These funds are gaining popularity in SA because they are a readily accessible and versatile tool to invest in, both for novices and pros. The funds offer diversification by mimicking a group of different assets. These include equities, bonds, & commodities. The ease of trading them at the Johannesburg Stock Exchange during market hours makes them highly liquid and convenient to use compared to traditional mutual funds.

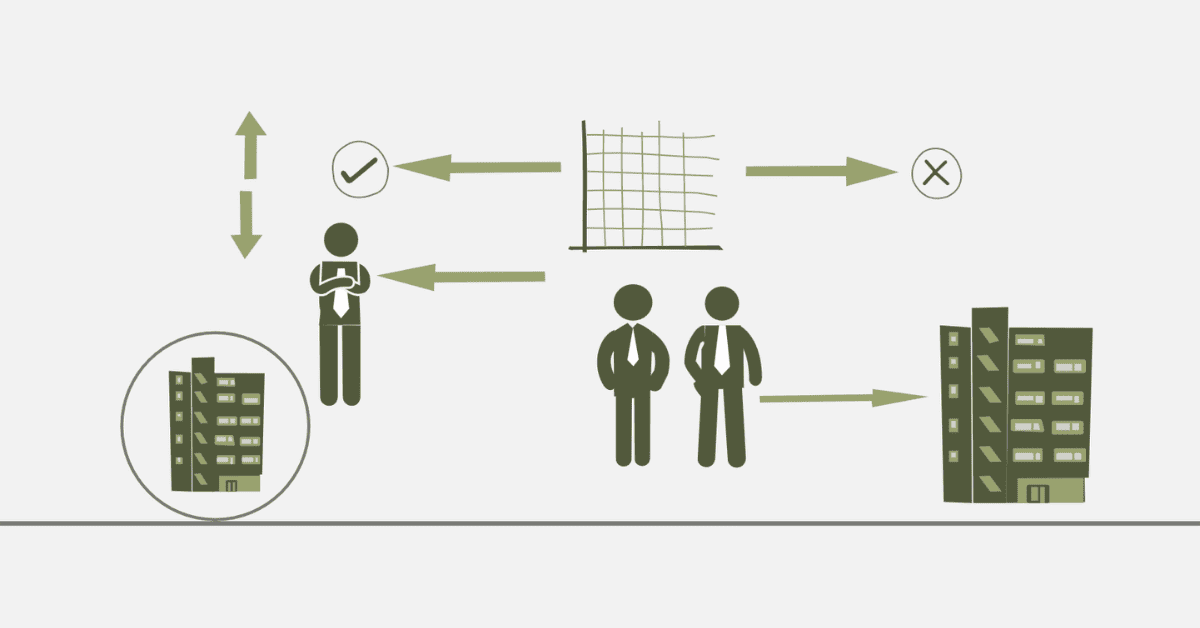

Are ETFs Flexible?

ETFs are also among the most flexible investments in South Africa’s market. Through them, the investor gets to experience different asset classes in the market, all without actually owning the physical bonds and the stocks. This flexibility comes from the structure: the ETFs are bought and sold the same way regular stocks are bought and sold at the JSE throughout the trading day. Unlike traditional unit trusts, whose pricing is only at the end of the trading day, ETFs are real-time, and the investor gets to decide on the trade.

Another aspect in which they are versatile is their ability to invest in different industries, including tech, finance, and commodities, depending on market trends. The investors also get to choose from various local and global market-tracking ETFs, including the FTSE/JSE Top 40, to diversify. The diverse ETFs also support different investor risk appetites, from conservative to aggressive.

Which is the Best ETF in SA?

