In South Africa, where financial stability is very important, knowing your credit score can have a big effect on your ability to get loans with low-interest rates.

Lenders see you as a lower-risk person because your credit score shows how responsible you are with money.

When people apply for personal loans, banks usually check their applicants’ credit to see how risky they are. However, people have control over who can see their credit records.

While we provide you with the best hacks and tips for your financial life, you must also understand how subjective it can be.

Each individual has his or her own record when it comes to finances. What may favour the other may not favour the other person.

However, it is important to always find means to ensure you improve your credit score and find ways to minimise getting bad credit.

What is a good credit rating for a personal loan?

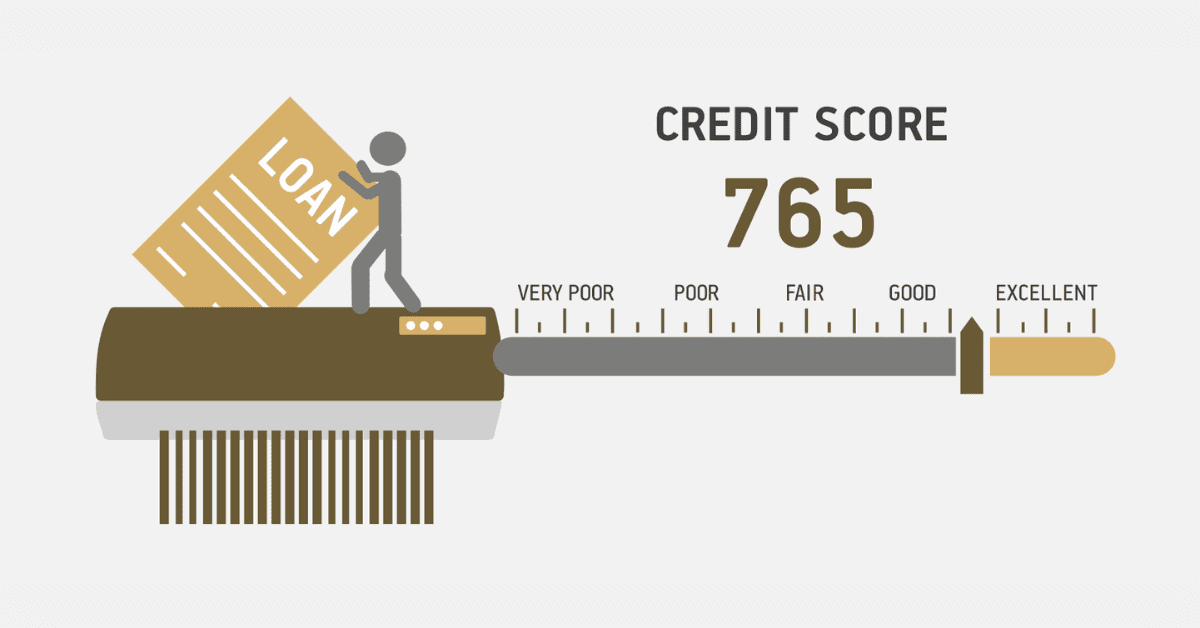

A good credit rating for a personal loan is important for people who need money.

