Did you know the numbers representing your credit score are also grouped in another set of ranges? This range defines where an individual falls into.

Talking about range, did you know you could have your credit score being prime? Not to deviate, the concept of prime numbers is entirely different from prime credit score.

Indeed, prime credit score exists and certainly derives from the entire credit score system.

In this post, we will look at the whole phenomena of prime credit, including its qualification, minimum score for prime credit, and many more.

What does a prime credit score mean?

Prime credit score is like a golden ticket when it comes to getting loans.

It tells lenders that you can be trusted and that you know how to handle credit well. But what does it mean to have a prime credit score?

Lenders needed a quick way to figure out if someone was creditworthy back then. That is why they started using credit scores, which are numbers that show your credit past.

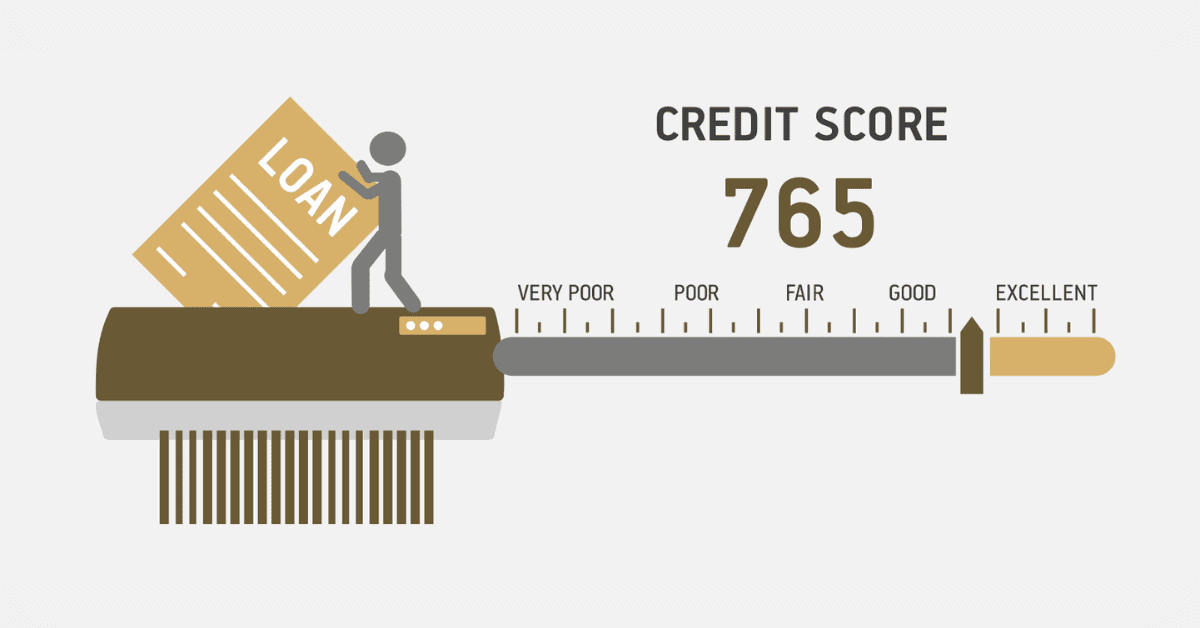

Around 720 or higher is considered a prime credit score, meaning you are at the top of the credit score game.

According to the Consumer Financial Protection Bureau (CFPB), a prime credit score is between 660 and 719.

On the FICO scale, this range covers both “fair credit” and “good credit.”

