Credit companies like Equifax are very important to people’s financial lives, and Equifax is one of the biggest players in this field.

Equifax is one of the main credit reporting companies in South Africa. It collects and keeps track of a huge amount of information about people’s credit.

It is very important for figuring out who is creditworthy, approving loans, and setting interest rates.

Equifax puts together full credit reports for millions of people by gathering information from many places, like lenders, suppliers, and public records.

Understanding Equifax’s part makes it clear how important it is to keep your personal financial information safe and your credit score high.

In this blog post, we will look at Equifax’s credit score, what a good Equifax credit score is and other related concepts.

What Is Equifax Credit Score?

Equifax’s credit score is one of the most important ways to figure out if someone is willing and able to pay back a loan.

An Equifax credit score can tell you how lenders see your financial situation and give you an idea of how likely it is that you will be accepted for a loan or line of credit.

Most lenders in South Africa use Equifax, which is one of the three main credit companies.

They use information from Equifax, Experian, and TransUnion to make a person’s total credit score, which they use to judge the borrower’s risk.

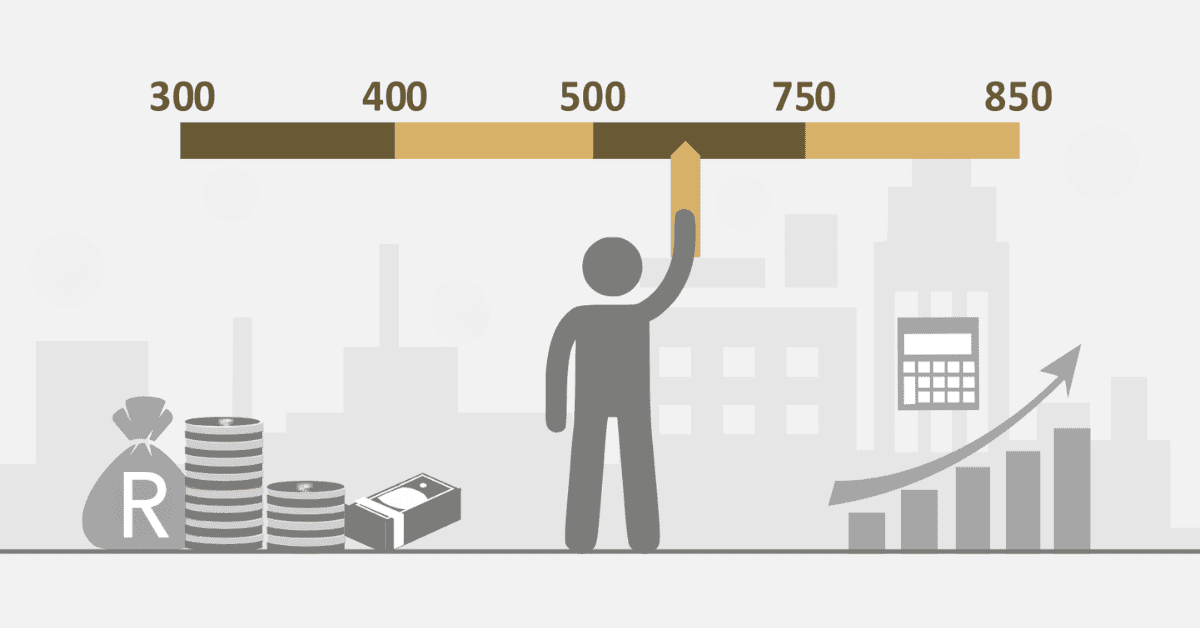

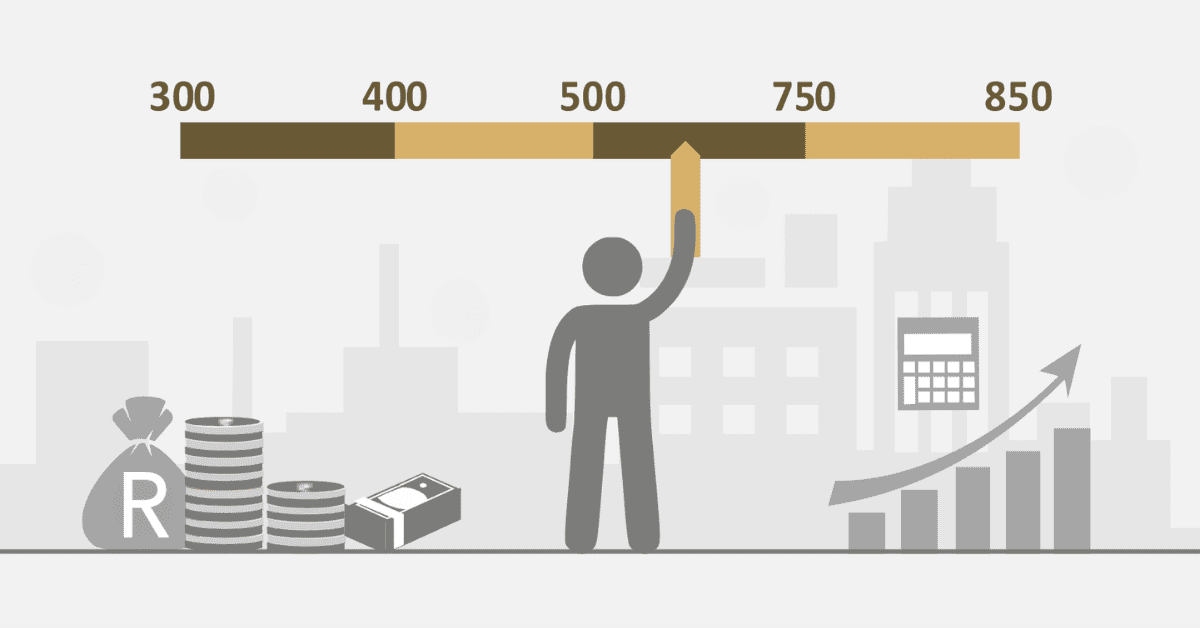

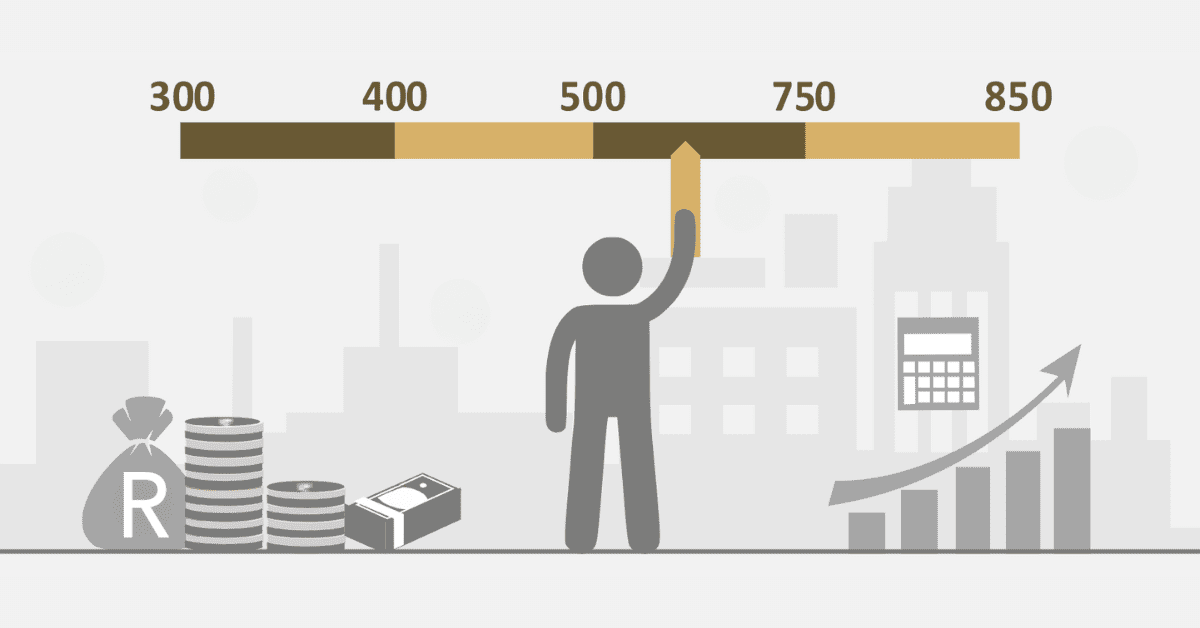

Equifax gives people scores between 300 and 850. Higher scores mean you are less of a risk and have a better chance of getting loans or other forms of credit.

Anyone who wants to better handle their money needs to know what the Equifax Credit Score is, how it is calculated, and how it can affect their ability to get credit.

What is a good Equifax score?

According to the guidelines set by Equifax, a credit score that is considered to be strong in South Africa normally falls somewhere between 670 and 739.

Nevertheless, it is of the utmost importance to become aware of the fact that the definition of a good credit score can change depending on the regulations of the lender as well as the particular sort of credit that is being sought.

The criteria that are used by different lenders to determine whether or not a credit score is satisfactory may vary. Consequently, when attempting to evaluate the quality of one’s credit score, it is vital to have a thorough awareness of the precise criteria that each lender uses.

