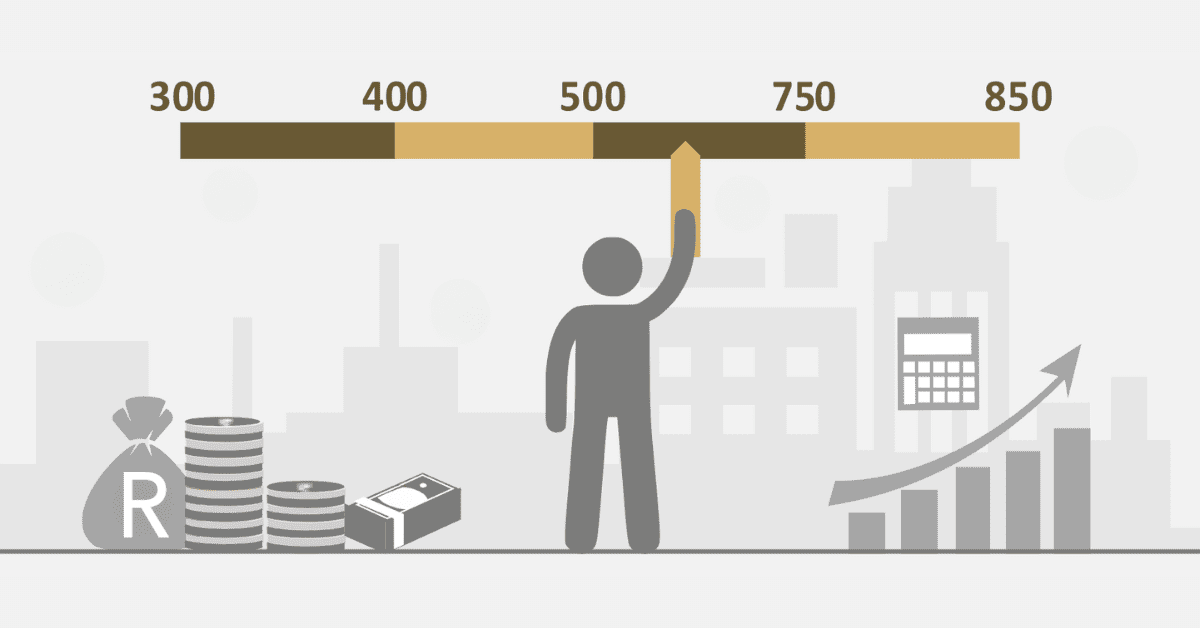

Credit grades are a pivotal aspect of fiscal health, impacting various things, from loan approval to interest charges. However, varied elements may negatively affect these ratings. This writing will examine the effects of a 500 credit grade, what hurt credit ratings the most, and tips to enhance credit grades. It will further reveal whether recruiting someone to amend one’s credit is possible. Understanding these aspects can empower individuals to manage their financial profiles better.

What Affects Credit Score Negatively?

Your credit ratings, a fiscal measure in South Africa, may be impacted by various elements. Delayed or missed pay on bonds, credit cards, or arrears can affect your grade, creating an image of undependability. Defaulting, judgments, or being under arrears review might greatly lower your rating, portraying you as a high-risk loanee. Applying for excessive credit in a short span can also dent your score, hinting at financial desperation. A high credit utilization ratio, the percentage of your available credit in use, can negatively impact your score, suggesting potential repayment issues. Aim to keep this ratio below 30%, ideally 10%. A short-based or limited credit history can also lower your score, indicating a lack of credit diversity or experience. So, tread cautiously in the monetary space, as every move impacts your credit grade.