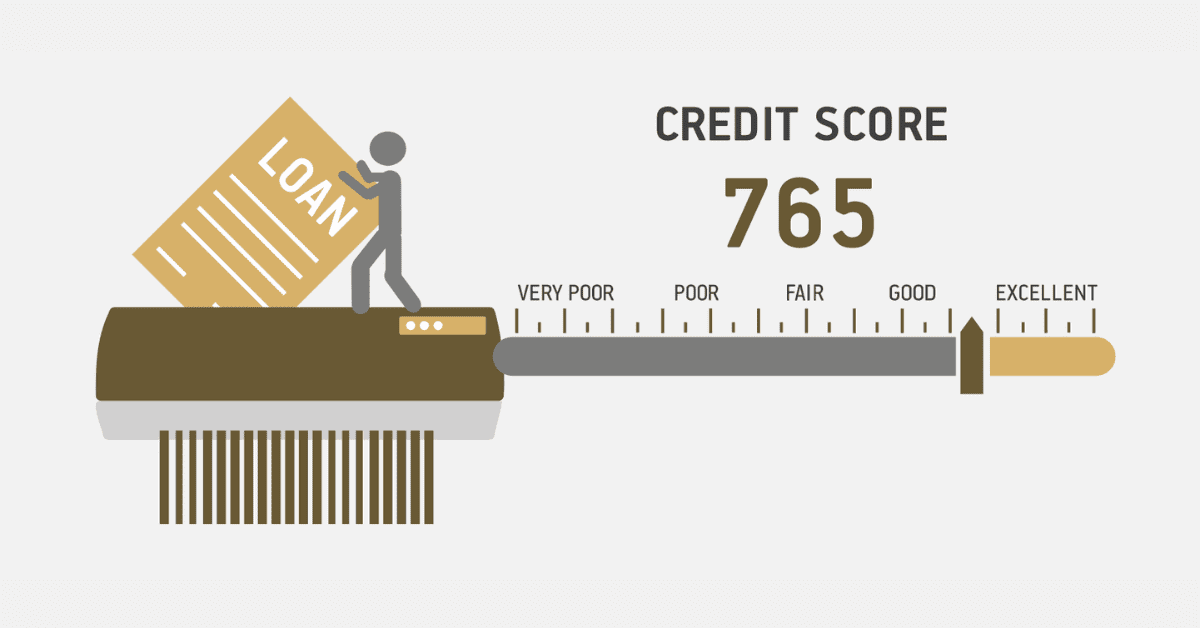

If you have a prime credit score, you have better chances to secure loans without going through a lot of queries.

Also, the terms and interest rates will be better. Falling into the prime credit score zone you are about to enjoy amazing offers from lenders

But it is not easy to get a prime credit score. To build a good credit history, you need to pay your bills on time, keep your credit card balances low, and only ask for credit when you need it.

What qualifies as prime credit?

Having a great credit score is important for keeping your finances in order and getting good loan terms.

But what exactly qualifies a “prime credit score” It is easy to understand: prime credit is based on the total credit number. This score tells lenders how creditworthy you are and how well you can handle debt. Once you have a score between 660 to 719, it qualifies one credit as a prime credit score.

What is the minimum prime credit score?

When it comes to credit scores, the word “prime” means a lot. People who want to borrow money often look for people whose credit is seen as very good.

The Consumer Financial Protection Bureau (CFPB) says that to get prime credit, you need a credit score of at least 660. It is important to remember that good credit scores are part of a range that usually goes from the very top of the range to the very bottom of the range. The minimum prime credit score in this case is 660, which is within the range of scores identified as “prime.”

If the prime credit score is from 660 to 719, the minimum number is considered to be the number that begins the range.

Therefore when a minimum prime credit score is mentioned, the first number can be 660.

