Managing SA’s ‘personal’ finances has often boiled down to this tough decision: investing your cash or paying up dues. This wouldn’t be an easy call in these uncertain economic times with fluctuating interest rates and certain financial landscapes. Personal finances in South Africa could go both ways; that would depend on the type of debt, interest rates, and the nature of the financial goals.

How do I decide whether to pay debt or invest?

This decision should be taken in a well-thought-out and carefully considered way. These include, among many others, considering first what interest rates your debts are at. Interest, which may be very high from using credit cards or personal loans, should generally be focused on repaying. Getting piled with high-interest debt can balloon very quickly, making it difficult to dig out of and reach some sort of financial stability.

On the other hand, if you have a loaned amount that charges low interest, like home loans, for example, you will invest as long as the investment yield is far higher. Second, look at your financial goals. Depending on whether you have long-term or short-term goals—in contributing to retirement or education funds—an earlier start is better due to the effect of compounding.

Then again, if you want to reach that point of short-term financial freedom, one of the first steps to achieve that is eliminating those excess debts. Consider even your risk tolerance. Investments are risky, and if you feel uncomfortable with losing money in the market, you might find paying off debt provides an added level of peace.

Finally, check your cash flow and emergency fund. More than that, having enough liquid assets will help in case of a shock from expenditure. Concentrating alone on debt reduction or investments may leave one without an enormous position in the case of emergencies without such an emergency fund in place.

Should I invest or clear my debt first?

If you are in this situation, dialogues may be filtered through the lens of your return on investment in contrast to your cost of debts.

If the interest rate on the debt exceeds expected returns from investments, it might be more brilliant to pay the debt first. For instance, credit card debt in South Africa can be as high as over 20%, and typical investment returns aren’t much more than 8-12%. Paying off debt would yield a better “return” than investing.

However, if your interest rate is relatively low—say, a home loan at 7-10%—and you feel that the return from investments could be a higher rate that you can consistently manage, it may be a reason to invest. A lot also depends on your psychological comfort. Some would rather be debt-free to enjoy peace of mind and let go of probable investment appreciation. Others would continue focusing on increasing wealth through investments, accepting the attached risk of some debt.

Should you empty your savings to pay off debt?

While that may be critical, repaying your debt must not be done at the expense of bringing your savings account down to zero. Nobody knows what the next minute will bring in South Africa—you could end up with a medical bill or something unexpected happens to the car—so it is always vital to have a financial cushion. If you drain your savings by using them to pay off your debt, then if such an event happens, you will be on the receiving end, which shall also prompt you into more debt for the upkeep.

First, however, take stock of your emergency fund. Experts recommend saving enough money to cover at least three to six months’ worth of living expenses for rainy days. If you are below this threshold, start building your emergency fund first. Once your emergency fund is adequate, use excess savings to repay debt.

Consider looking at the interest rates on your debt compared to what you earn on your savings. If interest on your debt far outweighs your savings, then try to power down some—but after locking in that safety net first.

Why should paying off some debt be prioritized before investing?

Some debt should be cleaned up before investing. High-interest debt can quickly balloon into a burden that erodes your wealth faster than most investments can grow. In South Africa, credit card interest rates run higher than 20%, making it critical to eliminate this debt as soon as possible.

High-interest debt first run-off also reduces financial stress. Having a massive balance of debt can get one twitching and immensely limits your financial freedom financially. By paying off these more enormous debts, you free up cash flow that could be directed into more productive financial goals, such as investing or saving for significant life events.

Another reason that individuals should focus on debt repayment is because it gives a guaranteed return. When you repay debt, it offers a risk-free return equal to the interest rate of that debt. If you, for example, repay a loan at an interest rate of 15%, that compares to giving yourself a 15% return on your money; you’re unlikely to get to grieving an investment like that without considerable associated risk.

Repaying debt will improve your credit score for even more straightforward and friendlier terms on future loans or investments. A better rating saves money in the long run. It qualifies you for reduced interest percentages on mortgages or other overdraft products.

