When an employee in South Africa passes away, specific tax-related procedures come into play, and all these processes are regulated by the South African Revenue Service (SARS). These procedures are meticulously designed to ensure that the deceased individual’s financial matters, encompassing tax obligations and asset distribution, are handled accurately.

What SARS Tax Procedure Do You Follow When An Employee Dies?

When an employee’s life journey concludes, there are essential steps regarding their tax matters:

- Reporting the Death: The initial step involves reporting the employee’s demise to SARS. This responsibility can be shouldered by the employer or the deceased’s legal representative.

- Final Tax Return: SARS mandates submitting a final tax return on behalf of the departed individual. This return should encompass the period from the commencement of the tax year to the date of their passing.

- Estate Duty: If the deceased possessed an estate surpassing a specific threshold, estate duty might become applicable. Estate duty is distinct from income tax and pertains to taxation on the deceased’s assets.

- Tax Clearance Certificate: A tax clearance certificate from SARS is Often a prerequisite before concluding the estate’s affairs. This certificate serves as confirmation that all tax-related obligations have been duly addressed.

- Payment of Taxes: Any outstanding taxes owed by the deceased individual must be settled using the estate’s assets before these assets can be distributed among the beneficiaries.

How do I report a deceased person to SARS?

To initiate the process of reporting a deceased person to SARS, adhere to these steps:

- Obtain a Death Certificate: Commence by acquiring a death certificate from the Department of Home Affairs.

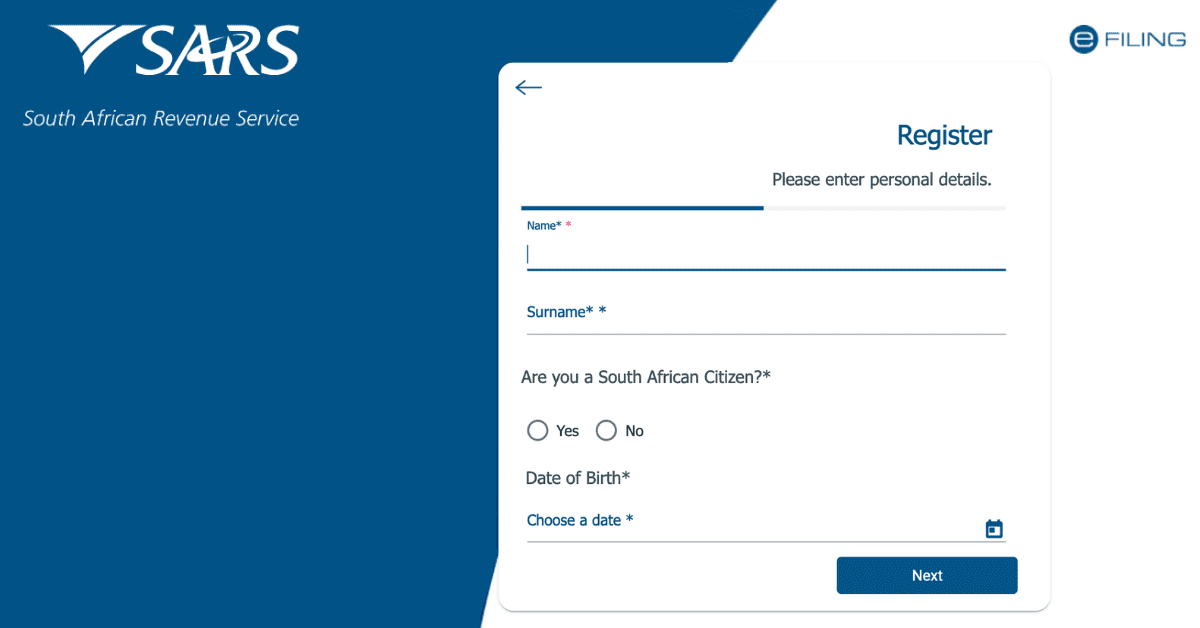

- Notify SARS: Next, inform SARS about the passing by completing a “Notification of Deceased Estate” form (IT14SD). Submit this form to your nearest SARS branch or via the eFiling system.

- Tax Affairs of the Deceased: Ensure that the deceased’s tax affairs, including filing any outstanding tax returns, are addressed appropriately.

- Settlement of Taxes: Collaborate with SARS to settle any outstanding taxes and obtain a tax clearance certificate if stipulated.

How long does South Africa take to pay death benefits?

The timeframe for the disbursement of death benefits in South Africa can fluctuate significantly, contingent upon several factors such as estate complexity, a valid will, and the efficiency of estate administration. Seeking legal expertise can expedite this process.

Can I claim tax for a deceased person?

Claims for tax in the name of a deceased person are conceivable under particular circumstances. These claims might encompass allowable deductions

What happens if you owe cash to an individual who died?

If you are indebted to someone who has passed away, your obligation to settle the debt persists. This debt becomes part of the deceased person’s estate and should be satisfied using the estate’s assets throughout the estate administration process.

How do I file a deceased person’s tax return in South Africa?

Submitting a tax return on behalf of a deceased person in South Africa involves a precise protocol, and compliance with the guidelines stipulated by the South African Revenue Service (SARS) is paramount:

- Comprehend the ITR12 Return: Initially, grasp the nuances of the Individual ITR12 Return for Deceased and Insolvent Estates. A comprehensive guide for this return is accessible on the SARS website, providing meticulous instructions for its completion.

- Gather Pertinent Information: Assemble all essential data regarding the deceased’s finances. This encompasses income details, deductions, and any other pertinent financial records.

- Finalize the ITR12 Return: Utilizing the accumulated information, meticulously complete the ITR12 Return form, adhering to the SARS guide’s directives. Precision is key to ensure accuracy.

- Submit the Return: Upon finalization, submit the tax return to SARS, making certain to adhere to the designated submission procedures, whether through electronic filing or at a local SARS branch.

- Settlement of Taxes: Should any unsettled taxes be attributed to the deceased individual, these should be addressed using the estate’s assets before distribution to beneficiaries. Estate duty, if applicable, must also be paid per SARS regulations.

- Maintain Comprehensive Records: Keeping thorough records of all financial transactions and tax-related activities during this process is imperative. These records will be indispensable in case of audits or inquiries.

- Seek Professional Guidance: If you encounter complexities or uncertainties in the process, consider seeking assistance from a tax professional or an estate administrator well-versed in South African tax laws.

In conclusion, adhering to the SARS tax procedures when an employee passes away in South Africa is a legal obligation and a crucial step in ensuring that the individual’s tax matters are appropriately settled, and their estate is distributed per legal requirements and wishes. Seek professional guidance to navigate these procedures efficiently and comply with South African tax regulations.