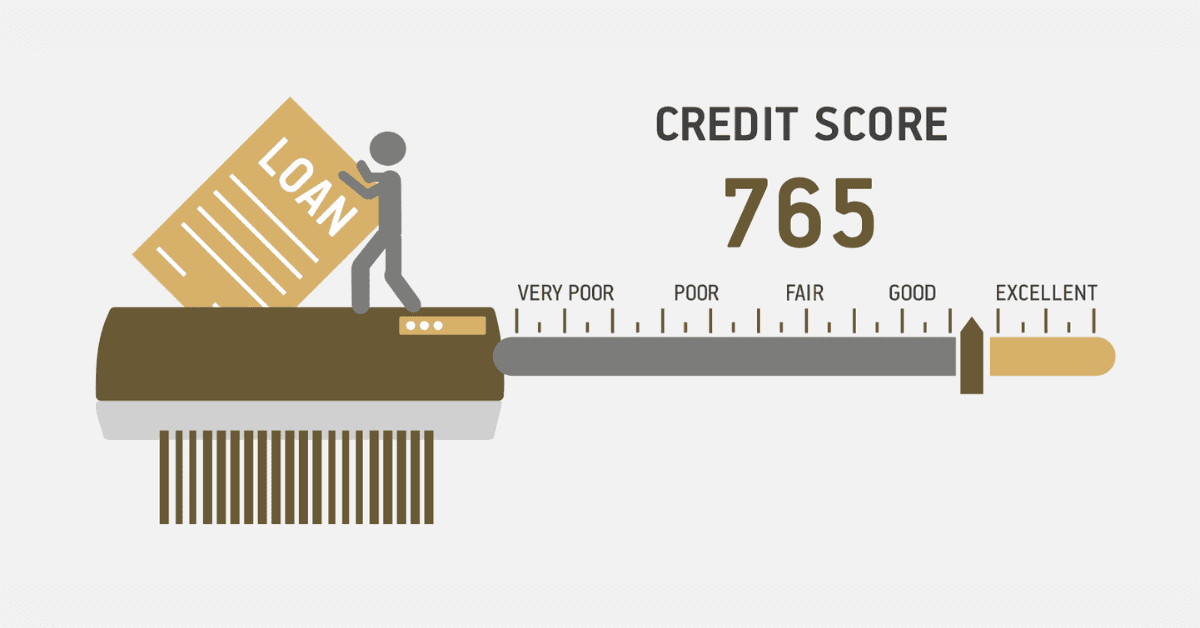

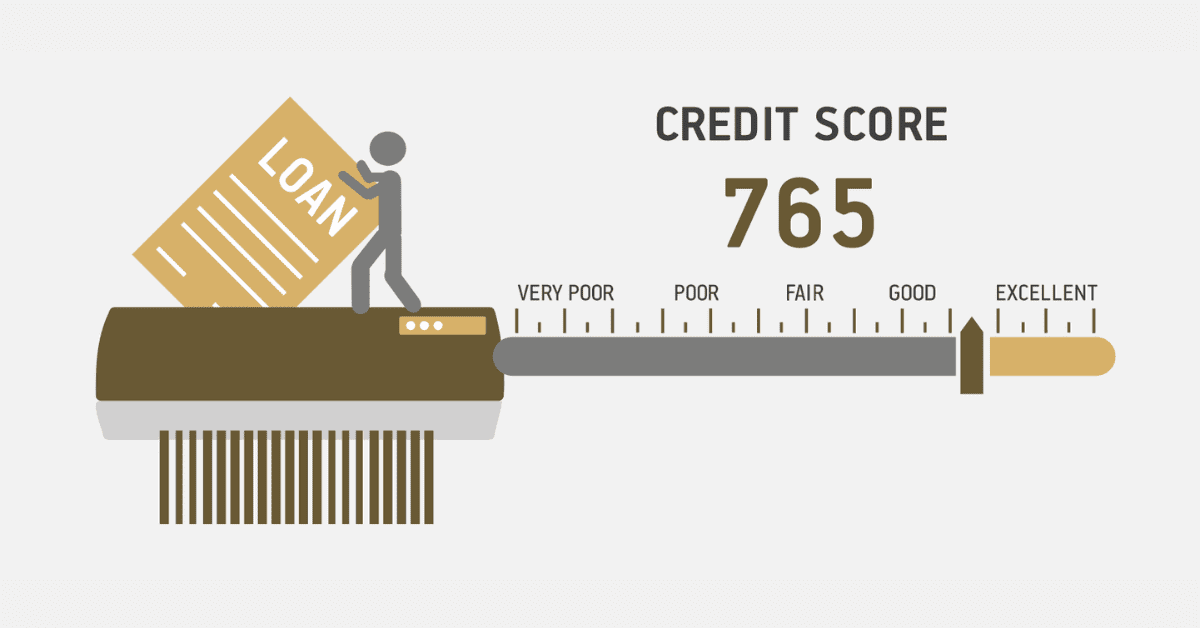

A credit grade, an arithmetic reflection of one’s monetary behavior, might be your path to top-notch mortgage deals. In South Africa, scores range from 0 to 999 or 1200, depending on the bureau. Higher scores signal better creditworthiness. Bureaus like Experian, TransUnion, Compuscan, and XDS calculate these scores based on payment history and debt amount. Are you wondering about the score for the best mortgage rate in South Africa or how to boost your score before applying? Remain tuned for insightful tricks and info.

What credit score secures the best mortgage rate?

As various creditors and banks from South Africa may impose different standards and expectations on the client, it is difficult to give an exact answer on what score is needed to have the best house loan rate. Credit scores of 670 or higher are usually considered good for getting home loans in South Africa, while over 700 is considered excellent. By maintaining a good or excellent credit score, you enhance the chances of getting a loan with a low-interest rate, a high amount lent to you by the moneylender, and better conditions.

Nevertheless, mortgage approval depends on some criteria, but it is not limited to income, work history, debt-to-income ratio, property type, value, down payment, or credit score (good or excellent). This makes us reckon that the other factors should not only be your credit score as a basis judging from reliable sources; it should also come in—the application and your whole financial status.