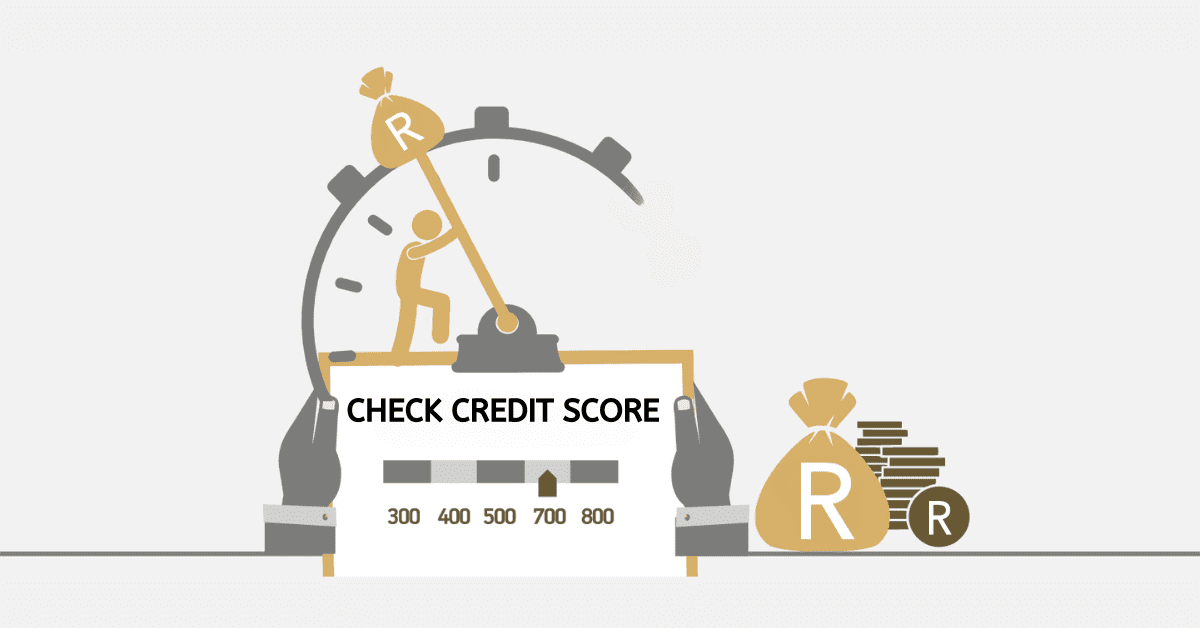

What is a normal credit score in SA?

Anyone who is trying to figure out their finances needs to know what a normal credit score is in South Africa.

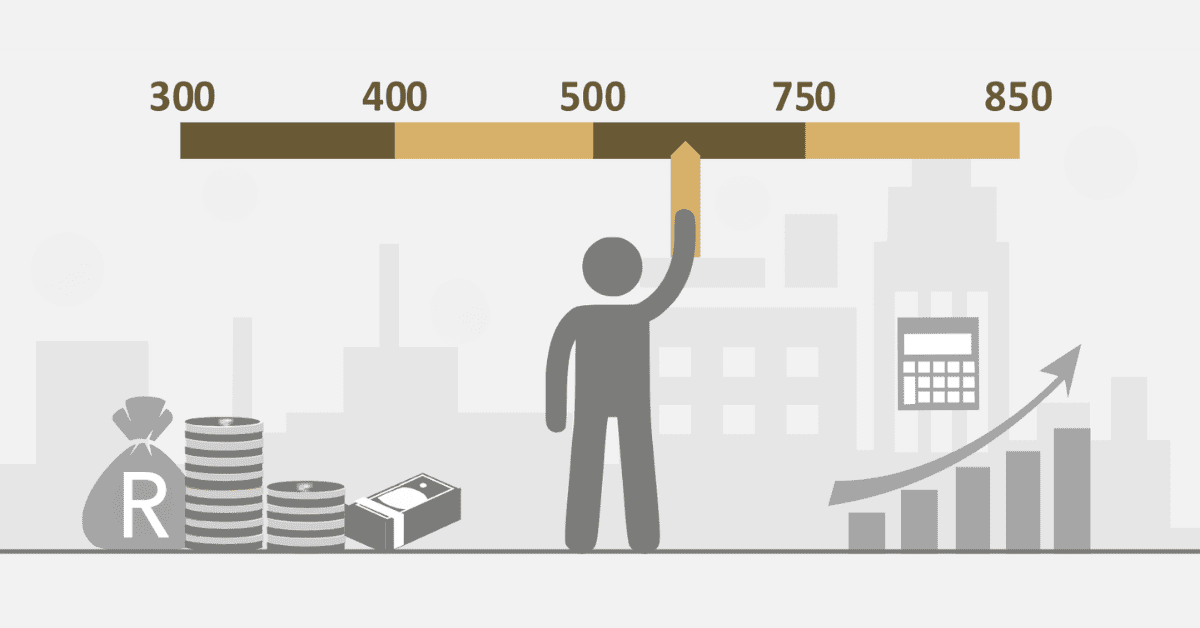

Credit scores in South Africa usually start from 300 for individuals; with higher scores meaning you are more likely to pay your bills on time.

Lenders may be wary of people with scores below 600, while scores above 650 are usually seen as good. You can think of 600 as a normal credit score. An average credit score, on the other hand, means that your credit score is normal.

