It is obvious to come across credit bureau scores which may sound unfamiliar. People know about credit bureaus and credit scores. But what is a credit bureau score? How does one translate this into a definite meaning?

Before we get into credit bureau scores, we must first understand its premises: credit bureau and credit score.

A credit score is like a map that helps someone find their way through all the different loan choices. The credit bureaus worked hard to develop this number fingerprint, which boils down all financial behaviour to some numbers.

Credit bureau gathers data using past financial histories.

They control who can get loans, mortgages, and credit cards, which means they have a say in how people’s finances work.

A credit score is like a lamp; it tells lenders the truth about a borrower’s ability to pay back debt. All of these things work together to make economic responsibility and, in a way, make people financially disciplined.

Having understood the separate concepts, let us jump into more context of credit bureau scores. This blog will further help you understand the calculation of the credit bureau score and many more.

What is a credit bureau score?

The credit bureau score, in simple terms, is an establishment of figures by financial institutions to identify financially responsible people.

At the core, the numerical representation of one’s diligence in finance is translated into a credit bureau score. It defines how one can pay off their loan and the timelines they may have.

The score is generated from different factors and statistics. However, the factors are more fundamental in generating the score, while the statistics determine how the score will fluctuate or adjust in time.

Some of the factors include existing debt, the timeline on your credit, the type of credit, credit history, payment history and new credit accounts.

The credit bureau score comes from these reputable credit agencies. One of the most common credit bureaus is the FICO credit which was developed by the Fair Isaac cooperation. This firm has been in existence for many years, working on credits and its systems.

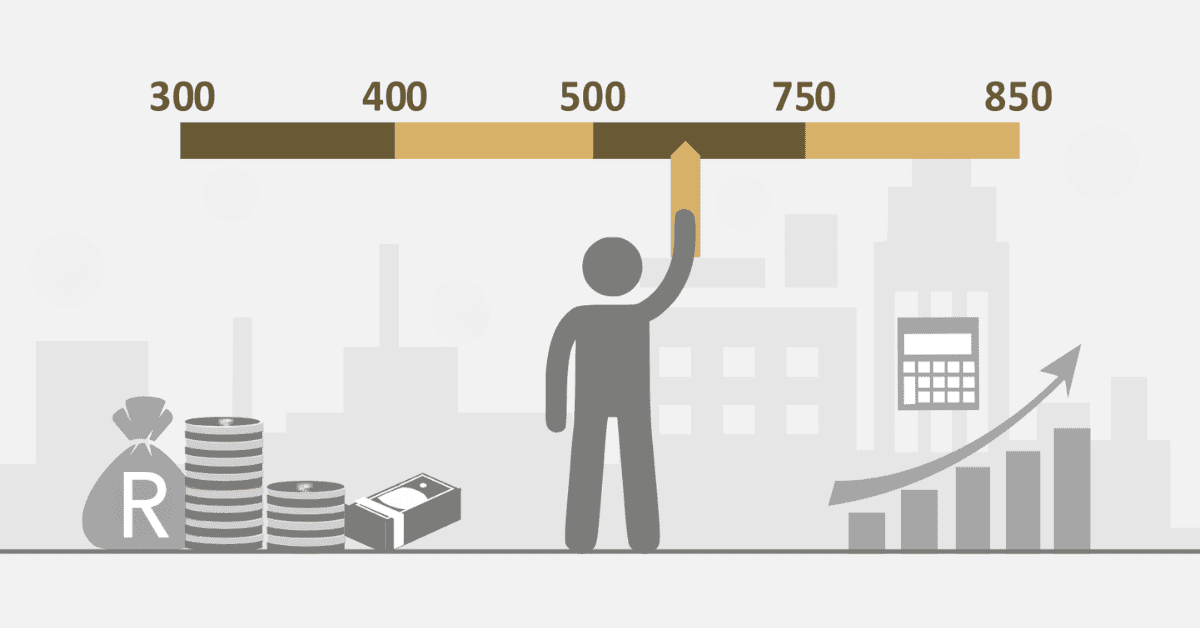

Credit bureau scores for individuals could range from 300 to 850. These figures stand for your entire financial responsibility and discipline.