The credit score you need to qualify for a home loan

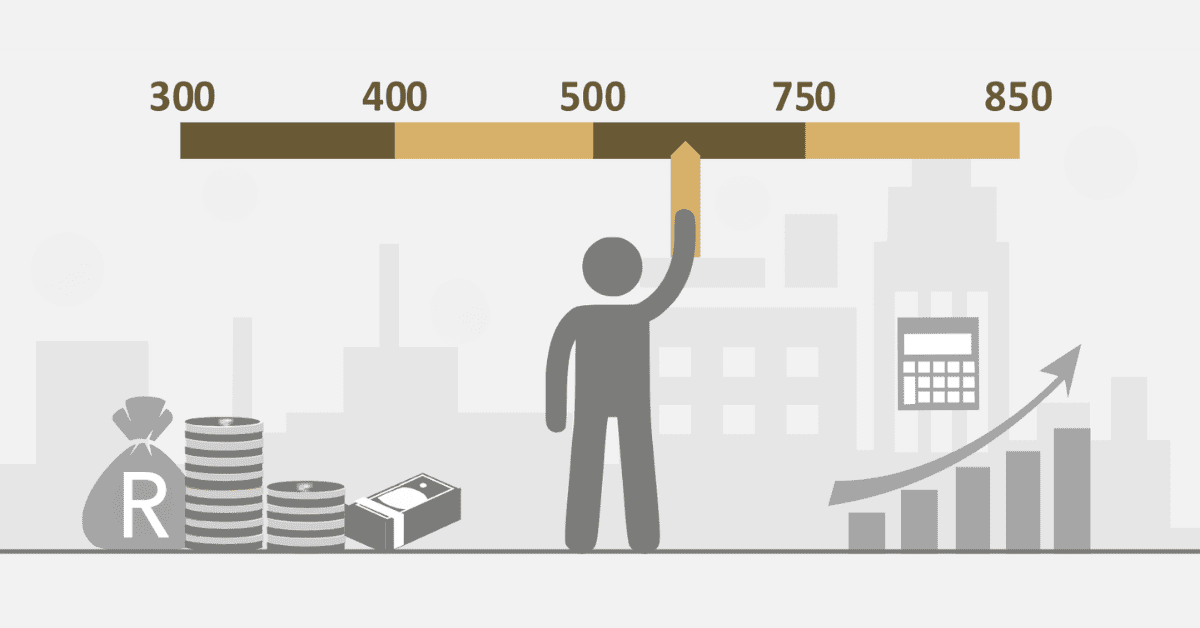

While there is no magical minimum credit score required to obtain a home loan in South Africa, due to the many standards and computations that lenders or banks use, we can provide a basic guideline that can help you estimate your chances of qualifying for those home loans. Again, banks typically approve house loan applications even if the credit score is 610 or higher on a scale of 300 to 900. The bank’s lending policy is also important; certain banks may consider allowing your application even with low credit scores, whereas others are more severe.

The type of house credit you apply for also influences the credit rating required to qualify. For example, conventional agencies normally require a minimum credit grade of 620. Government-backed agencies include FHA, VA, and USDA, which may give borrowers a lower credit rating or even no minimum requirements depending on the program and lender. For example, FHA agencies may accept borrowers with credit grades as low as 580 if they make a 3.5% down payment. While VA and USDA companies do not feature a bottom-level credit grade, they have other demands, such as military service, earnings, and region restrictions.

Can I possess a home in South Africa with a 600 credit score?

- ADVERTISEMENT -

In SA, a fair credit grade is marked 600, which could give you good odds to authorize house credits subject to the creditor and the kind of loan. Whereas for the loan approval, some difficulties and restrictions which you might face could be:

- The higher the interest rates: A lower credit score means more risk for the loan money and, therefore, higher interest paid by the borrower. Along with high interest, it naturally increases the monthly payment and the entire loan amount. For example, a borrower with a 600 credit score may get an interest rate of prime plus 3%, currently at 14.75%, whereas a borrower with a 700 credit score may obtain an interest rate of prime minus 1%, currently at 10.75%. With this in mind, for a R1 million loan payable over 20 years, the individual with one credit score below would amortize R10,762 per month, attracting a total interest of R1,582,880, while the individual with a higher credit score was expected to repay about R9,008 accruing to a total payable interest amount of R1,161,920. This will make the difference between R1,754 a month and R420,960 in total interest.

- Lower loan amount: The second way a lower credit score could affect you is it may cap the amount of money you are eligible to borrow because of restrictive requirements by lenders on affordability and debt-to-income ratio. This means that maybe you cannot afford the house you want, or you should save for a bigger down payment to reduce the loan amount.

- Fewer alternatives to fill out: Also, with low credit scores, there are fewer lenders and types of loans to pick from, as some could outright reject your application or be willing to dispense with significantly less favorable terms and conditions. So you need to shop around among several options and compare them before landing the best deal possible.

What is viewed as a good credit rating in South Africa?

For the case of Experian, which stands for one of the four primary credit agencies in SA, a good category grade for loans scales within the bracket of 650 to 850. A score above 750 and below is excellent, while one below 650 is poor. However, this scale may vary slightly depending on which credit bureau you use.

A good credit score is worth a very bad score. It shows a responsible and reliable advance giver who willfully makes due in between timetable payments, keeps their debts low, and uses mixtures of different types of credit. Some of the things that an excellent credit score enables you to do involve access to the best deals on your mortgage and the cheapest rates on all forms of borrowing like personal loans, car loans, and even credit cards, saving money on most types of insurance.