Isn’t it funny how so many hidden factors can play a big role in our lives? On the financial side, your credit score and history are one of these. We rarely think about it until we need it- but then it is too late to make positive changes to achieve our goals. Today we unpack the mystery of the credit score, why it matters, and what you can do to fix a bad one.

What is a Credit Score?

A credit score is a three-digit number assigned to your ‘credit profile’ with the credit bureaus. It takes into account factors like your payment history, how you use credit, the length of time you’ve had credit, the types of credit you use, and how frequently you apply for new sources of credit. It is used to give potential lenders a sense of how creditworthy you are and how much of a risk they are taking by loaning to you. It is not only used not only to decide if you get a loan. It is also used to determine how favorable your rates and terms for that loan will be.

A high credit score proves you have used credit responsibly in the past. A low score can make you look like a poor risk. It will limit your access to credit, as well as reduce the favorability of offers you receive.

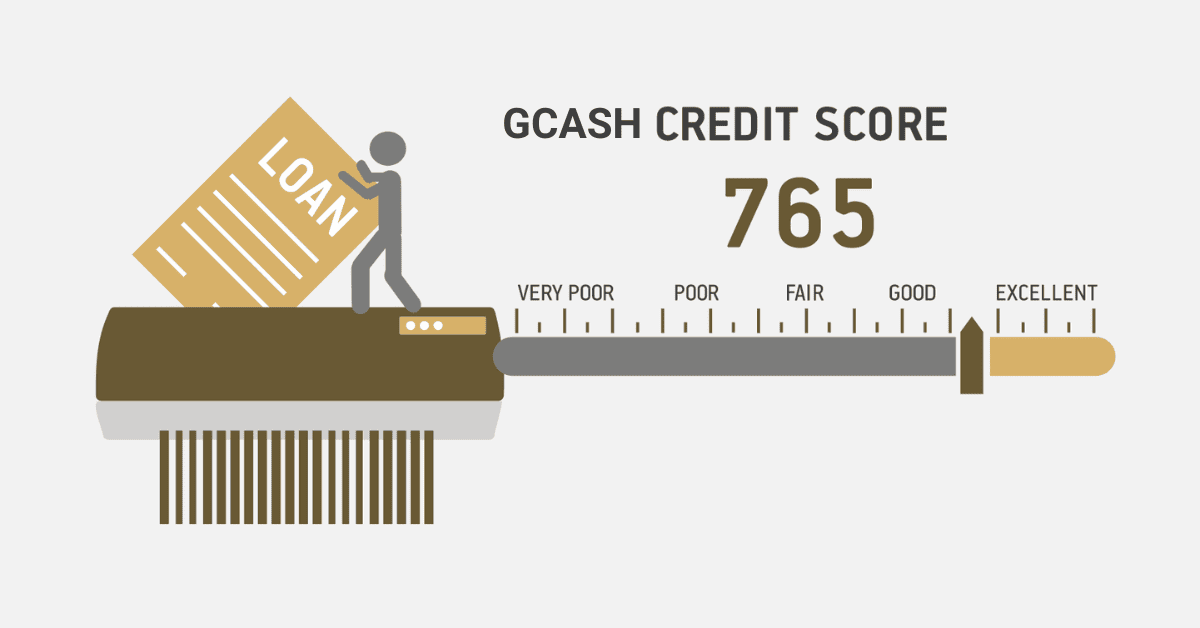

South Africa uses a scale between 0 and 850 to assess your credit potential. However, this isn’t a test at school! You don’t have to get ‘top marks’ to win. For most people, keeping a credit score at least in the 600s, preferably above 670, will be more than enough to get the best possible access to credit.

Why is it Important to Have a Credit Score?

Credit scores are used to assess how much of a good credit risk you are. Financial institutions, lenders, and even potential employers use this score to assess your ability to manage credit responsibly. A good credit score opens doors to favorable financial opportunities, such as obtaining loans with lower interest rates, securing credit cards, and qualifying for mortgages.

A positive credit history will impact other aspects of your life, too. It can influence rental applications, utility deposits, and insurance premiums. Additionally, employers may consider your credit score as an indicator of financial responsibility and trustworthiness. So it pays to build a strong, positive credit history.