How to build Equifax credit score?

Building Equifax’s credit score is just like working on any other credit score. You must first ensure to understand what Equifax requires before taking steps to build it.

Although almost all the credit bureaus like Equifax have similar metrics in building credit.

Here is a simple way how to build an Equifax credit score.

- When you take steps to improve your credit, you can see benefits, though it may take a while. Paying your bills on time every month is a big part of improving your credit score, but many people do not realise how much of an impact it has on their creditworthiness.

- It is very important to settle all judgments and debts that are still open. Also, it is important to bring past-due bills up to date.

- To improve your credit score, you might want to close open accounts that you are not using and have already paid off.

- It is important to keep your credit utilization ratio in check; try to keep the amount on each credit card below half of its credit limit.

- If you want to buy a car with a loan, you should get credit approval from your bank or credit union, especially if they handle your cash account. If you choose dealership funding, your credit may be checked more than once, which could hurt your score.

Is Equifax your real score?

Different sources provide data for Equifax to generate credit scores. Even though your financial behaviour is considered, the data used is fetched from other points.

Equifax can be your real score. It is one of the most prominent credit bureaus handling credit score systems in South Africa.

Does Equifax hurt your credit score?

This could be a bit ambiguous for many people who are not familiar with Equifax and the things that could hurt your credit score.

Equifax is the credit bureau that looks at the affairs of the credit score using the financial information and details of individuals. Whereas what hurts your credit score could go general to some of the financial habits many people practice.

Indeed, your Equifax could be managing your credit, but there is no deliberate plan to hurt your credit score.

Although a lot of things can hurt your credit score, hard inquiries which may directly come from a credit bureau like Equifax can hurt your credit score.

In general, Equifax, as an institution, does not have the power to intentionally hurt your credit score.