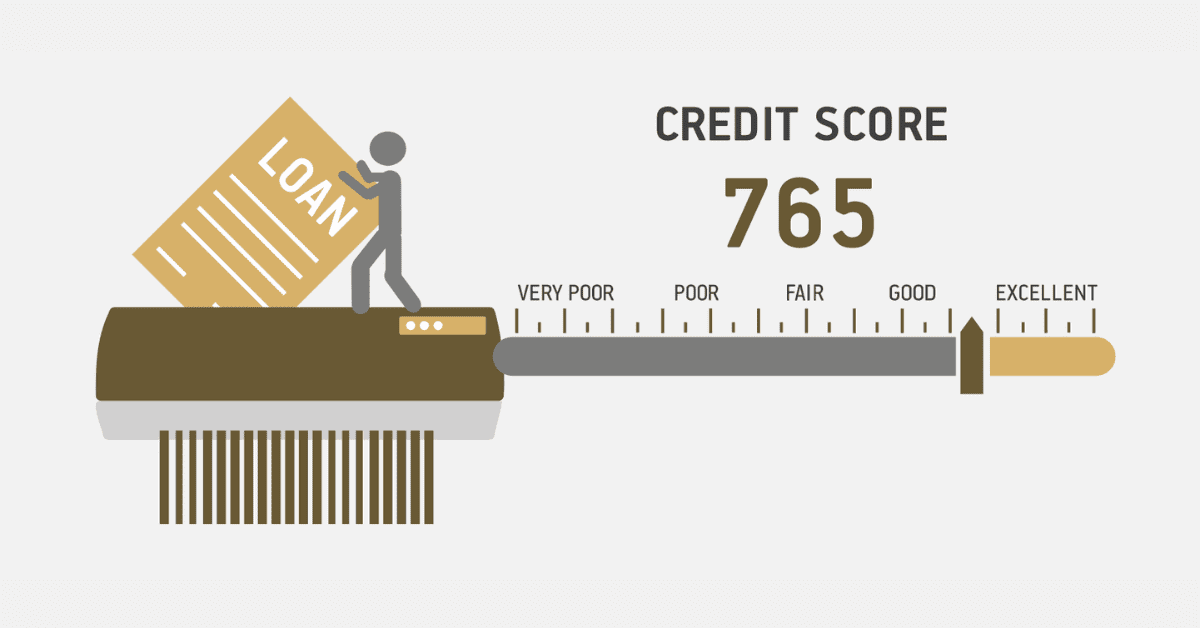

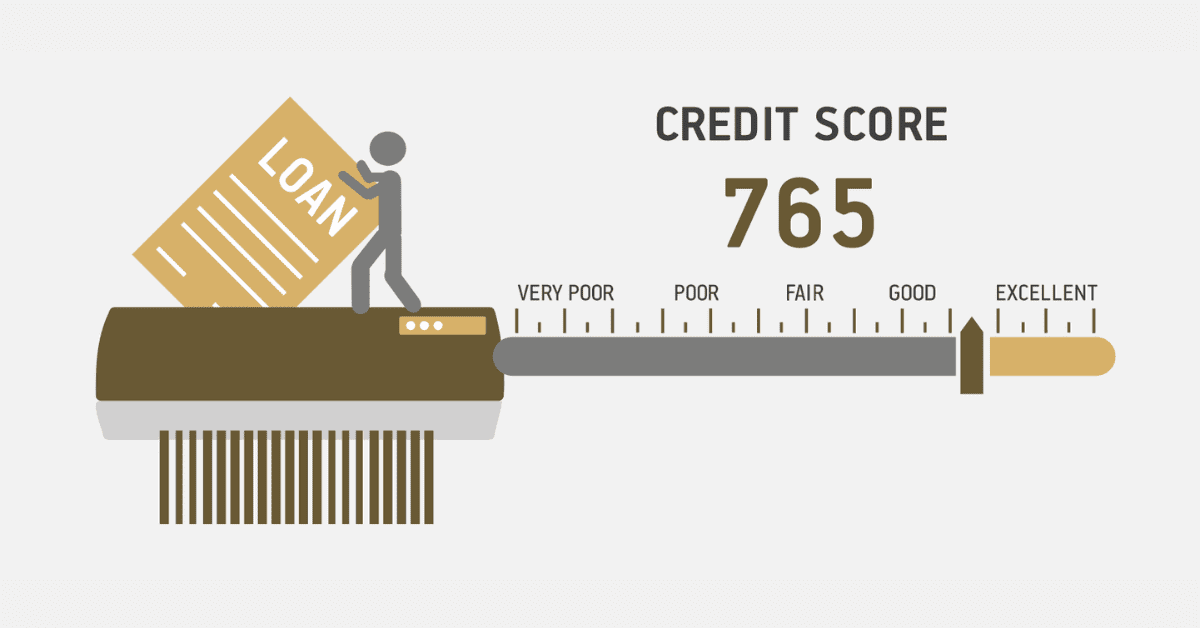

There are many ways that your credit score affects your finances. Banks and other lenders use it to decide if they will give you credit, loans, mortgages, or other types of financing.

A higher credit bureau score can help you get better interest rates and terms, which could save you a lot of money in the long run. In addition, landlords, insurance companies, and even employers may look at your credit number when deciding what to do with you.

To keep a good credit bureau score, you need to be careful with your money. To do this, you should pay your bills on time, keep your credit card balances low, avoid starting too many new accounts at once, and check your credit report often for mistakes or signs of fraud.

A credit bureau score is an important way for lenders and other businesses to figure out how creditworthy you are. Knowing how it’s determined and what it means for your money gives you the power to make smart choices and take charge of your financial future.

How to calculate a credit bureau score?

To calculate the credit bureau, you must understand the components of it. However, these components can be very confusing. If you find yourself looking to calculate your credit bureau, you need to know how complicated it can be.

However, the fundamentals are used in percentage forms to determine an individual’s entire credit bureau score. These percentages work hand-in-hand and can be influenced by an individual’s financial behaviour.

- Payment History (35%): This is very important. Banks and lenders want to know if you’ve been good at paying your bills. One example is that Gustavo TK’s credit score will go up if he always pays his bills on time.

- The amount you owe (30%): Having credit accounts isn’t a bad thing, but using all of your accessible credit might be.

- Credit duration (15%): Having credit for a longer time is usually better for your score. But it’s not the only thing that matters.