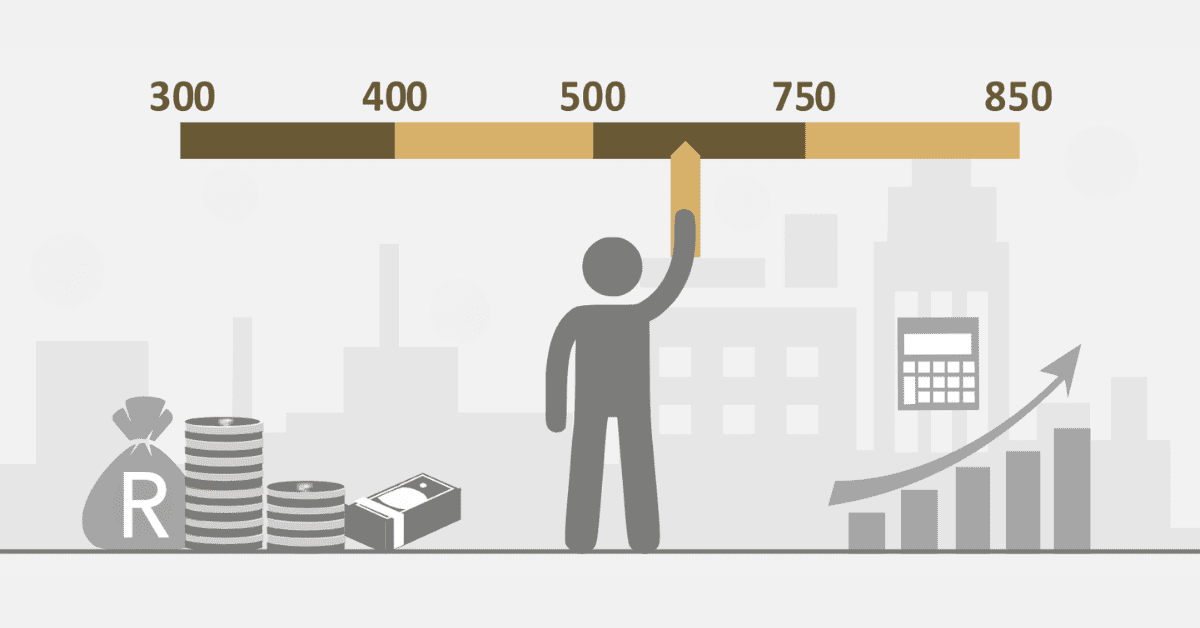

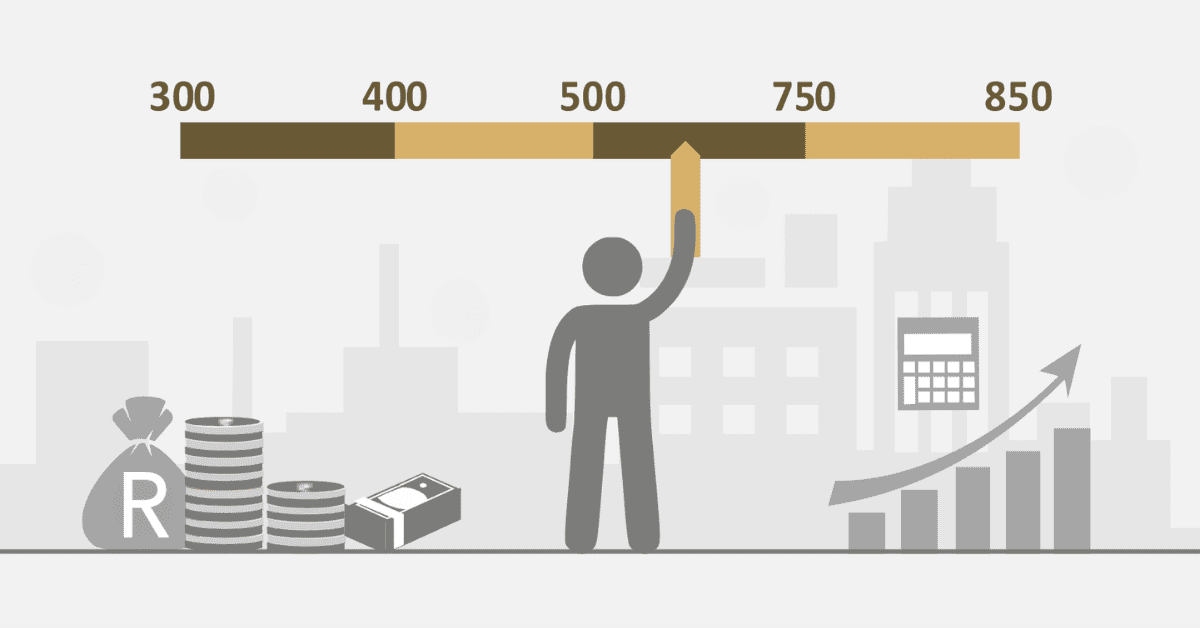

In South Africa, where creditworthiness plays a big role in loan decisions, a credit score above 650 is usually seen as good for getting a personal loan quickly.

