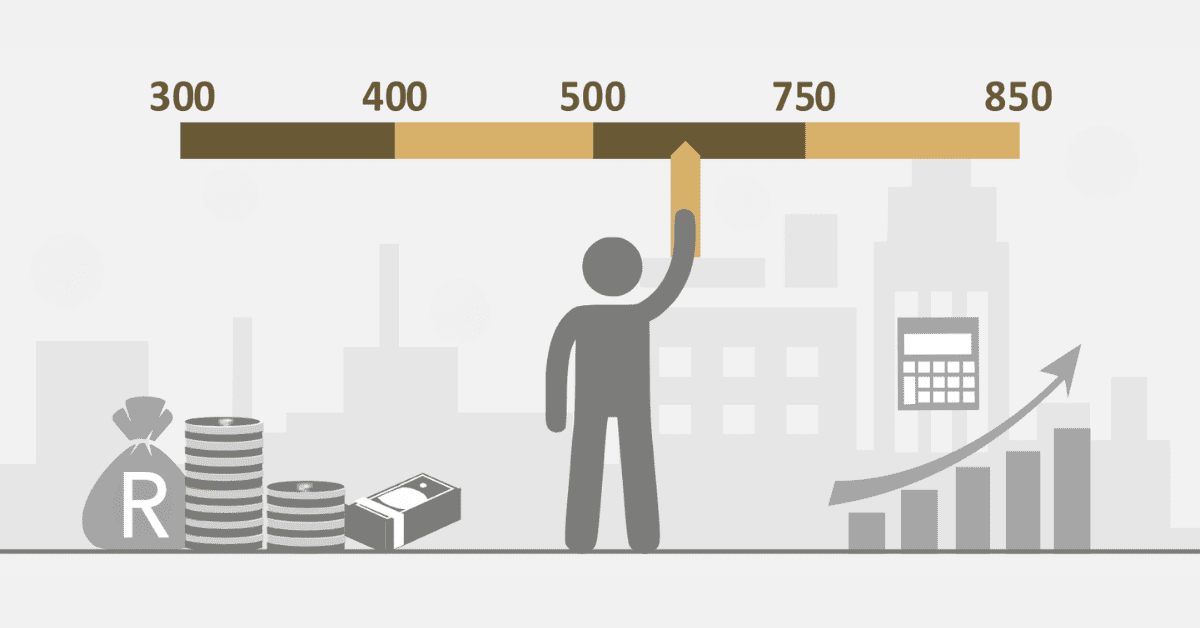

For some credit bureau businesses credit score starts from 0-100 and with some it starts from 0-999. But when it comes to commercial business credit scores 0-100 are mostly considered among credit bureaus and other financial institutions.

Before we look at the common good credit score for business let us look at that of the Transunion.

Transunion credit score ranges from 0-999. With this, there is a performance indicator for each range.

According to Transunion, any business credit score of about 681 is considered to be good.

If you are a business in South Africa, and your credit report comes from TransUnion, a good credit score for your business should not be less than 681.

In 2005, the National Credit Act was enacted. This was an institution to look into credit scores for businesses and that of individuals. After several years of working, the institutions came up with data to give insight into credit scores and also help with determining the performance remarks for these credit scores.

If you work with any other credit bureau whose credit score ranges from 0-100, then you should consider a score of 70 and above to be a good credit score for your business.

There are many advantages to having a good business credit score, such as lower loan interest rates, bigger credit limits, and more negotiating power. It shows how stable and financially healthy a business is, which gives possible partners and investors confidence in it.

Businesses should pay their bills on time, handle their debts properly, and check their credit reports often for mistakes to keep their credit score high. It is also important to build a strong credit past by using different types of credit and keeping your credit utilization ratios low.

How long does it take to get a business credit score?

Building and getting a business credit score are two different things. When it comes to building a business credit, it is the act of finding the right means to improve your score while your credit exists. This means you have already applied for the credit and have received the approval for the application.

Getting a business credit score requires documentation and application. You can apply at any accredited financial institution that has the mandate to provide you with credit.

Although the requirements and processing can differ among financial institutions, it should not take more than 5 months to get a business credit score.

Once your application has been sent for a business credit score, you should get your business within 30 to 90 days.