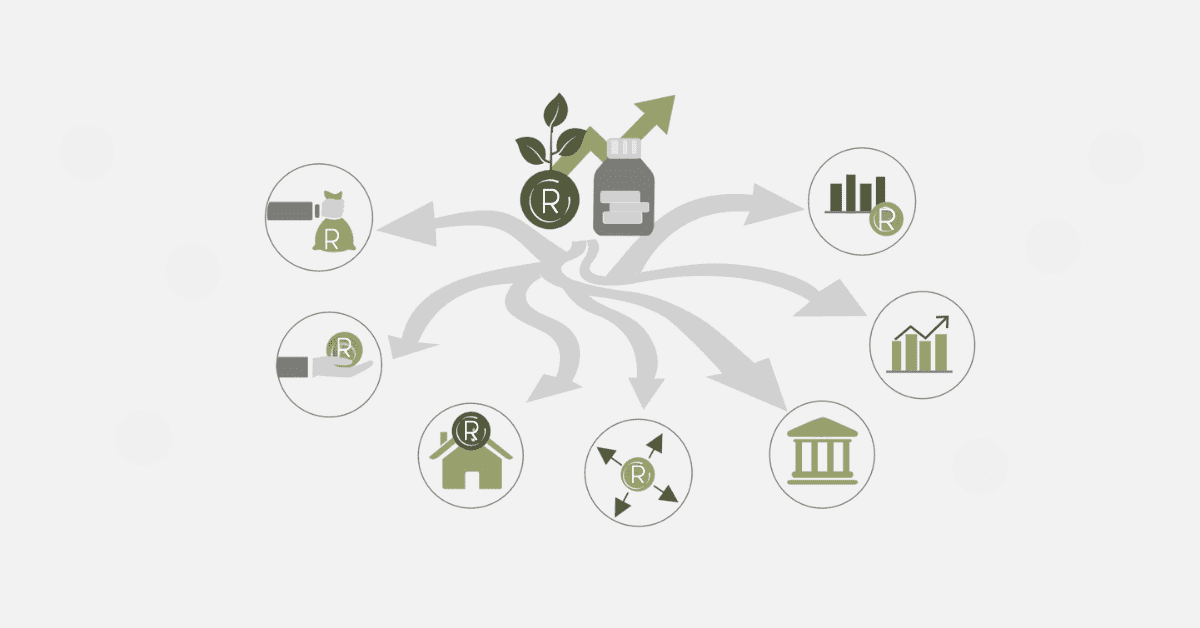

Choosing the most suitable ETF in South Africa depends on the investor’s objectives, the investor’s appetite, and the investor’s outlook. Some JSE-listed ETFs are good performers and good return and stability providers. The Satrix 40 ETF, which follows the FTSE/JSE Top 40 Index, ranks among the most in-demand. The investor benefits from having the most liquid and largest JSE-listed businesses, and long-term investors choose the same because the company offers them the desired stability and increase.

Another well-regarded fund to consider is the Sygnia Itrix MSCI World ETF, which tracks global equities and makes global equities available to local investors. This fund is the most suitable if you diversify from the local economy. Dividend-driven investors are also well-served by the CoreShares DivTrax ETF, which concentrates on high dividend-yielding equities. The 1nvest S&P 500 ETF also gives the local investor the means to gain entry into the equity market in the US, which has historically returned high numbers. It’s unlikely that the same fund will be the most suitable for all. The appropriate fund depends on the goals and the market at the current time.

What Are the Main Advantages of ETFs?