A good credit rating shows that you have been careful with money in the past, by paying your bills on time and using credit wisely.

Lenders see these kinds of people as lower-risk borrowers, so they often give them better loan terms and interest rates.

It is important to keep in mind, though, that credit score requirements can be different between lenders and the region. Loan approvals are also affected by things other than the number score, like how much commitment you make to your debt.

How much can you borrow with a 620 credit score?

If you are a South African resident with a credit score of 620, you may be thinking how much you can borrow.

An important factor in figuring out how much money lenders are willing to give you is your credit score, which is a number that shows how creditworthy you are.

People in South Africa think that a credit score of 620 is fair. It is not the best score possible, but it is also not the worst.

You might still be able to get loans and credit with this score, but the terms and amounts you can get might be less flexible than for people with better scores.

Lenders may consider thoroughly how much they can lend you with a score of 620.

With your credit score of 620, you may want to borrow a small amount from the start; but that confirmation does not lie in your hands.

The lender determines the amount to give you with that amount with high interest or reject your application.

However, based on confirmations and certain applications, individuals with a 620 credit score can borrow at least R5000. This amount could go way higher but your lender may determine if you qualify for the loan after checking your credit history

Do banks do credit checks for personal loans?

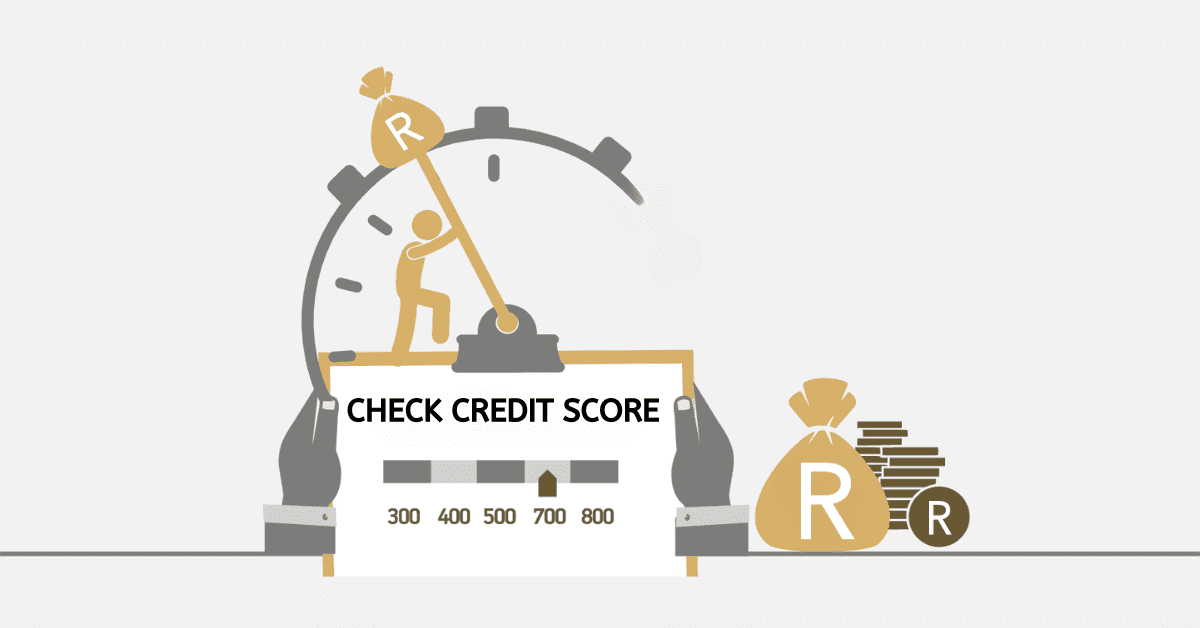

If you want to get a personal loan, you may wonder if banks check your credit. Let us talk about what a credit check is before we look at the possibility of a bank doing a credit check.

