Once you find yourself in a “credit score” country like South Africa, it becomes a must for you to accept the terms and conditions. These terms and conditions are not documented within the financial institutions but are considered to be the guidelines for managing your credit score.

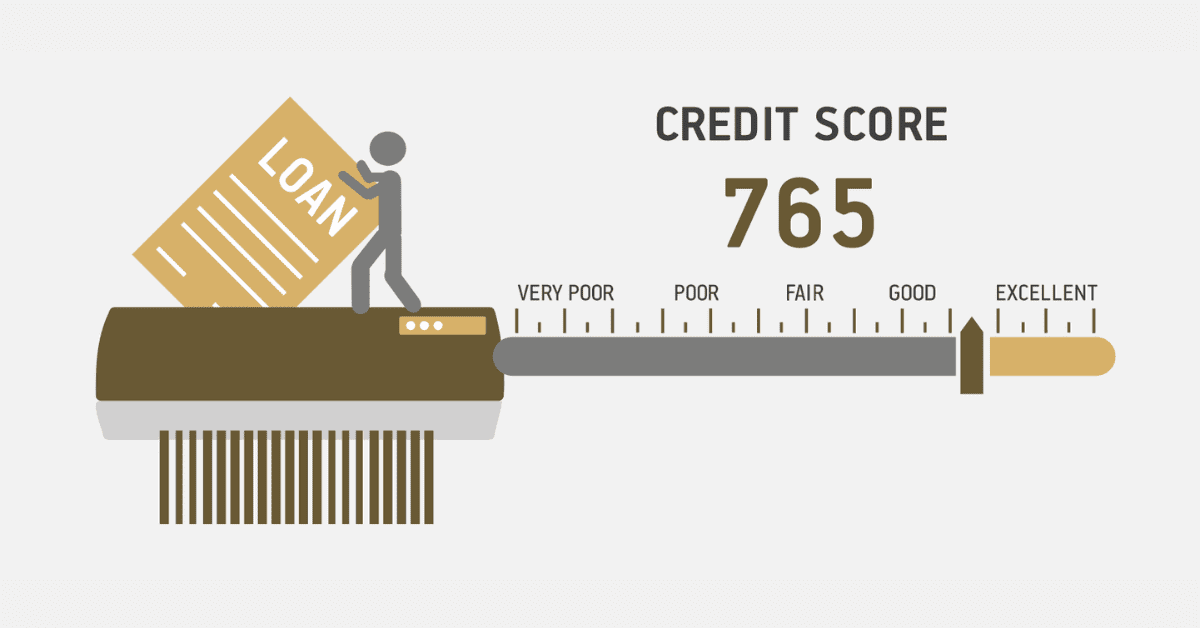

In South Africa, once you begin your working life, there is always the need to find credit. Finding credit means you are about to embrace the figurative measure of your financial abilities.

In general, credit scores are more of the quantitative method of extracting information about how credible an individual can be.

Once you get this credit, you have to start looking at how to make it better. If you deviate from building your credit score, it can affect your financial life.

As we share details about your credit score, let us take you through some of the things that could ruin your credit score. We will delve into more credit score ruining and how to fix it.

What can ruin your credit score?

These days, your credit score is more than just a number. It is like a mirror that shows how responsible and trustworthy you are with money. When it comes to getting a loan, renting an apartment, or even getting a new job, your credit score can make a big difference in the options you have.

Let us look at some important things that can ruin your credit score.

- Your payment history is a very important part of figuring out your credit score. If you do not make payments on time, it can hurt your credit score a lot. Credit companies like FICO say that your payment history is a big part of figuring out your FICO credit score.

Imagine that you had a credit card with an R750 limit and missed the payment due date by just one day. In addition, if the payment is not made within the agreed time, it could be reported to credit companies, which could ruin your credit score.