The word “normal” can mean different things to different people, but it is used to describe most people and the basics of credit companies.

For example, two people, Sam and Alex, both want to borrow money. Sam has a credit score of 720, which shows that they are good with money and would be a good borrower. Alex’s score, on the other hand, is 580, which means he might have problems like late payments or a lot of debt, which makes lenders hesitant to give him loans or good terms.

People in South Africa need to keep an eye on their credit scores regularly because they affect their ability to get credit and take advantage of financial possibilities.

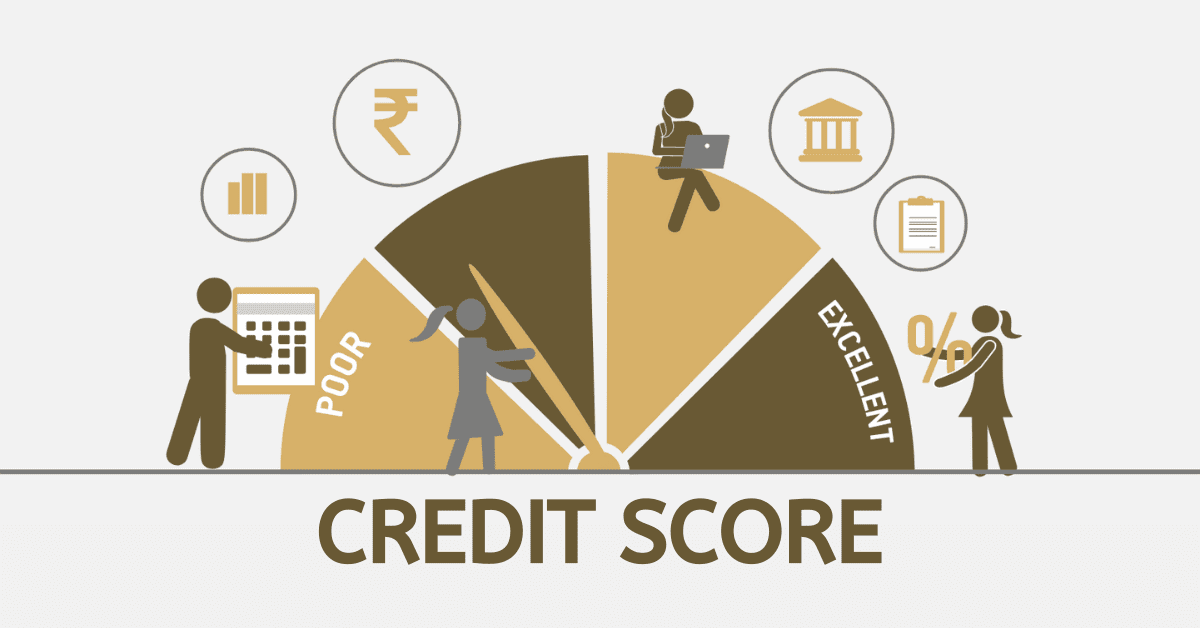

What are 5 factors that affect a credit score?

Credit scores are very important in South Africa for financial deals. Several things can affect a person’s credit score. Here are at least 5 factors that can affect a person’s credit score.

- One of the most important things that affects your credit score is your payment history. Check this to see if you have paid your bills, credit cards, and loans on time. If you have late payments, failures, or accounts that are in collections, it can hurt your score a lot.

- Credit Utilization Ratio works by comparing how much credit you are using to how much credit you have available. It shows good credit management to keep this number low, ideally below 30%. High utilization can hurt your score because it shows that you are having trouble paying your bills.

- How long you’ve had credit cards is also very important. A longer credit past usually helps your score because it gives lenders more information to decide if they can trust you with credit.

- When you ask for new credit, lenders usually do hard inquiries on your credit report. If you get too many hard questions in a short amount of time, it could mean that you are having money problems or are a high risk, which will lower your credit score.

- Your credit score can be positively affected by having a variety of credit kinds, including credit cards, loans, and mortgages. It shows that you can appropriately handle various forms of credit. But, your score can momentarily drop if you apply for too many different kinds of credit in a short amount of time.