What is a proprietary score? What comes into our mind when you hear about the proprietary score; is it a common type of credit score?

Taking into account the word “proprietary” it certainly talks about sole ownership and management of a company.

In business ownership and control, there are different terms. And one of the terms is proprietary.

Some may say this is under legal rights according to geographical laws and is considered as managing and controlling the affairs of a business or company.

But today, our focus is not on proprietary but on proprietary score. It is always important to understand the origination of words in order to decipher them in a much better way.

Such as we have the business credit score for companies, and there is a proprietary credit score. It is part of the types of business ownership.

As you continue to read through, the blog post will give you a much better insight into what a proprietary score is, what is considered a good proprietary score and other subjective topics.

What is a proprietary credit score?

A term that is used a lot in the credit and business world is “credit score.” This is especially important when you are talking about getting a credit card or borrowing money.

A credit score is a number that tells lenders how likely it is that a person will pay back money they borrow.

And with this, there is a concept of proprietary credit score. A proprietary credit score is a credit scoring model that was made by a specific entity, like a bank or credit bureau, to be used only by that entity.

Supposing that in South Africa, a bank called TK Bank creates its system for figuring out creditworthiness. TK Bank might look at more than just traditional things like payment history and credit usage. TK Bank will consider checking things that are relevant to the South African economy, market and statistics.

Proprietary credit scores are an important part of the financial world. They provide lenders with custom solutions but make it hard for consumers to see what their options are and compare them.

It is becoming more and more important for people who want to responsibly use credit to understand the subtleties of both proprietary and generic credit scoring models as financial technologies continue to change.

What is a good proprietary credit score?

Businesses need to keep their credit score high because it can affect their ability to get loans, negotiate good terms with suppliers, and get trade credit. Businesses can improve their proprietary credit scores by showing that they are good with money and have a good credit past. This makes it easier for them to get credit and find business opportunities.

Taking into account the features, pros and cons of proprietary credit score it can be confusing to know what exactly a good credit score is.

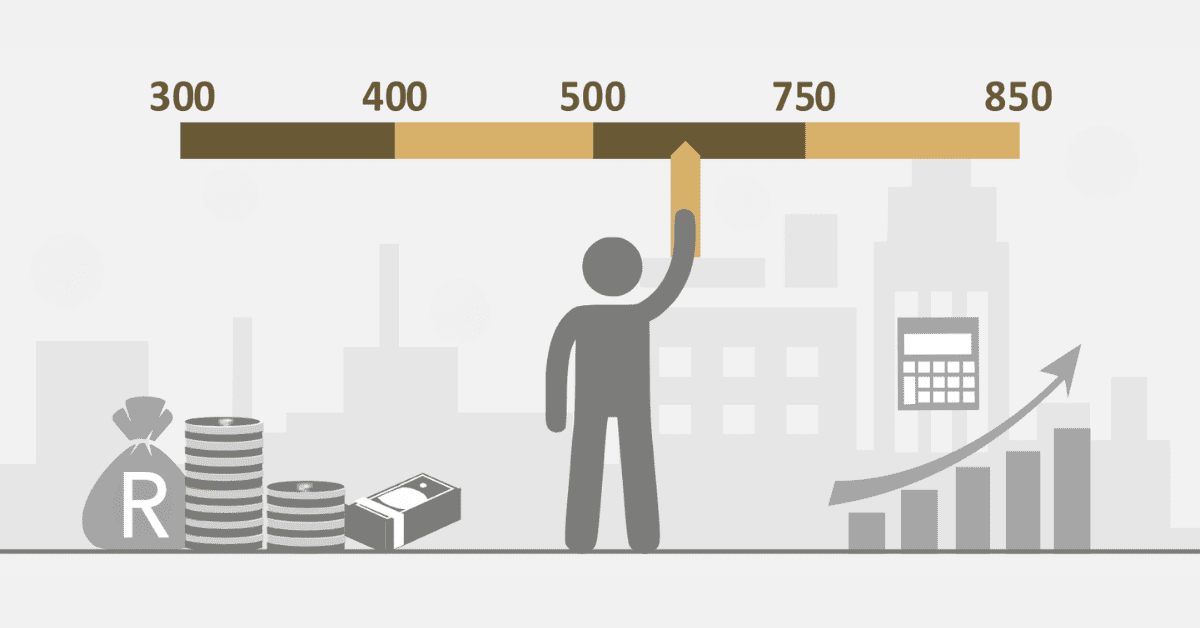

Based on the credit bureaus and offers, a good proprietary score is considered to be any figure above 700.

What are the 3 types of credit scores?

You can roughly put credit scores into three types: FICO, VantageScore, and others. Each of these types of credit score has the metrics and methods of calculating credit score.

Although they may be different, they are designed to support lenders determine the creditworthiness of people.

What causes credit scores to go down?

There are a lot of things that could cause a credit score to go down. Looking at these things is very important as they tend to help you build your credit.

Certain common things have been tagged as part of the major cause of making a credit score go down. While looking at these causes, it is necessary to understand the origin and find new ways to improve your credit score.

- Should you miss a payment deadline or pay after the due date, it can have a big bad effect on your credit score.

- If you use a lot of your credit limit on credit cards, it can hurt your credit score. To avoid going over your credit lines, try to keep your credit card balances low.

- Opening a lot of new credit accounts in a short amount of time can lower the average age of your accounts and make you look risky to lenders.

- Getting rid of old credit accounts can shorten your credit history and lower the amount of credit you can use, which could lower your score.

- When you apply for new credit, like a loan or credit card, your credit score may go down temporarily due to hard inquiries.

- Having accounts sent to collections or not paying back loans can have a very bad effect on your credit score.

- Your credit score can drop a lot if you have a bankruptcy, a foreclosure, or a ruling against you in a public record.

- If there are mistakes on your credit report, like wrong account information or theft, they can lower your score. Check your credit report often for mistakes and challenge any that you find.