What is the recommended strategy for clearing debt?

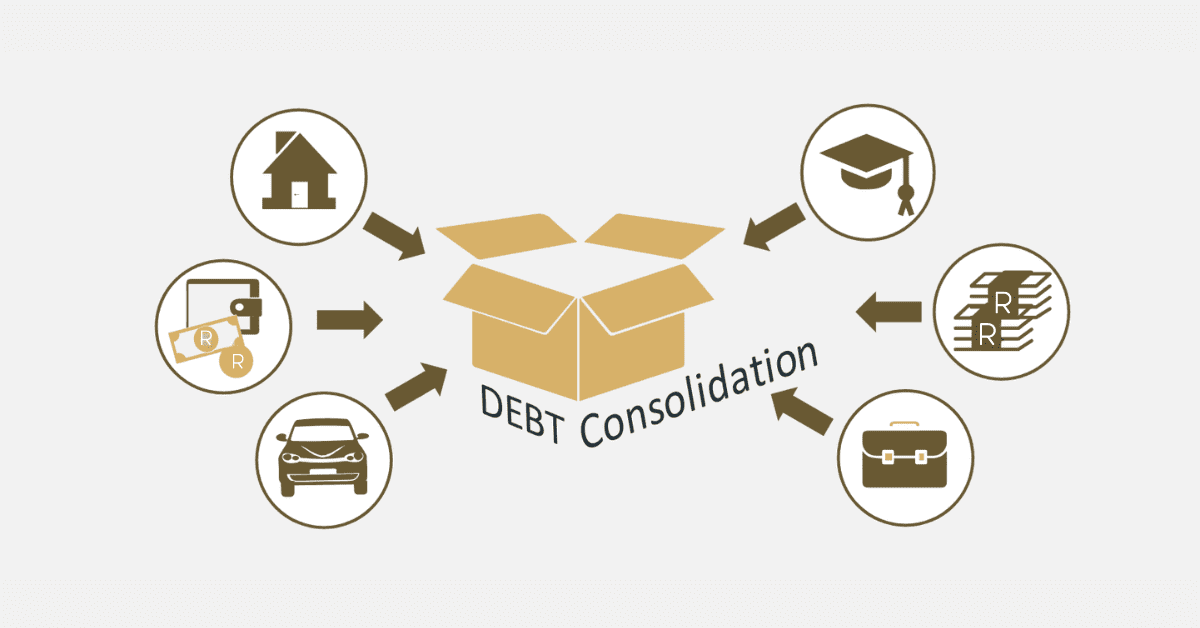

The most straightforward approach is through prioritization, budgeting, and plain hard work. List all the debts you have viewed, including interest rates and minimum pay. This will give you absolute clarity about what your financial situation is.

One of the best ways to do this is through the Avalanche method: Pay the highest-interest debts first and at least make the minimum payments on the others. This method takes less interest paid over time, so one can be debt-free more quickly. Alternatively, the snowball method pays off the smallest debts first, providing psychological motivation due to a few rapid wins that keep one motivated.

Budgeting is an essential part of debt repayment. Set aside a given percent of your income for debt repayment every month. You can cut some expenses or look for other means of earning to expedite the process. Be consistent, track the progress regularly, and revise the strategy whenever necessary. If you get hold of windfall cash like a bonus or tax refund, use it to make a lump-sum settlement against your arrears. Apart from clearing this current debt, never accumulate other new debts simultaneously.

Final Thoughts

The choice between starting to pay off your debt or investing first is a personal decision based on one’s financial position, goals, and risk tolerance. You will want to know in advance how to treat these investments, given that the economic conditions are relatively unpredictable, considering the case with South Africa. However, focus on paying off high-interest debt while you utilize long-term goals for investment as well. That way, you have facilitated yourself and assured secure prosperity by creating a balanced approach and contending with your financial objectives.