This fund is traded on stock exchanges, much the same as for stocks. An ETF typically includes assets such as stocks, commodities, or bonds. It is frequently set to operate an arbitrage mechanism that keeps trading close to its intrinsically calculated net asset value, although deviations could occasionally occur. The main reasons that make an ETF attractive for an investor are the liquidity, diversification, and lower cost compared to mutual funds. They have become popular investment vehicles worldwide and are so prevalent in South Africa due to their flexibility and accessibility.

What Is An Exchange-Traded Fund?

ETFs are securities for pooled investment; though they are similar to mutual funds, they are also bought and sold in the exchange like individual stocks. Usually, the composition is designed to track against a set index, sector, or commodity and is purchased during the day trading process along with other market items. This ability to trade in real-time is one of the prime pros of this option. This is the opposite of mutual funds, which one can only purchase or sell at the end of the trading hours.

How do ETFs work in South Africa?

The South African ETFs operate in the same fashion as they do within all other global markets but are customized to track specific local and international indices that would be relevant for a South African investor. Local ETFs would then track an index such as the JSE All Share Index or the JSE Top 40 Index, thus giving exposure to the South African equity market.

International ETFs have availed themselves to South African investors just as advantageously as they exist elsewhere, making it easier to gain easy access to markets worldwide for proper management framed with a diversified international portfolio. ETFs in South Africa are bought and sold using investment brokerage accounts directly on the Johannesburg Stock Exchange (JSE) or any other trading platforms present when the account setup is completed.

Are ETFs safer than stocks?

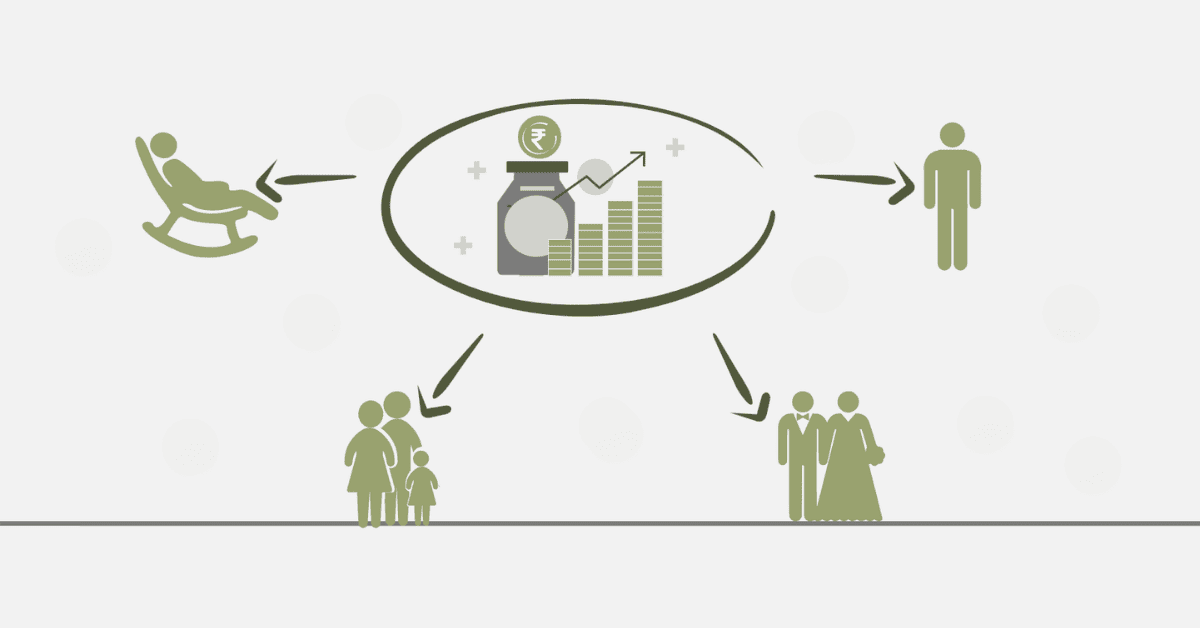

ETFs are considered much safer vehicles than individual stocks since they are diversified. Generally, when investing in an ETF, one invests in a securities portfolio but not a single company. It means that risk is diversified; one ill-performing asset cannot have much effect on the total investment.

For instance, if one stock within the portfolio does poorly in an ETF, it will not have a substantial effect on the course value of the ETF because the remaining performing securities of the portfolio dilute it. There are potential risks associated with ETFs, though. Market risk, sector risk, and liquidity risk, among others, may impact ETFs.

Market risk is that part of the overall risks through which the fall in the value of the whole market or a particular sector gets reflected in the ETF. Another specific risk is sector risk, which is related to a particular segment of the market that an ETF is tracking. For instance, an ETF with its core in the technology sector would be more volatile than one tracking any other primary market index. Liquidity risk entails the risk of being able to sell or buy a given ETF without significantly affecting the market price of that underlying ETF. Lastly, liquidation risk is more concerned with less-favored and less-traded listed ETFs.

How is ETF different from a mutual fund?

One of the crucial distinctions lies in their being traded. ETFs are traded during the day. This aims to provide an investor with an end-of-day day to trade at market prices other than selling at net asset value. On the other hand, a mutual fund is traded at the end of the day only, with the NAV price.

The other difference is in their management style. ETFs are considered passively managed because they aim to track a particular index. This management style further contributes to their management fees, which tend to be lower in most cases compared to mutual funds because many mutual funds are actively managed. Active management styles involve fund managers selecting and trading securities out of benchmark indexes to beat various levels, which involve higher fees due to labour-intensive research and trading activity.

Another significant advantage of ETFs over mutual funds is their excellent tax efficiency. ETF shares trade on an exchange, and an investor simply buys or sells shares from other market participants without affecting the fund’s underlying assets; hence, no capital gain is realized. In contrast, mutual funds may have to sell holdings to meet investor redemptions, potentially realizing capital gains for all shareholders.

What is the best-performing South African ETF?

This might change regarding market circumstances and specifications opted by the analyst about performance evaluation, such as rate of return, volatility, and expense ratio. One of this nation’s perennially top-rated performing funds is the Satrix 40 ETF, which shadows the JSE Top 40 Index.

The ETF offers exposure to the 40 largest companies listed on the Johannesburg Stock Exchange, therefore providing investors with a broad representation of the South African market. Satrix 40 ETF falls in the most extensive baskets of this category due to the solid performance records, low costs, and colossal liquidity associated with them. It provides exposure to the diversified portfolio of leading South African companies geared to mining, financial services, and telecommunications in the most prominent players. Its performance depends on the portfolio performance of the JSE Top 40 Index, which has witnessed massive growth in the past.

Final Thoughts

To sum up, ETFs have become integral parts of many investment portfolios. They do so by their flexibility, low cost, and diversification benefits. However, the conceptual understanding of how exchange-traded funds work, together with their benefits and risks, is necessary for sound decision-making on an investment by the investor.