A credit check happens when a lender or creditor takes action to look into your credit history. This is to assess your ability to repay the loan on time.

In South Africa, credit scores can only be seen by companies that you permit to do so.

When you ask for credit, like a personal loan, you usually give permission for a credit check to be done. You have to do this when you ask for a personal loan unless you specifically look for one that does not check your credit.

When someone wants to borrow money, banks have to check their credit. The bank should know what kind of risk they are taking by giving this loan. If you get approved or turned down for this personal loan, the check can tell.

Can I get a loan with 625 credit score?

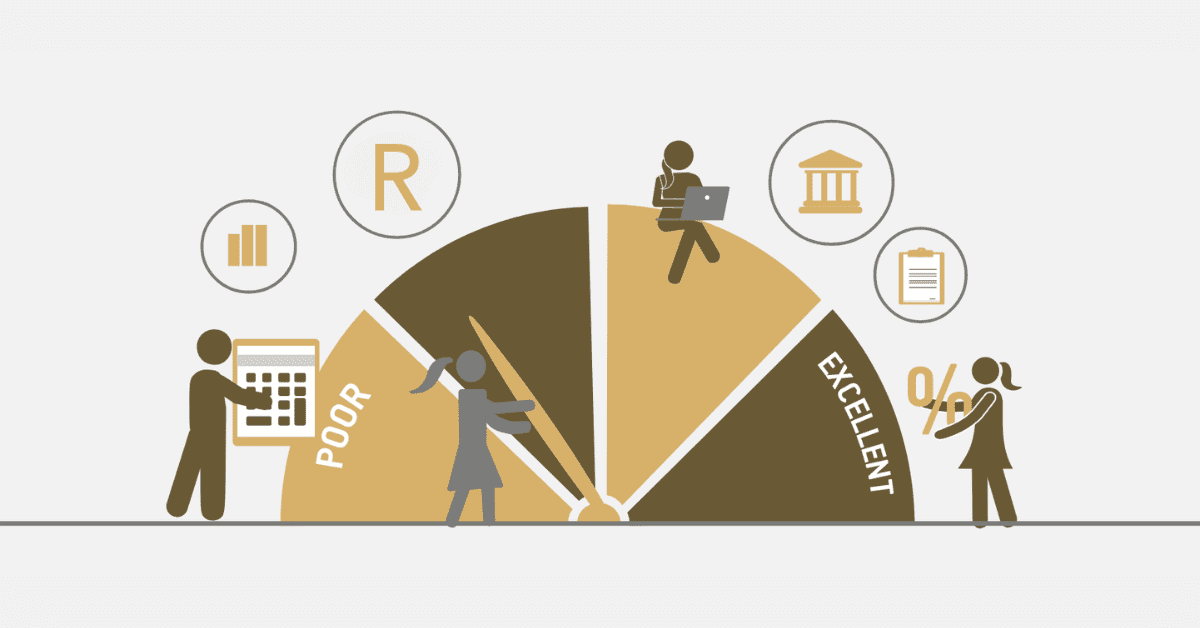

Speaking of credit scores, there is no benchmark set for giving out loans.

Indeed your credit score is important but in the credit system, no standard has been captured to qualify you for a loan. But here is the catch about getting a loan with a 625 credit score.

If have a credit score of 625, it can be considered as “good” which means you have been diligent with your credit and payment.

However, you can also be seen as a high-risk borrower which means it can be difficult for you to secure loans with good interest rates. There is a big difference here.

With a 625 credit score, you can get a loan, but at what interest? Someone with a higher credit score of 825 can enjoy a very low interest rate and will be liked to get the approval for the loan in the shortest possible time.

In all these, it is important to check out more lenders to compare options. A 625 is a fair credit score to give you a loan, but remember to keep your options open.

In South Africa, many individuals with a 625 credit score can secure a loan but may find it difficult to secure the loan in the shortest possible time.