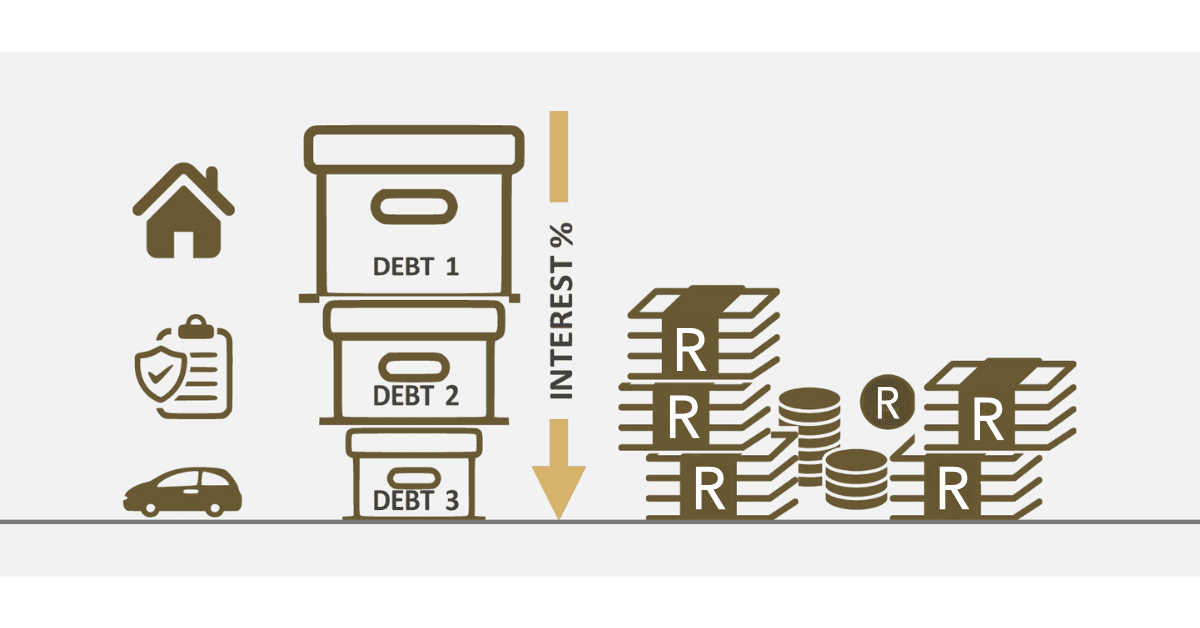

- Another important thing to think about is your credit usage ratio, which shows how much credit you are currently using compared to how much credit you have available. Having a lot of debt compared to your credit limits can show that you are having money problems and hurt your credit score.

- Another important thing to think about is your credit usage ratio, which shows how much credit you are currently using compared to how much credit you have available. If your amounts are higher than your credit limits, it could mean you are having money problems, which will hurt your credit score.

- Bad financial luck, like losing your home or filing for bankruptcy, can hurt your credit score for a long time. Your credit score may go down a lot after these things happen because they can stay on your report for years.

You had to file for bankruptcy, which was a bad thing because it meant your bills were forgiven. This move will unfortunately stay on your credit report for a long time, which will make it hard to get credit with good terms.

