Have you ever wondered about when your credit score is updated? Has that thought ever battled your intuition?

This is something interesting that draws the curiosity of many. This is because people with trouble with credit scores may want to keep tabs on it. Keeping a close eye on the credit score before it is updated

Defaulters of credit payment or individuals who are not diligent with their credit scores are always seeking for quick ways to make the necessary corrections. When the day of the month is near, they may want to see if they can adjust for their credit score to favour them. However, the whole credit score system does not work that way.

But do you know the interesting thing about the credit score update? We are about to find out more. In this blog post, we will talk more about credit score updates and the day of the month the update may occur.

What day of the month does the credit score update

The process of determining when your credit score will be updated can be more difficult than you have expected. At first, there is not an easy answer to this question because there are many credit scoring models in use.

Usually, there is no set day for when a person’s credit score will be updated every month. Several things affect when the event happens. These include when lenders send information to credit bureaus when those bureaus update their reports, and when credit-scoring companies use this information in their score algorithms. For this reason, it is not possible to say for sure what day of the month changes to credit scores are handled. Instead, it is very important to understand that credit reporting and scoring are always changing because lenders, credit bureaus, and scoring businesses are always sharing information.

Does your credit score go up each month?

Depending on your financial obligation to your credit account, your credit score can be updated every month. And this is generally because of the financial activities you may have.

However, your credit score may not go up each month. There are times when your credit score stays the same for that particular month.

The increase in your credit score does not happen every month because of the systems involved in the credit score and also the financial activities on your credit score.

How often does credit score update in South Africa?

The credit score update is considered to be the frequent changes in your credit score which is mostly generated from the financial activities on your credit.

When you pay your bills on time, when you apply for a loan; all these activities are considered to be part of your credit score.

When it comes to the credit score update in South Africa, there is no fixed number of times it may be updated. The update generally falls on the activities the credit may receive within a particular time.

The credit score update may come as and when the credit bureau receives the detailed report about your finances.

However, in South Africa, your credit score could be updated at least once a month. There is no specific day for this update.

How do I know when my credit will be updated?

Many people who are new to credit ask the question “How do I know when my credit will be updated”?.

Once you are know to the credit score system it becomes obvious as you may want to monitor it to see the progress.

To know when your credit score is updated, you can always monitor your credit report on the credit bureau platform. This is the platform to inform your credit score.

To have better-organised information, you could sign up with your credit bureau newsletter to stay updated about all news which may include an update for credit score.

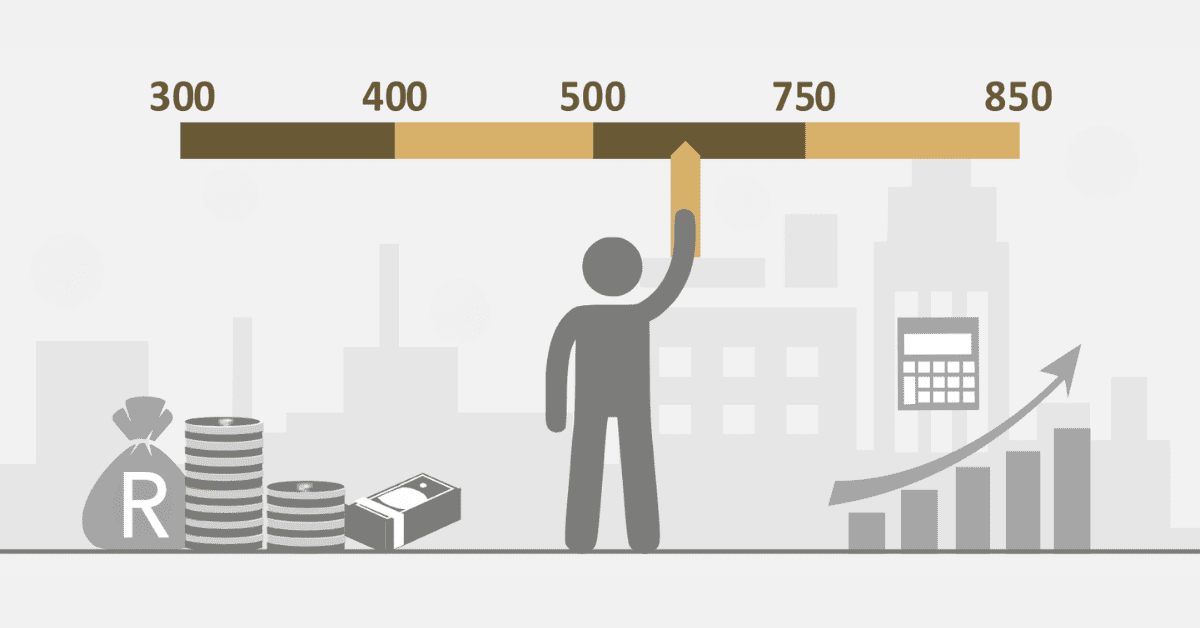

How long does it take for your credit score to go up South Africa?

In South Africa, the length of time it takes for your credit score to improve depends on several things, such as how responsible you are with money and how bad the marks on your report are. Positive changes in your credit behaviour, like always paying your bills on time and lowering your debt, can usually show up in your score within a few months. But big changes may take longer, usually between 90 and 180 days, because credit bureaus look at your financial actions over time.

This timeline is not fixed as other factors may be involved. The ideal timeline to see a significant improvement in your credit score is to wait for at least 6 months.