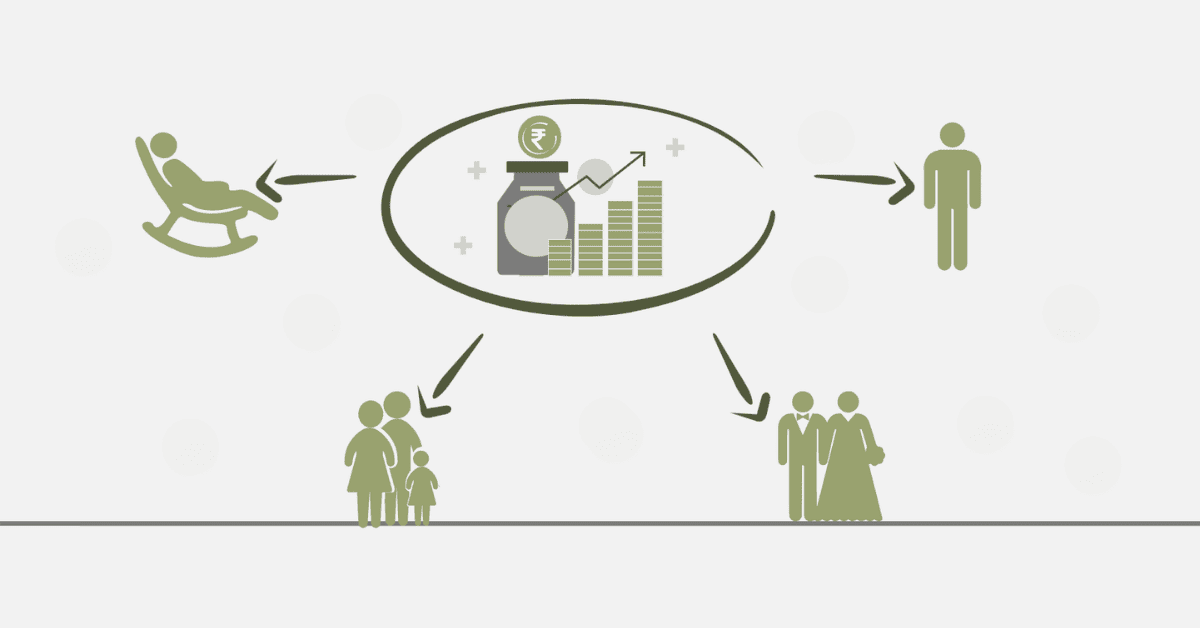

One of the significant advantages is diversification. Investing in a solitary ETF gives the investor diversification in terms of various assets, reducing the risk associated with investments in different stocks. This diversifying impact protects investors from market fluctuations and ensures long-term economic security.

Another key advantage of ETFs is efficiency in terms of cost. Unlike fund management-charge-intensive actively managed funds, most ETFs carry lower expense ratios, meaning the investor gets to hold back most of the return. Liquidity, too, is another advantage, in the sense that the ETF could be bought and sold in the JSE in the same manner as ordinary company shares, enter and exit at any point during market hours. Transparencies are another advantage in that the ETF components are disclosed daily, and the investor gets to see what he holds.

