A credit inquiry is an important part of figuring out someone’s financial situation because it affects their ability to get different types of financial goods and services.

For the most part, it means that a lender or creditor asks a credit bureau to show someone their credit record. This action gives lenders information about a person’s spending habits, which helps them decide how risky it is to give them credit or loans.

When an investor checks someone’s credit score, they are looking for information about how creditworthy the person is. This check looks into the person’s credit history, like payment history, current debts, length of credit history, kinds of credit used, and recent credit inquiries. Based on this information, lenders can determine how likely it is that the person will be responsible for paying their debt.

As we have shared about credit inquiry; although there is another type of inquiry, we will focus more on hard inquiry.

In the end, we should be able to understand the outcomes of hard inquiry and the points to lose.

What is a hard inquiry credit score?

When someone applies for a loan or credit card and checks your credit report, this is called a “hard inquiry.” This will have an effect on your credit score. It is like when a possible landlord checks your recommendations before letting you move in. Because they show you are constantly looking for credit, hard inquiries can temporarily lower your credit score. However, the effect is generally small and does not last long.

Let us say you want to get a car loan. To find the best rate, you go to a few different banks or credit unions. It is possible that lenders will check your credit every time you apply for a loan. Also, when you ask for a new credit card, the credit card company will usually do a hard inquiry to see how creditworthy you are.

Your entire application and follow-up questions could pose a threat to lenders on loans. It could send a signal to the lenders or creditors that your responsibility in paying off the loan could be questioned.

But if you are just looking for the best rates quickly, credit scoring models will usually treat multiple inquiries for the same type of credit as a single search, which will have less of an effect on your score.

What counts as a hard inquiry credit check?

A hard inquiry credit check is when a lender or creditor looks at your credit report to decide whether to give you the applied loan. It happens when you ask for credit, like a credit card or a loan. A typical example is when you apply for a new credit card

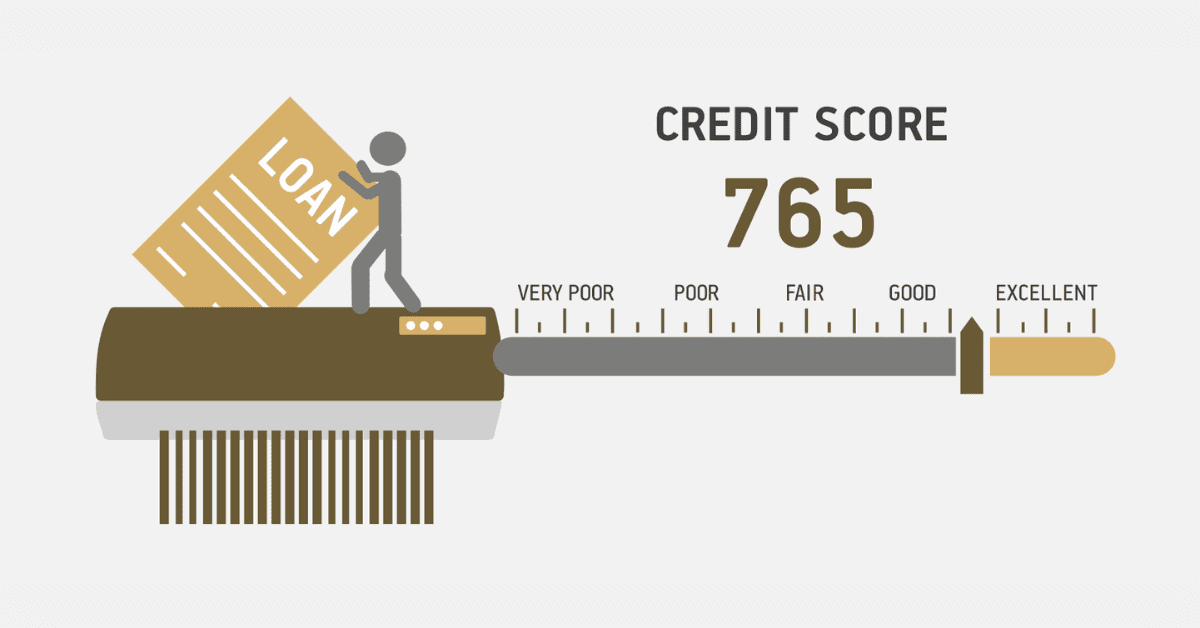

How many points does one hard inquiry affect credit score?

One hard inquiry is considered as one lender looking into your credit score to check your financial abilities. By doing so, read through your credit report to know your payments, debt, credit score and others.

A single hard inquiry can make you lose precious points even though it is not significant. In all circumstances once there is at least 1 hard inquiry be prepared to lose some points.

According to FICO 1, hard inquiry could make you lose at least 5 points or less.

However, the highest point one could lose after 1 hard inquiry is at most 10 points.

Does a hard inquiry mean I got approved?

At the point of applying for a loan; whether a car or mortgage it becomes necessary for the creditor to see if you possess any risk.

Typically, when you apply for a new credit, it calls for creditors to pull your credit with your authorisation.

Unlikely, getting a hard inquiry on your credit does not mean you are going to get approval for the loan. However, there is always a pre-approval option that can be very subjective.

Once you see your lenders requesting to see your credit score, do not assume your credit application or loan will easily be approved.

What is a soft inquiry credit score?

Soft inquiries, sometimes called soft pulls or soft credit checks, are a common component of background credit checks for both individuals and businesses.

This inquiry is done as part of the background check procedure and will not impact your credit score in any way.

In contrast to the hard inquiry that is typically conducted when you request credit, a soft inquiry has no effect on your creditworthiness.

Soft inquiries provide useful information about your financial health without affecting your credit-based score, so it is important to understand them well. But distinguishing them from challenging questions, which can temporarily lower your score, is of the highest significance. Soft inquiries may not have any obvious consequences, but the information they give to people in charge of their money is invaluable.