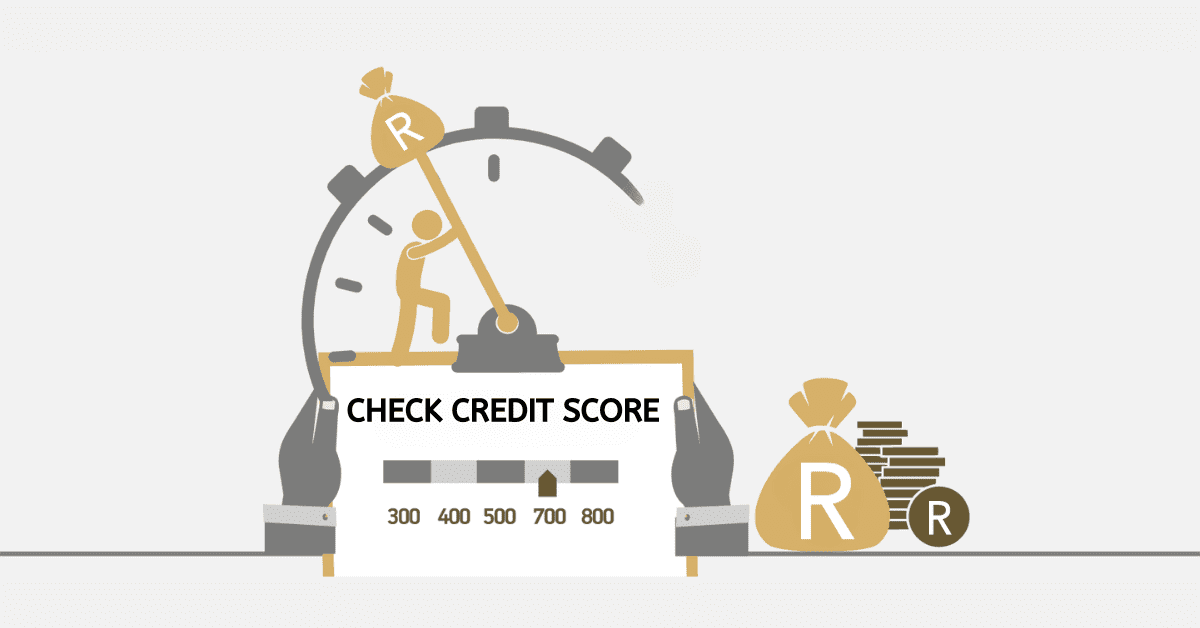

How much does an unpaid bill affect my credit score?

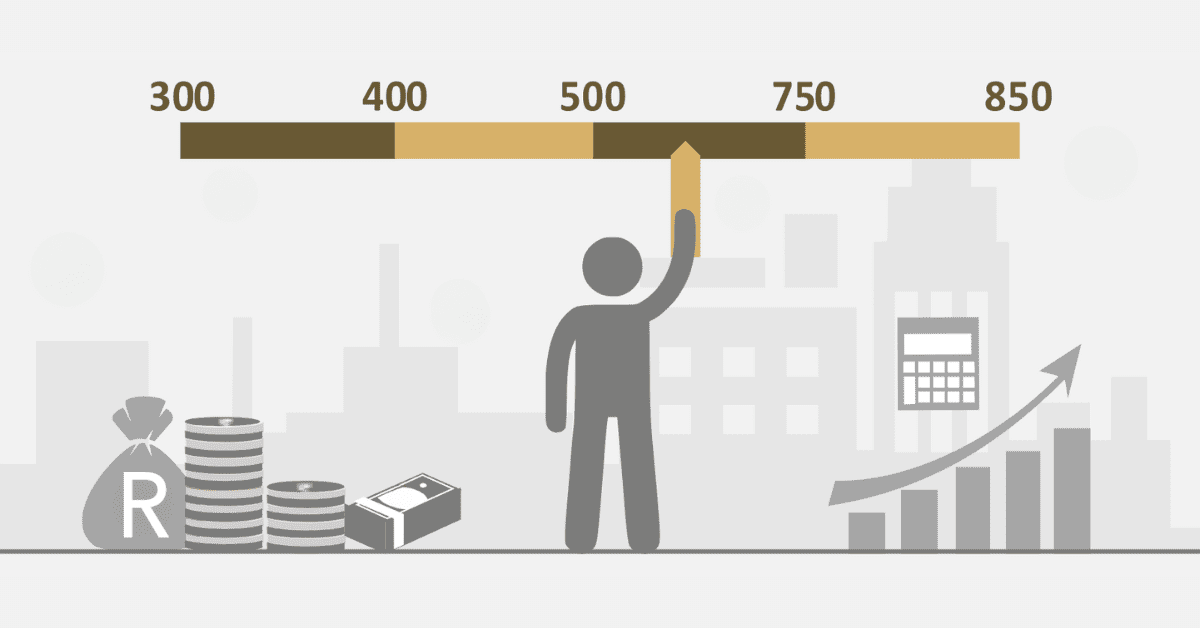

Paying your bills and paying them on time contributes a lot to your credit score. This aspect forms about 35% of your credit score calculation.

You could lose between 50 to 150 points from your credit score if you have unpaid bills. Imagine having a credit score of 650 and then because you had unpaid bills of about R2500, you get to lose about 100 points, that will sound devastating. At that point, you know your credit score is going to get bad.

What is the number one credit-killing mistake?

The number one credit-killing mistake is not paying your bills on time. Every bill comes with its conditions. Once you default on your bill payment, even for a day, it significantly affects your credit score. Many credit bureaus advise individuals and companies on ensuring to pay bills on time. If you can not pay your bills on time, you can further re-negotiate with your lenders to buy some time rather than ruining your entire credit score.

