With this investment class, South Africans have exposure to a diversified and balanced portfolio of ventures. The funds expose them to assets such as equities, bonds, property, and cash in one single venturing product. They are the best for spreading risk and earning moderate to high returns depending on the risk profile of the specific fund.

Multi-Asset Fund Definition?

It is a venture vehicle that pools cash from multiple capitalists into various asset classes: equities, fixed income, real estate, and cash. The goal is to present a diversified portfolio that may perform well in different market conditions. They hold a mix of assets to reduce risk and earn returns from multiple sources.

Investors benefit from diversification without investing in several individual funds and maintaining separate accounts. This is why multi-asset funds reach a big audience in South Africa, from novice to experienced investors, since they are diversified and thus offer an accessible entrance into choosing between asset classes. These funds are managed by professionals who adjust the portfolio according to changing market conditions and the fund’s specific strategy; hence, it is a hands-free investment choice for those seeking diversified exposure.

Whether for higher growth or stable income, multi-asset fund investments could go into either more equities or, correspondingly, a higher proportion of bonds and cash, depending on the specified risk profile of the fund. Some multi-asset funds are geared toward income generation for investors, while others may be set up for capital growth. This flexibility makes the funds lucrative to many investors with various financial goals and risk appetites.

How Does a Multi-Asset Fund Work?

Multi-asset funds allow the fund manager to invest pooled funds across various assets given various market conditions and with a specific strategy the fund may have. Fund managers decide which asset groups to invest in and the amount of each based on their economic outlooks, research, and general market trends. This active management allows the fund to adapt to changing market environments, capturing opportunities in different sectors. As such, a multi-asset fund works because of the diversification strategy.

The risk generally decreases when investments are made across various asset classes. For example, at some point when substantial gains are coming from bonds or other more stable assets, underperformance in the equity market is cushioned off from affecting the overall returns of the fund. This enables multi-asset funds to provide considerably more stable returns than their counterparts- for example, equity-only funds- which may be more volatile.

By design, multi-asset funds are subject to the provisioning of the Financial Sector Conduct Authority and its governance on asset allocations for investor protection. These funds typically have tight mandates, including the specific ratio of equities to bonds or the maximum exposure threshold to the riskier asset classes. Multi-asset funds can, therefore, be practical in their dynamic nature toward both capital growth and income generation, depending on the objective of any particular fund and the manager’s approach to that objective.

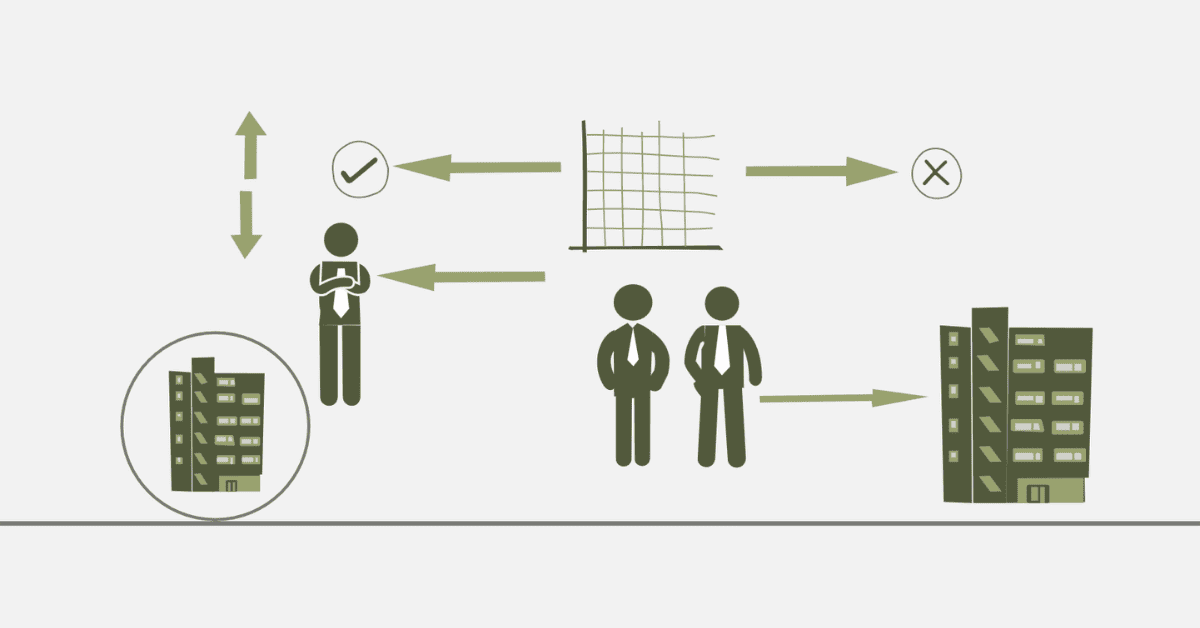

What is the Difference Between Multi-Asset & Balanced Funds?

Both are a variant of diversified investment funds, but the modality of pursuing asset allocation and the type of risk managed differentiates them. The most common form of multi-asset fund is the so-called ‘balanced’ fund, which keeps its asset mix at a fixed split, such as 60% in equities and 40% in bonds. A balanced fund is constructed for growth and income, managing risks via a consistent asset mix.

Contrasting with that, multi-asset funds allow for greater flexibility in their asset allocation. While a balanced fund sticks to a strict allocation ratio, which does not change much, a multi-asset fund changes its weighting dynamically with the market conditions and, thus, the manager’s view. Against the volatility backdrop of the market, for example, the manager of a multi-asset fund can raise the weight of bonds or cash to lower the risk. In contrast, in a balanced fund, the predefined ratios would be held onto.

What is the Difference Between Multi-Asset & Hybrid Funds?

While they share some similarities, the two offer nuanced differences. Multi-asset funds are designed to create multi-diversified portfolios across different asset-class exposures, including equities, bonds, property, and often commodities, to enable adaptation through changing market conditions. This asset mix may be changed at a certain discretion of the fund manager to meet the needs of the investment objective and market opportunities of the fund.

Hybrid funds, by contrast, stick to one asset allocation strategy as a rule much more than a multi-asset fund, and they are usually less flexible. Hybrid funds often come with a set asset allocation of stocks and bonds. While the fund manager can change the asset composition, the changes tend to be narrower than those of multi-asset funds. The eclectic mix is done for a balance between risk and reward. However, hybrid funds may not be able to change or adapt to sudden market changes like multi-asset funds.

How Are Multi-Asset Funds Taxed?

The South African taxation policies provide different tax treatments for multi-asset funds, depending on the type of income derived from such funds. A withholding tax of 20% is payable on the dividends paid out from such a fund, while interest income accrued to the capital of such a fund is charged against the investor’s applicable tax rate. CGT, in turn, is only paid on profits booked if these assets are sold for their increased value; individuals forward 40% of the gain at their marginal tax rate.