When you are new to debt consolidation, the term may not look favourable. When you gain some insight into what debt consolidation is, you start looking for ways to connect the dots to your credit score.

The credit system in South Africa compromises different branches, terminologies, features etc.

How does debt consolidation get into credit score? Is it considered to be beneficial to start a debt consolidation? Is there any effect on your credit score upon consolidating your debt?

Well, this and many other questions are going to be addressed below to provide some knowledge on this particular subject.

After reading this blog, you should know the consequences of debt consolidation on your credit score.

What Is Debt Consolidation?

Debt consolidation is the process of combining several bills into one loan or payment plan that is easier to handle.

Usually, this means getting a new loan to pay off old ones, like credit card balances, personal loans, or hospital bills.

People who consolidate their debt hope to make their payments easier, possibly get lower interest rates and make their funds easier.

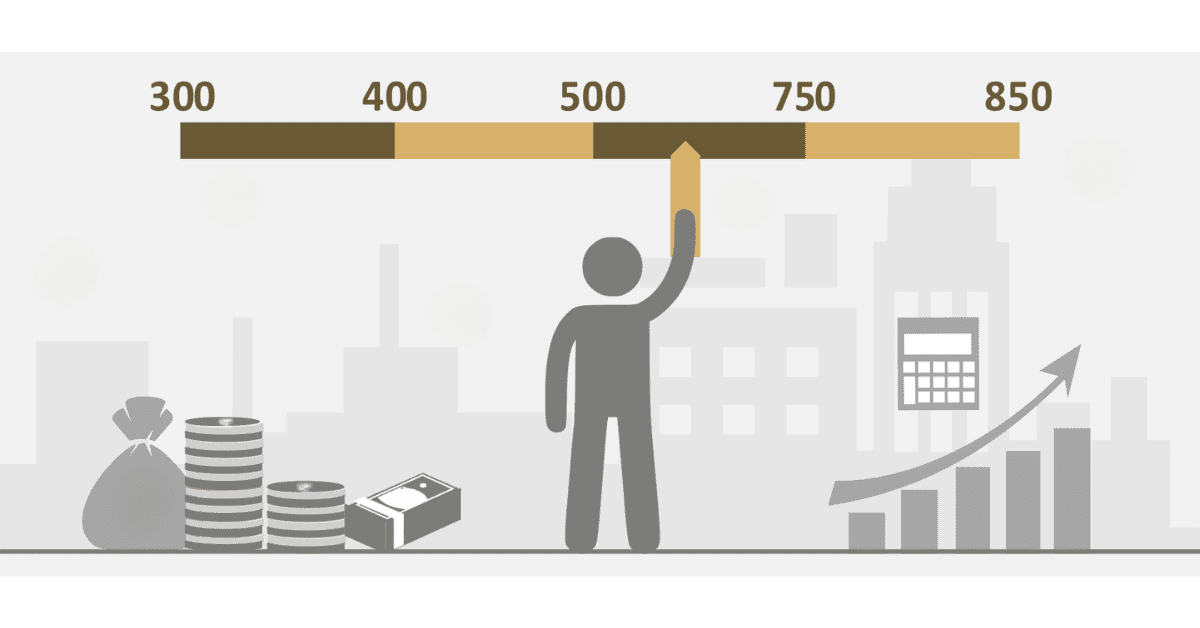

There are different ways that debt reduction can affect your credit score. At first, it might cause a short-term drop because of the request for a new loan and the closing of old accounts.

But over time, managing the combined debt responsibly; making payments on time and lowering the total amount of debt can improve credit scores. Having a single, organized payment plan may also help people avoid missing or being late on payments, which can improve their creditworthiness over time.

What does debt consolidation do to my credit score

Debt consolidation is the process of combining several debts into one big debt. This makes your monthly payments easier.

Getting rid of debt can take a few weeks to a few months. How long the process takes depends on a number of things, such as the total amount of debt, the method chosen to consolidate, and the steps taken by the lender.

When you first start to consolidate your debt, it will hurt your credit. Still, if you pay your bills on time, debt consolidation should be good for your credit in the long run.

In the short term, debt consolidation might lower your score a little if you do it right. A hard inquiry, which shows up on your credit report every time you apply for credit, is what caused the drop. Some credit bureau says that the drop is usually less than 5 points, and your score should go back up in a few months.

In the long term plan debt consolidation increasingly builds your credit score. Once you keep doing the expected, your credit score improves over time.

Is it better to settle or consolidate debt?

When you have a lot of debt, choosing whether to settle or consolidate can be very important. Both choices have pros and cons, especially when it comes to credit scores.