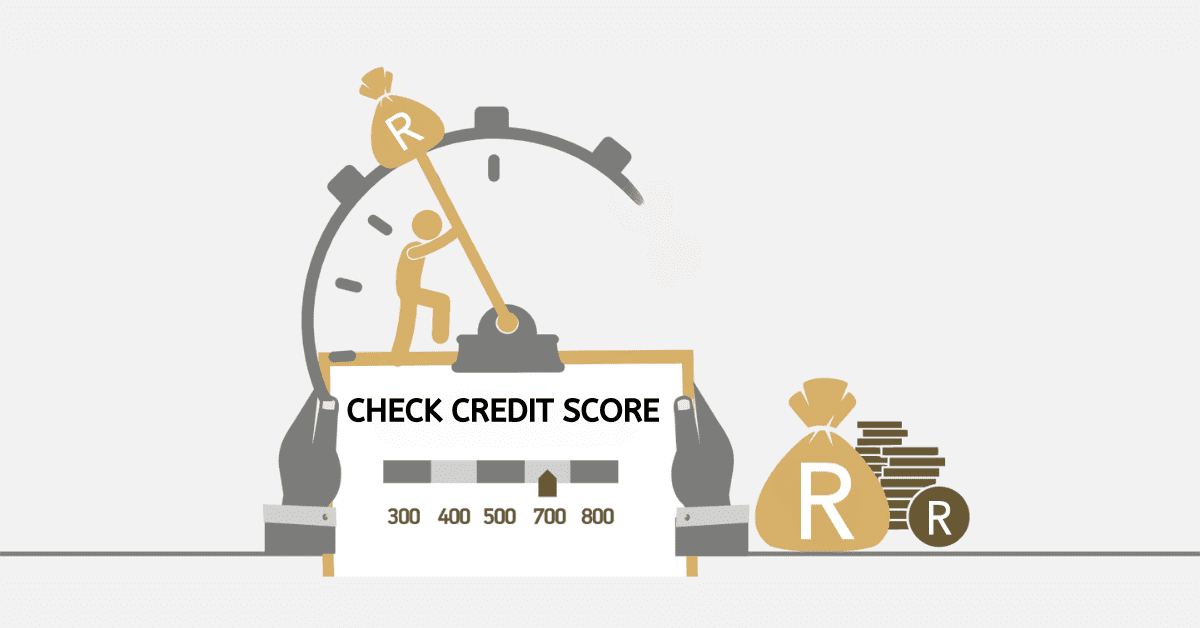

What is a Good Credit Score in South Africa?

The official ‘good’ credit score band in South Africa is 670 plus. This becomes very good at 740, and excellent at 800. However, 580 to 699 may be called ‘fair’ and not good officially, but it is where many of South Africa’s better savers sit and will be good enough to access many lines of credit, so don’t panic if you aren’t quite in the good band just yet!

What’s a Bad Credit Score in South Africa?

In South Africa, a credit score below 580 is seen as bad. You have no credit rating if your score is under 300. This could be due to bad credit habits, but also may simply mean they have no data on you yet. Here’s some food for thought. The current average South African credit score is 560, in the bad credit band. This is symptomatic of our poor financial habits and overuse of credit as a nation, regrettably.

How Do You Fix a Bad Credit Score?

We have good news and bad news for you. You can fix a bad credit score! You likely can’t do it quickly, however, especially if you are starting with a bad credit history and not no credit history. You will need to take a strategic, planned approach to rehabilitating your credit. You can’t just hope for the best!

Start by pulling a copy of your credit report from at least one of the major four bureaus. Don’t rely just on the credit score tools you may have through your bank. It is time to see exactly what is going on. Comb through the report, and note what it says. Are there entries that should have been closed and haven’t been? Or a strange activity that isn’t yours? Then contact the lenders and the bureau to resolve it.

Next, you need to fix what’s already broken. This could mean paying off overdue credit if you have the means. Alternatively, contact the lender and see if you can work out a payment plan. If you have defaults or judgments against you, you will have to wait for them to pass off of your credit report in time.

Once you have done everything you can to mitigate the poor credit history you have already, it is something of a time and numbers game. Newer lenders should slowly open a few lines of low-impact credit, like store cards or possibly a secured credit card. These are rare in South Africa but do exist. You effectively prepay the balance you can spend, to show you can use credit responsibly. If you started with bad debt, focus on improving the lines of credit you already have. You are unlikely to qualify for new ones with a bad track record. But you may be able to add a small short-term installment loan or store card to give yourself a boost. Of course, you can’t immediately spend it to the max!

Ensure you are paying on time, every time, too. Payment history has a big effect on your credit score. Aim to bring outstanding balances on your credit lines under 50% of the total for an extra boost, too. Lenders don’t like maxed-out credit on your credit report. If you take this methodical approach to fixing your bad credit score, you will soon be back in the black.

Credit scores matter. But the good news is they can always be fixed, even if it will take some time and effort. Good luck!