If you are now ushering yourself into the credit score world, it is an advantage to learn about the terms and conditions. The terms and conditions are not strict rules or laws about credit scores.

Rather they speak about the classes of credit score, the pros and cons, the process and many more.

When you obtain a credit score, your activity is considered to be null but your credit begins from 300. The 300 is the starting point for many people using personal credit. Once the activity starts on your credit the number begins to change.

Credit score details with numbers and these numbers represent the performance of your financial activities. At every point where there is an activity, there is a plus or minus to your credit score. Although the calculation goes on in the background, it does not immediately reflect on your credit score.

As time goes on your credit score could tell a lot about you to lenders. Whether you have good credit, bad or average, there is an evaluated indicator given to your credit.

So should you find yourself within the average, what do you do? What does that average credit score mean? How do you fix that and what are some of the financial opportunities available for the average credit score bearer?

What does below average credit score mean

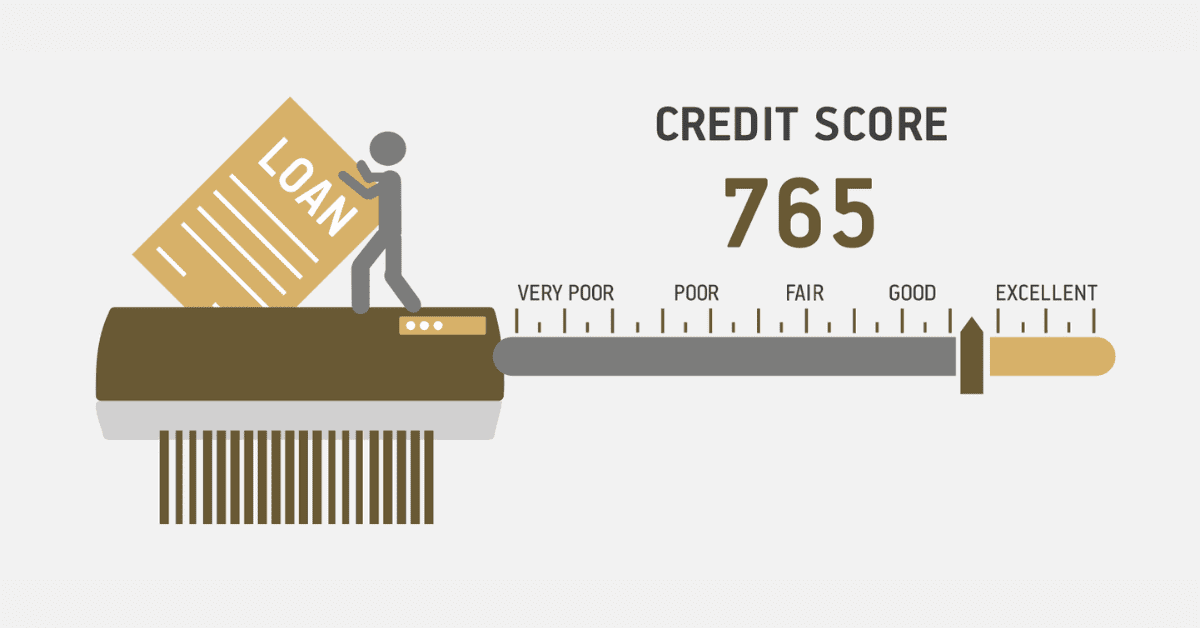

Understanding your credit score is crucial for maintaining a healthy financial profile. It provides insights into your creditworthiness, taking into account factors such as your payment track record, debt levels, and credit utilization. The credit scores range from 300 to 850, with higher scores indicating a greater likelihood of credit approval and better financial opportunities.

In simple terms, an average score is considered neither good nor bad. An average credit score is considered a fair score for most of the credit bureaus.

For some, an average is considered between 550 to 650. And to some 700 is considered to be the average.

However, in the mathematical concept, an average is seen as the addition of the lowest and highest which is halved into 2. With this, the average can be taken as 575 points.

While maintaining an average credit score can be beneficial for improving future scores, it is crucial to consistently manage it.

Financial goods are available to individuals with fair or average credit, but those with excellent credit enjoy even greater benefits, such as lower interest rates and more favourable terms.

When lenders consider you for loans, they carefully evaluate your credit score, as it has a significant impact on the rates and terms you may qualify for. By striving to improve your credit score, you increase your chances of qualifying for notable credit cards, favourable mortgage terms, and competitive rates for loans.

What happens when your credit score is below average?

The consequences and the outcome of having your credit score below average can be detrimental to your finances. When you see that your credit score is below average which could be below 650, it is time to start making the necessary corrections.

When your credit score is below average it limits your access to so many financial opportunities. Once you have a credit score below average, it can be considered poor or bad credit. Lenders see you as a high risk and may withdraw from giving your loans.

How do I fix my below-average credit score?

It takes a focused approach and a strong commitment to improve your credit score.

First and foremost, it is crucial to confront your money habits directly. Identify areas of excessive spending and make significant cutbacks. Create a disciplined budget that intelligently allocates your funds, prioritizing debt repayment above all else.

As part of the ways to fix your below-average credit, make sure to thoroughly review your credit record for any errors or inaccurate information. Ensure that your report reflects your current financial situation by promptly addressing any inaccuracies.

Incorporate healthy spending habits into your everyday routine. It is advisable to only use your credit card for essential purchases and ensure that you maintain a balance well below your credit limit. Be responsible with your credit usage, demonstrating your trustworthiness and financial maturity.

Above all, develop the habit of being accountable and self-disciplined when it comes to managing your finances. Be aware that every decision you make regarding money has an impact on your reputation.

By adhering to a well-thought-out strategy and exercising caution, you can enhance your credit score and secure a more promising financial future.

What is the range for a below-average credit score rating?

Anything below an average credit score is considered to be poor. Having a below average credit score limits you to loans and if possible also increases the interest for all your loan approvals.

Any score below 650 can be considered as an average. Taking into account the minimum level of credit score, the range for a below average credit score can be between 300 to 570.

Can I get a loan with below-average credit score?

While this may seem unreal, some lenders may not mind having to give out loans to individuals with poor credit scores.

Any credit score below average can be considered as bad or poor.

It is possible to get a loan when you have a credit score below average but the conditions may be tough. Individuals who may seek loans with below-average credit scores may meet tough conditions like high interest rates.

Having a below-average credit score is not the best but must be seen as a temporary solution while working to improve your bad credit.