Debt settlement means talking to your creditors about paying a smaller amount of what you owe. This usually lowers your overall debt. This can help right away, but it usually comes with a big hit to your credit score because of late payments and closed accounts.

Debt consolidation, on the other hand, means combining several bills into one loan with a lower interest rate. This can make your payments easier and could help your credit score by showing that you can handle your debts responsibly. Getting a combination loan, on the other hand, might require good credit at first.

It is important to think about your financial situation and goals as you weigh these choices. If you need help right away and are ready for possible negative effects on your credit score, a settlement might be the better option. On the other hand, if you want to improve your long-term credit health and security, consolidation is a better option.

Always take time to assess and evaluate the need to settle or consolidate your debt before initiating the process.

Certainly, the information provided will give you a bit of an insight into how debt consolidation works, the benefits and its disadvantages.

How can I consolidate my debt without affecting my credit score?

It is never possible to consolidate debt without hurting your credit. Once you start the process of debt consolidation, one way or the other it can affect your credit score.

However, there are simple guidelines to help you consolidate debt without affecting your credit. These are considered as advice in order to reduce the impact on your credit score.

- Always make sure to pay your bill on time. As soon as you miss it, you must pay it quickly to avoid any extra interest and credit deduction.

- Do not start the habit of applying for multiple credit or loans in a short period of time.

- If you move debt from one or more credit cards to a new one, the new card may have a higher utilization rate. However, it is better to have low utilization rates on all of your credit cards.

- Paying off a balance transfer quickly has the tendency to minimize the effect of debt consolidation on your credit score. This can be translated as high utilisation and is good to keep your old cards open even after paying off the debt.

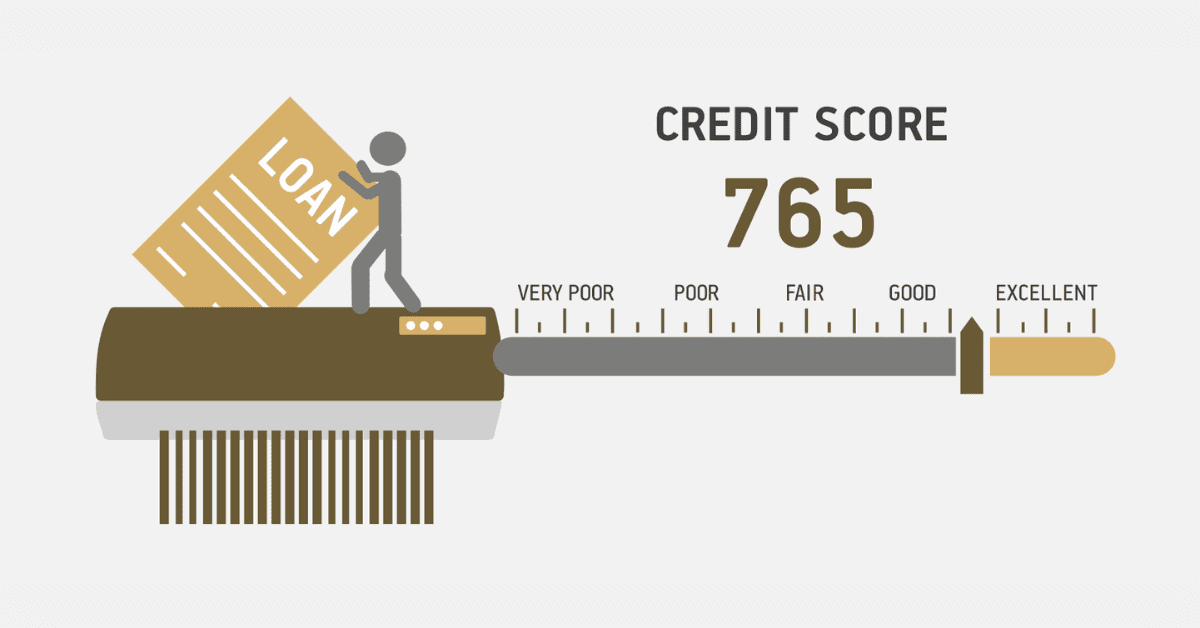

How long does it take to rebuild credit after debt consolidation?

During the initial stage of debt consolidation, the impact on your credit score can be significant. This is normally considered the first phase of debt consolidation. This is mostly within the first few weeks of this process.

However, the long-term plan, which takes months, helps your credit score to get better.

After debt consolidation, it can take you about 6 months to 12 months to rebuild credit. Once you complete your debt payment, you need time to have your credit open and also not to be quick about seeking loans.

In summary, it can take about 24 months to get your credit back on track after debt consolidation.