An inquiry is an indication that appears on your credit report whenever someone or some group with legal permission looks at your credit information.

A lot of the time, inquiries happen when you apply for credit or a loan

When a lender or creditor wants to know if someone is creditworthy, they will look at their credit score and make an inquiry. Such an inquiry is needed to figure out how risky it is to give money. Limits on credit, interest rates

There are two types of credit checks: hard inquiry and soft inquiry. A soft inquiry is also considered to be a soft pull.

As continue to shed some light on inquiries, we will hammer on soft inquiry, the points one could lose for a soft pull, the effect of the soft inquiry and many more.

What is a soft inquiry credit score?

It is important to know about soft inquiries on your credit record, especially if you want to get new credit in South Africa.

A soft inquiry also called a soft pull, is when someone or a business looks at your credit report as part of their background check. Soft inquiries do not hurt your credit score like hard inquiries do.

Soft inquiries are popular in South Africa. They are done by companies for pre-approved credit offers, by people looking for work, and by people checking their credit reports.

If you want to get a new credit card, for example, banks may do a “soft inquiry” to see if they can give you certain deals. This has no effect on your credit score and lets you look at your choices without any risk.

Soft inquiries can also be made on a person’s credit record. Checking your credit report often is a good idea to find any mistakes or behaviour that you did not do.

If you live in South Africa, you can do this through credit companies like TransUnion or Experian.

Knowing the difference between “soft” and “hard” inquiries gives people the power to make smart financial choices. Soft inquiries are not harmful and can even be good for you. Hard inquiries, which are usually caused by credit applications, can temporarily hurt your credit score. You can feel more confident about your credit in South Africa if you know when and why these questions happen.

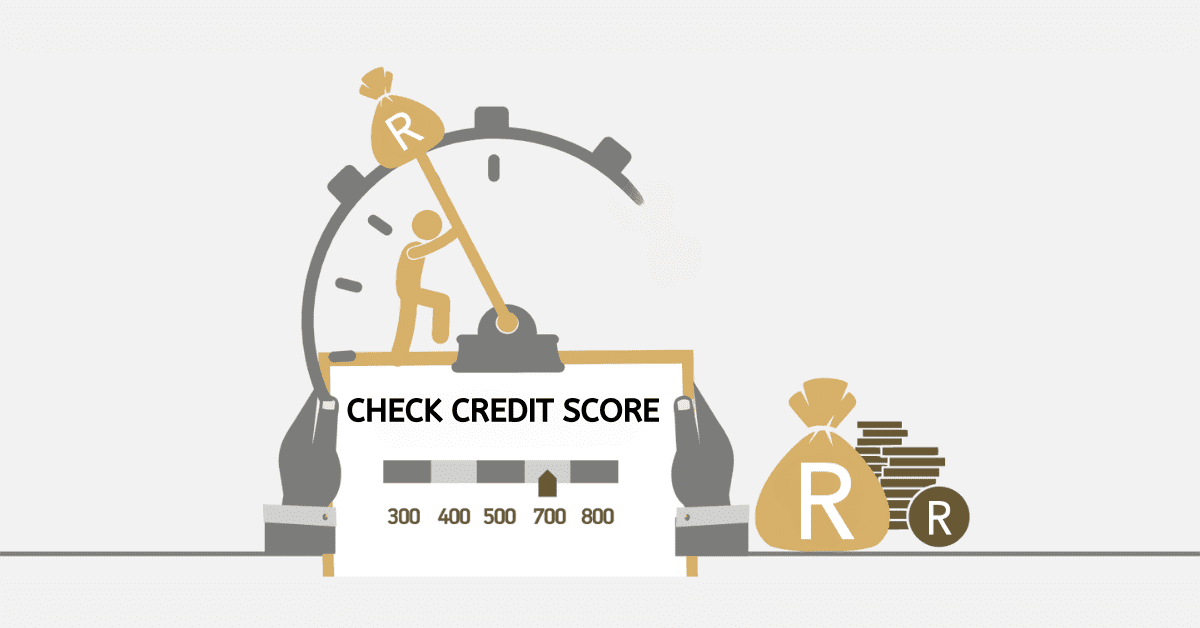

How many points do you lose on a soft inquiry?

A soft inquiry is one of the most common checks done on credit for individuals and businesses. The soft inquiry is mostly done for pre-approval purposes.

It is always a concern for many individuals who do not understand the effect of soft inquiry. People assume a soft inquiry works the same as a hard inquiry.

In general, a soft inquiry does not affect your credit score. You do not lose any points when you get a soft inquiry on your credit score, unlike a hard inquiry.

Do soft inquiries hurt your credit score?

There is no effect on your credit score in South Africa when someone does a soft inquiry. It is kind of like getting a quick look at your credit record without applying for a loan or credit card. Firms often do them for things like background checks or offers that have already been accepted. Soft inquiry does not hurt and will not change your credit score or ability to borrow money. They are only there to give you information; they will not hurt your credit score.

What’s The Difference Between Hard And Soft Credit?

To properly manage your credit score, you need to know the difference between hard and soft credit inquiries. Someone looks at your credit record for both types of inquiries, but they are used for different things and can have different effects on your credit score.

A lender or creditor does a hard inquiry when they look at your credit report as part of the process of deciding whether to give you new credit.

Most of the time, these checks start when you ask for a car loan, credit card, or mortgage.

Other creditors can see hard requests, which can temporarily lower your credit score because they make it look like you might be taking on new debt.

Soft inquiries, on the other hand, are only used to get information and do not have any effect on your credit score. They can happen when you check your own credit report or when a business offers you a credit card or loan before you even ask for it.

You might also be asked about your past when you are applying for a job or getting pre-approved for an apartment rental.

By knowing these differences, you can make smart choices about when and how to apply for credit, which will help you keep your credit score high.