Purchasing your home is an exciting time in anyone’s life. Even if you’ve done it before! You have dreams and fresh possibilities entertaining your imagination- but there’s still financial reality to face, too. Few people can buy a house in cash outright, with no mortgage lender to help out. To qualify for a mortgage, you need to prove you are responsible, will pay on time, and can afford the loan. A key factor lenders will use to determine all that is your credit score. This is a reflection of your previous history with credit, and how creditworthy you are. Typically, mortgage lenders demand some of the highest credit scores around- after all, this is one of the biggest purchases most individuals ever make! Here’s what you need to know.

What is the Best Credit Score to Buy a House?

If you’re hoping to be approved for a mortgage in South Africa, you will need a credit score of at least 640. If it is over 670, you are likely to have very few issues getting approved for a mortgage.

However, remember that mortgage lenders will look at a variety of factors, including how much you earn and how much of that money is already needed to cover existing debts and credit. It’s not as simple as just having a great credit score! You need to appear unburdened by the credit you already have, show responsible payment habits, and have enough cash to cover the new loan, among other factors. Additionally, it isn’t just a case of being approved or not. Mortgage lenders will offer more favorable rates and lower interest to more responsible clients. So pushing up your credit score just a little could have a big impact on the rate and terms you receive.

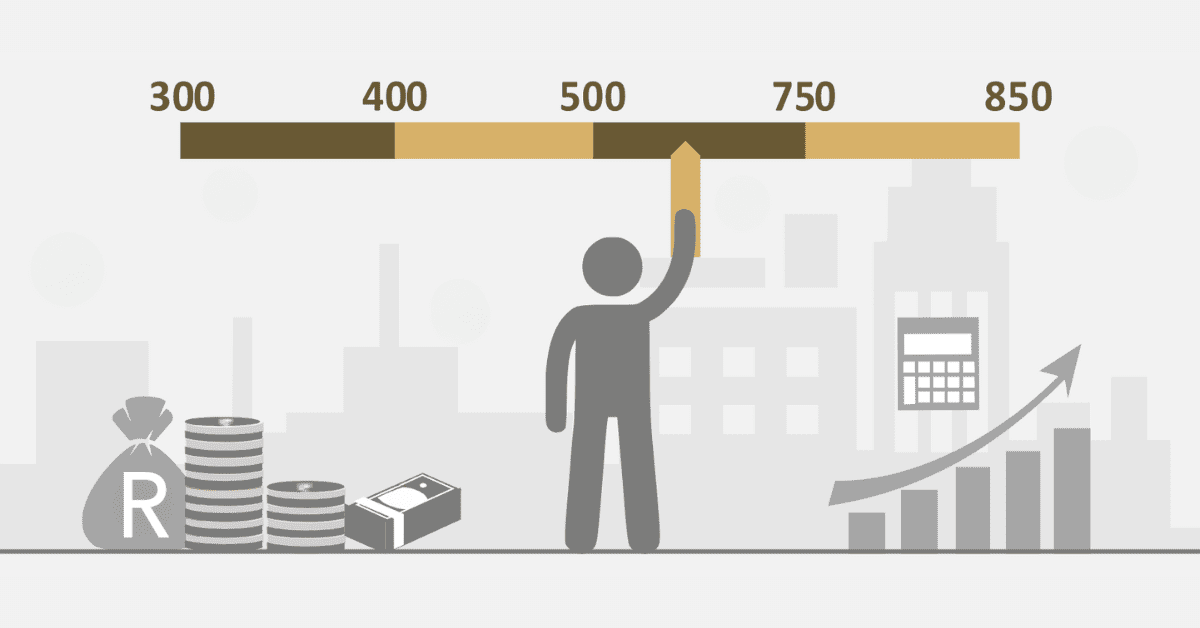

With this in mind, the best credit possible credit score to buy a house would be 850- the maximum you can have! That’s unrealistic for most of us, but worth keeping in mind. The better your score, the higher your chances of getting a great deal. So any improvement you can make will be worthwhile.

What is the Lowest Credit Score to Buy a House?

On the flip side, the lowest credit score to buy a house in South Africa will be in the 600 range. As we mentioned above, lenders typically want to see at least 640 to approve a mortgage application. If you are in the 600s and close to that amount, you may get lucky and get approved. It is highly unlikely anything lower will, however.

Remember that a higher credit score will also unlock better interest rates and terms from your mortgage lender, so the better you can make your credit report look, the better for you.

How Much Credit Score Do You Need to Buy a Car?

As the amounts involved are lower, vehicle finance lenders are a little more forgiving than mortgage lenders. But only just. That’s still a lot of money, to be paid back over a long period! In South Africa, you need a credit score of at least 580 to buy a car. Between this and 670, you will count as a ‘subprime’ lender. This means they will consider you, but not give you the most favorable rates. Anything above 670 should unlock the most options and the best possible terms and interest rates for you.

Does a Bond Approval Affect My Credit Score?

Any time you successfully open a new line of credit, you will see a slight dip in your credit score. So yes, a bond approval will negatively affect your credit score a little. As will the hard inquiry they made before approving you. Don’t worry too much about this. It will soon start rising again when you diligently make your bond payments. It’s a natural part of the credit score life cycle and not something you did wrong.

What’s a Good Score on ClearScore?

Tools like ClearScore are very useful if you are trying to improve your credit score. It’s also smart to regularly monitor your credit report. Not only does it let you know if errors or inaccurate information are being shown, but it also helps you identify fraud before it becomes a problem! ClearScore uses data from 2 of the main credit bureaus, Experian and illion. So it is a bit of an aggregate score, but will give you a solid sense of how your credit history is progressing.

On ClearScore, aim for a score of at least 560 before you try to access credit. This will ensure you are in line with the South African average but isn’t considered a good score. If you see a score higher than 650 on ClearScore, that is good- and higher is even better!

Ensuring you have the best possible credit score before you approach a lender for a mortgage is the best possible way to ensure you get approved. So if buying a home is in your future, now is the time to take action on your credit score.