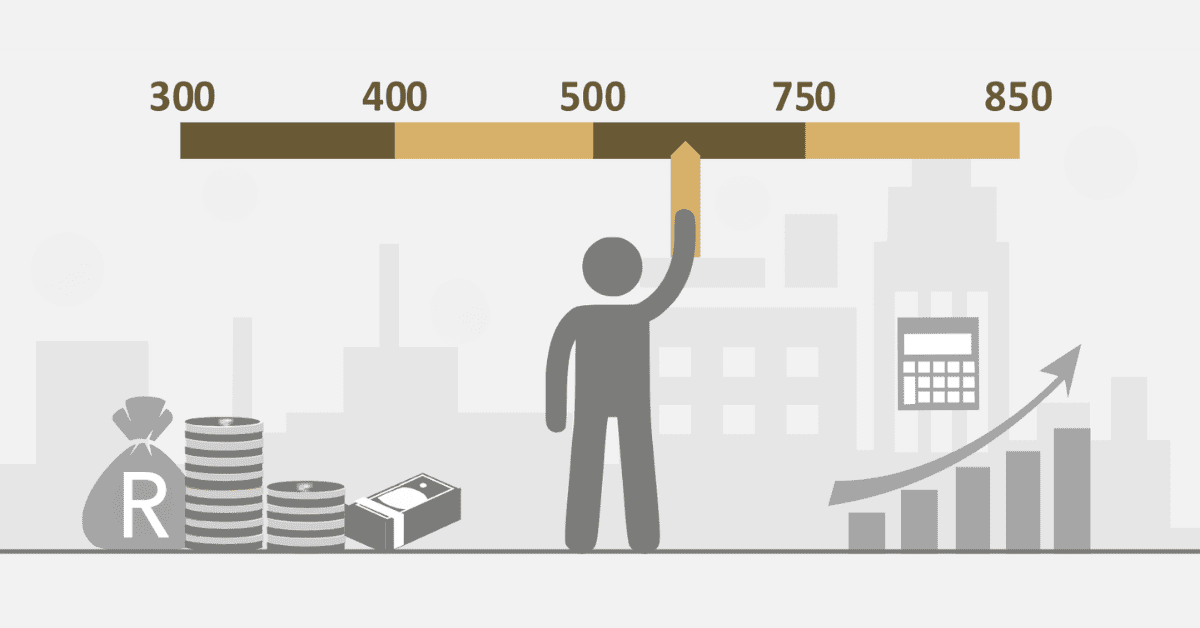

How Worse Is A 500 Credit Rating?

In SA, a five hundred credit grade is a fiscal red flag. It suggests unreliable credit performance and high default risk. This score can cast a shadow over your financial landscape. Accessing credit products like loans or mortgages might become a Herculean task, with providers offering unfavorable terms. Services like cell phone contracts or insurance might become elusive or expensive. Job opportunities, especially in finance or senior roles, might slip away, with employers offering lower pay or benefits. Saving money, investing, or achieving financial goals might become an uphill task, with more money spent on interest, fees, and penalties.