Can you fix a ruined credit score?

Fixing credit scores requires a strategic approach and discipline. When you find yourself in a spot where your credit score is going down, it is always important to look for a solution. Once that credit is stained and ruined, you may find it difficult to obtain new credit.

It is not impossible to fix a ruined credit score but at what expense? Fixing a ruined credit score can be time-consuming and will gradually drain you.

How do I fix my worst credit?

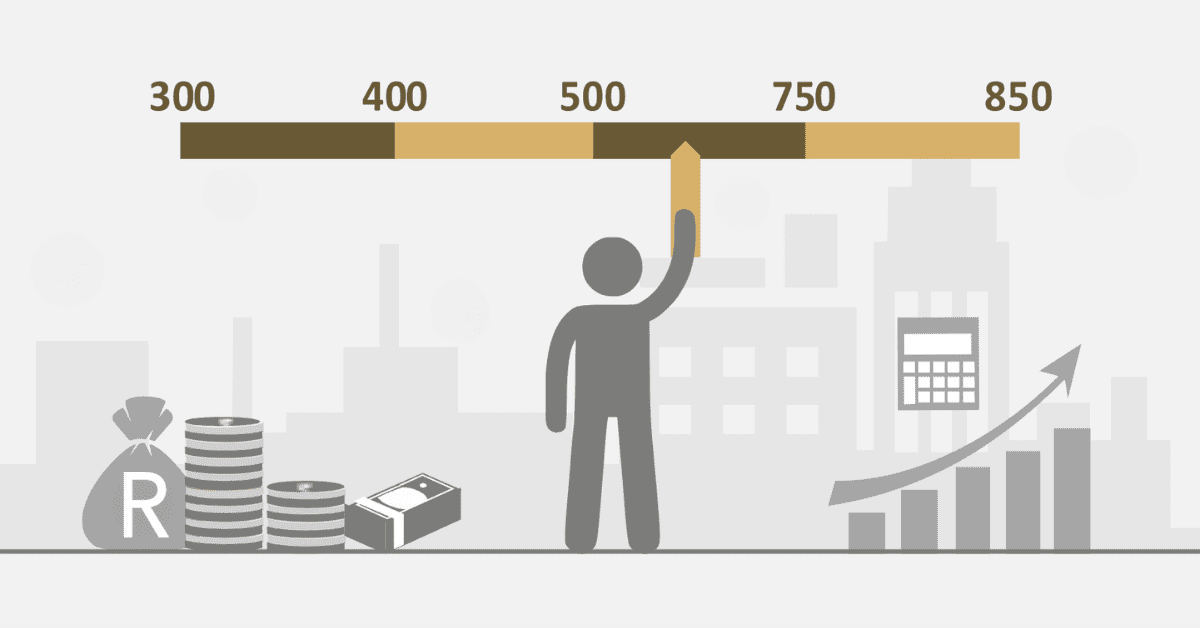

There is no fixed method to fix your worse credit. However, certain guidelines could help you get your credit back on its feet. Improving your credit score takes time, so you need to be patient and keep trying. Your credit score will slowly go up if you regularly use credit wisely.

It can be very challenging when fixing your credit score but here are some bulleted points to give you a clue on how to fix your worst credit.

- Check your credit report carefully to see if there are any mistakes, such as wrong information about late payments or accounts that do not belong to you. It is important to dispute any mistakes you find on your credit record. You can always file a dispute with your credit bureau.

- Paying your bills on time is very important if you want to keep your credit score high. You might want to set up regular or reminder payments or reminders to make sure you pay all of your bills on time.

- You should try to keep your credit card balances well below your credit limits. Do not use more than 30% of your available credit.

- Your credit score may go down temporarily when you apply for new credit, so there is a need to be careful about how many times you do this. It is important to be careful when you ask for new credit.

- If getting a regular credit card is hard for you, you might want to look into getting a protected credit card instead. If you use this kind of card wisely, it can help you build credit.

- Take part in talks with your creditors If you owe money on accounts that are past due, you should try to work out a payment plan or deal with your creditors.

- If you want to raise your credit score, you need to constantly use credit responsibly. Credit cards should only be used for small purchases, and the amount should be paid off in full every month.