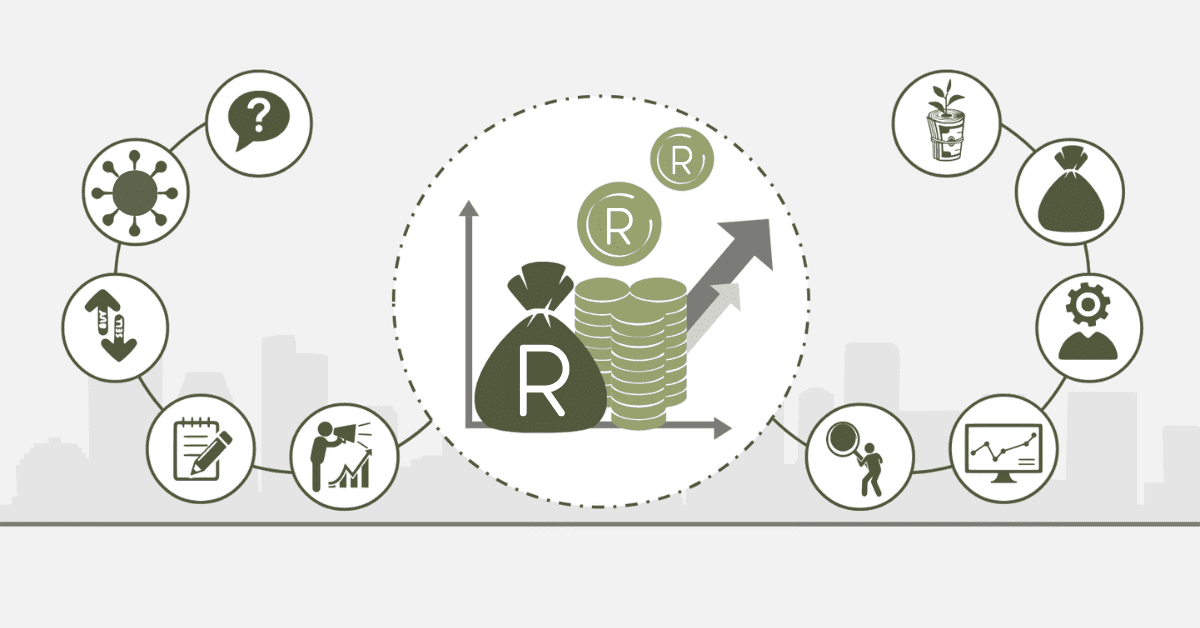

What is the Main Disadvantage of an ETF?

One of the major pitfalls is market risk. Based on an index or asset class, the fund’s performance follows the market movements. The fund’s value falls if the tracked index or the tracked sector performs adversely, resulting in possible losses. Therefore, in any case, the investor who desires assured return and/or total protection of the invested capital isn’t appropriate to hold an ETF.

Another disadvantage lies in the effect of trading expenses. Even if ETFs typically carry fewer management expenses than actively run funds, repeated trading means more significant transaction expenses. Repeated buyers and sellers of ETFs could pay considerable in the way of brokers’ fees, cutting into overall return. Also, while transparency is vital in the case of the ETF, some intricate ETFs based on the use of derivatives and leverage are not appropriate to all investors because they involve more significant risks.

Which ETF Pays the Highest Returns?

The performance of the ETFs varies depending on market conditions, and some give higher returns than others. In South Africa, ETFs internationally tracked, such as the Sygnia Itrix MSCI World and the 1nvest S&P 500, in the past returned higher percentages than local asset tracking alone. The internationally tracking ETFs benefit from the global economic boom, and the local investor enjoys the good-performing economies in the EU and the US.

Among locally domiciled ETFs, the Satrix 40 ETF has also remained a consistent performer due to the JSE’s most significant companies to which the fund offers exposure. It also benefits from the long-term-performing blue-chip equities in the country. Sector-specific funds, such as tech and financial services, could also provide more returns during the market upturn. However, high return also comes at the cost of greater risk, and the investor needs to assess his or her appetite.

Why is ETF Not a Perfect Investment?

While ETFs are great investments to many, they are, by all means, not the appropriate fit for all. Partly because they are market-based, some South African investors are poorly served by ETFs. Since the funds track an asset class or an index, in the case of a downturn, the investor risks losing money in economic downturns and market collapses. Unlike the case in the use of actively managed funds, in which the fund’s investments are adjusted to hedge the risk, the ETF merely follows the index.

Another drawback to look at is the point that ETFs offer no guaranteed income, and so are less attractive to conservative investors who are looking to earn a steady income. Dividend-yielding ETFs are possible, but the dividend payouts may be less than other income-bearing investments, including fixed deposits and bonds. The variety of available ETFs also means the investor risks making poor decisions if research isn’t thoroughly conducted.

Final Thoughts

ETFs offer investors in South Africa a simple and low-cost mechanism to diversify portfolios and achieve local and global market opportunities. The transparency, the fact that they are day tradable, and the fact that they pay less regarding fund management are reasons many believe they are a good fit. Like any other investment, the risks involved are market volatility and the lack of active fund management. The investor’s market outlook, appetite, and objectives dictate the selection of the proper ETF.

![Internal Rate of Return [IRR] – Calculation](https://www.searche.co.za/wp-content/uploads/internal-rate-of-return.webp)