The outcomes of every action depend on the reaction and preparation. When you begin your credit score journey, it is always important to study the trend and how it works.

The credit score building is not so direct; this is because other things can influence a greater part of it.

Whether it is a positive or negative influence, always be prepared to embrace the outcome. Accepting it and working towards it can make a great difference.

Because of the dynamics of the credit score, there are a lot of people who are always seeking information on how to improve it. While it is a great proactiveness, you must first understand what could negatively affect your credit score. Understanding those hits can give you a better insight into how to tackle and improve your credit score over time.

This is the reason searche.co.za is always providing you with valuable information on how you could better your credit score.

In this part of the blog post, we will look at some of the things that could negatively affect your credit score and other related matters.

What can negatively affect your credit score?

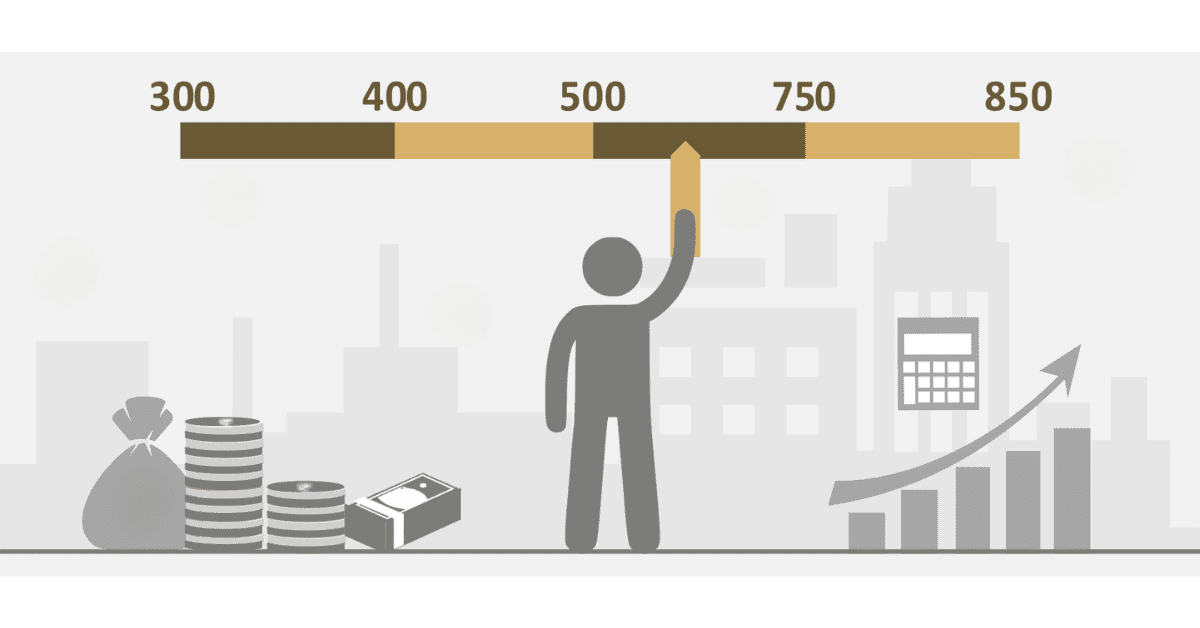

In South Africa, your credit score is a big part of figuring out how financially stable you are and whether you can get loans and credit cards. It is very important to fully understand the different things that can hurt your credit score and learn how to handle them properly. Below are some of the things that can negatively affect your credit score.

- To keep your credit score high, you need to make sure you pay back your loans and credit cards on time. One example is that if you consistently miss your monthly credit card payments, it hurts your trustworthiness.

- Lenders may think you are having money problems if you use up all of your credit cards or a big chunk of your available credit limit. To keep your credit score high, try to keep your credit usage ratio below 30%. For instance, if your credit card limit is R10,000, you should keep your amount below R3,000.

- If you do not pay back loans like personal loans or car loans, it can have a big effect on your credit score. If you do not pay back a loan as planned, the lender can report the default to credit bureaus. This can make it harder for people to get loans in the future.

- Lenders may be wary of people who apply for a lot of credit at once, as it could mean they are financially unstable or need money quickly. When you ask for credit, a hard inquiry is made on your credit report. This can cause your credit score to drop for a short time.

- Court decisions, bankruptcies, and debt review processes can have a big effect on your credit score. These bad marks on your credit report could mean that you are having money problems and could stay there for a long time.

In South Africa, to keep your credit score high, you should pay your bills on time, use your credit cards sparingly, avoid loan defaults, limit your credit applications, and take care of any public records or decisions right away.

It is important to check your credit report often and fix any errors or issues that you find. Your finances will be safer if you do this.

You can also get good advice on how to carefully handle your credit by talking to financial advisors or credit counsellors.

What payments affect your credit score?

Your credit score is affected by payments that are linked to your credit card, like loan payments or energy bills. These payments are sent to credit companies and are carefully kept track of in your credit report. Making payments on time will raise your score because it shows that you are responsible with money and can be relied on. But missing or being late on payments can hurt you. Your credit score could go down, and you might not be able to get good terms on future loans or lines of credit. To keep your credit score and finances in good shape, it is important to make sure you do not miss any payments.

How do you fix a negative credit score?

Before we look at how to fix a negative credit score, let us look at the possibilities. Your credit score can run to negative if there is a wrong reporting or error.

Should you see this negative error, the first thing is to file a credit history dispute. This will allow your credit bureau to look into it and rectify the mistake.

There are other possible ways to fix a negative credit score but this can be considered as a waste of time. It can take over 5 months and requires you to check with professional and credit agencies.

If you do not have the resources, the best possible way to fix a negative credit score is to file a complaint and allow your financial institution to look into it diligently.

What are three things that do not affect your credit score?

That is certainly true; some things do not affect your credit score. These items do not constitute the credit score calculation.

Here is a list of three things that do not affect your credit score.

Income: how much you earn does not influence your credit score. Your credit does not report your income and therefore this does not affect your credit.

Checking your credit: It would be unfair for individuals to have their credit score affected after checking their credit. There is no effect on your credit score when you check it. This is not considered part of the credit score calculation.

Assets: assets are elements that are usually considered unless they become critical. When it comes to credit score, it is all about your financial behaviours and how credit-worthy you can be. Whatever assets that you have acquired are not reported on your credit history and do not influence your credit score.