- Credit Mix (10%): Having a variety of credit types, such as loans, mortgages, and credit cards, can help your score.

- New Credit (10%): Getting a lot of new credit accounts quickly can be risky, especially for people who don’t have much credit history.

With the above percentages and factors; of every credit obtained, your payments, timelines, and rate go into calculating the credit bureau score. This is done by the credit bureau within a short period of time to determine the score you get.

What happens when you are reported to credit bureau?

Being reported to a credit bureau could be a good thing but mostly, the report is to give negative criticism. When you are reported to a credit bureau, your financials are looked into.

Certainly, there is going to be an investigation and checks to see your entire credibility using your credit history.

Creditors and lenders will also have access to your information from the credit bureau after they have received a report about you.

How do I know if I am on the credit bureau?

Before one could be on the credit bureau, you must have applied for credit. Whether you received the final credit card or not, your information is saved with the credit bureau.

Individuals who are on the credit bureau have an existing credit score and can utilise their credit.

Once you are on the credit bureau, you will have access to their platforms to view your entire credit history.

What is the difference between a credit score and a credit bureau?

A credit score is a number that shows how creditworthy a person is and how likely they are to pay back borrowed money.

It depends on the past of payments, how much credit is used, and the length of credit history.

However, a credit agency is a business that keeps track of credit information about people and businesses. Credit reports are made up of information about a person’s payment history, current debts, and credit requests made by lenders. A credit bureau gives you the specific information used to make your credit score, which is a single number.