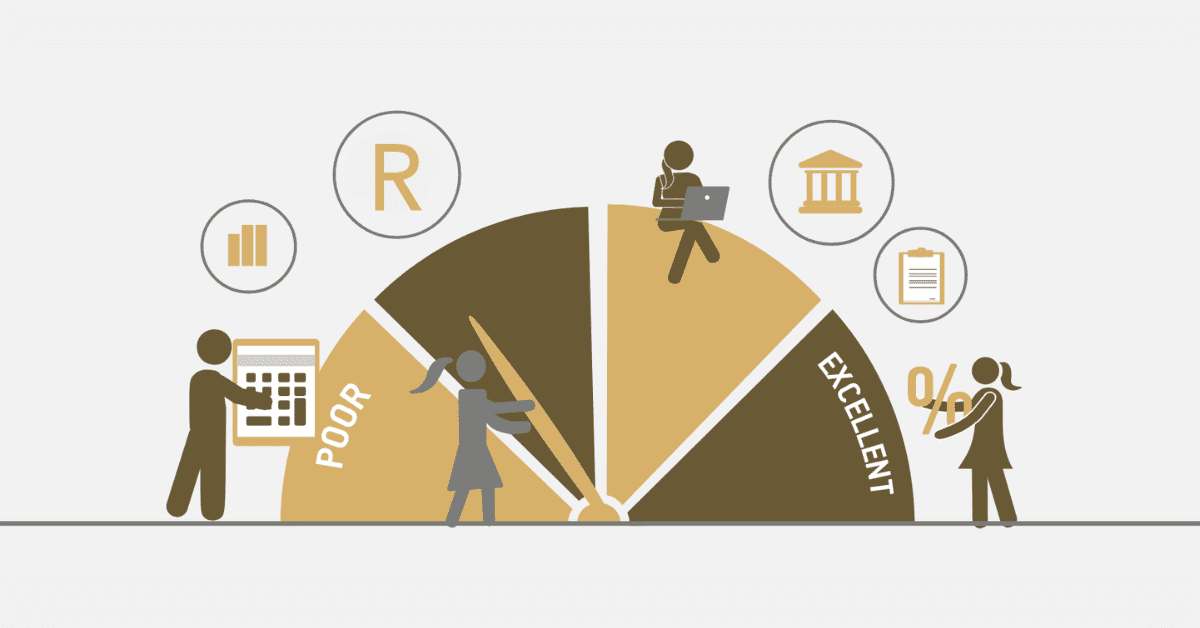

What Hurts Credit Scores the Most?

Your credit score, a financial mirror, reflects your monetary habits. Defaulting, judgments, or being under debt review cast long shadows, indicating high-risk borrowing and significantly lowering your score. These marks linger on your credit report for up to five years, sometimes longer. Late or missed payments on bonds, credit cards, or bills are common blemishes, suggesting unreliability and moderately impacting your score. These, too, stay on your report for up to five years. Lastly, applying for excessive credit in a short span temporarily dents your score, hinting at financial desperation. This results in challenging queries on your statement, affecting your rating for up to twelve months.

How To Improve A Credit Score?

Ensuring your credit score remains boosted in South Africa is like nurturing a plant, which requires consistent care and attention. The following are tips on how to:

- Timeous Payments. Settle your accounts promptly and in full. Equivalently, watering your plant regularly is a measure of portraying financial discipline and debt handling. Set up reminders or stop orders to remove the weeds from interest, charges, and penalties.

- Credit Utilization. Just like ensuring that your plant receives but does not have an oversupply of water, maintain low credit utilization rates. Target 10%, and rarely cross the 30% mark. Settle balances soon after they come up, make a few monthly payments, or increase the credit limit, but within limits.

- Checks credit reports. Frequently checks your credit report and corrects inaccuracies. Just like checking the garden for any pests or diseases. Ensure the credit record is reflective of your credit behavior.

What Things Lower Your Credit Score?

Late or missed payments on bonds, credit cards, or bills can dent your score, reflecting financial unreliability. Serious issues like defaulting, judgments, or being under debt review can significantly lower your score, indicating high-risk borrowing. Applying for excessive credit in a short span can temporarily affect your score, hinting at financial desperation. A high credit utilization ratio, the percentage of your available credit in use, can negatively impact your score, suggesting potential repayment issues. Short-based or limited credit history can lower your score, indicating a lack of credit diversity or experience.

Can I Pay Someone To Fix My Credit?

One can hire someone who fixes your credit in South Africa but with caution. Not all that you see claiming to repair credit are honest or effective. Some may even do worse for you at a higher cost, and some may engage in scamming. Nobody can guarantee to fix your credit unless they’re correcting valid errors. According to the National Credit Act, credit information can be amended only by registered credit bureaus. The only way to repair this score is by paying off existing debt, keeping credit card balances low, and using credit responsibly. Help is also available from a registered debt counselor, but be warned that if they place you under debt review, it will impact your credit score. So before you pull the wallet out of your pocket, do some research, look at their credentials, and avoid anyone who asks for upfront fees or guarantees. Remember, the safest way to fix your credit is to do it yourself.