With the increasing unreliability of the South African Post Office, it has become the norm for SARS to issue you any correspondence through the eFiling platform. Not only does this allow for immediate delivery, but it makes it simpler and easier for all parties to track matters. Today we will walk you through the process of checking SARS correspondence on eFIling, and actioning anything you need to do based on it.

How to Check SARS Correspondence on eFiling

If you are already an eFiling user, SARS will notify you when correspondence is issued on the platform via your chosen contact method- email, SMS, or both. Don’t ignore these messages- while some will simply be statements of account or notifications that a tax item has been processed, others may need your input. Think outstanding amounts due or requests for supporting documents.

We outline how to check for the correspondence you have been notified about on eFiling below.

How to Access the SARS Correspondence on Your Profile

To access your SARS correspondence on your eFiling profile, follow these easy steps:

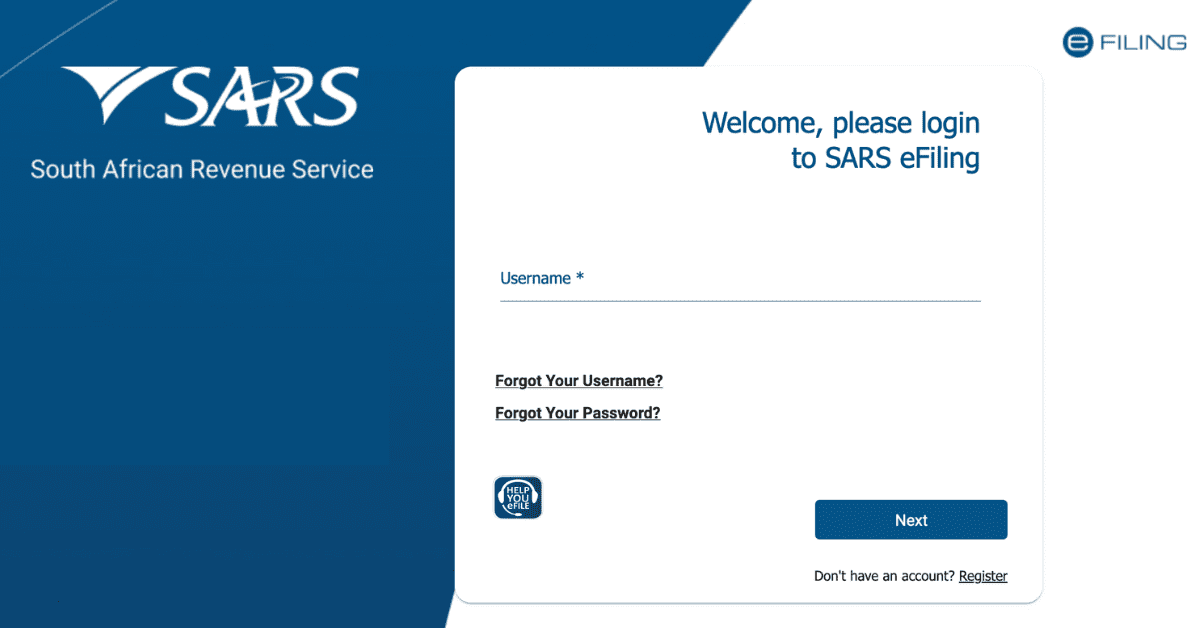

- Log in to your SARS eFiling account.

- Click on the “Profile” tab at the top of the page.

- Click on the “SARS Correspondence” link in the left-hand menu

- This will take you to a page that displays all of your recent correspondence with SARS, including letters, notices, and statements.

- To view a specific piece of correspondence, click on the corresponding link. The document will be displayed in a new window or tab. SARS correspondence is typically a pdf, so you will need a pdf reader. Most new operating systems have one natively installed, or you can use Adobe Reader.

- If you have not yet registered for a SARS eFiling account, you can do so by visiting the SARS eFiling website. Once you have registered, you can log in to your account to access your SARS correspondence and other tax-related information.

From the eFiling platform, you can initiate payment requests; dispute matters you do not agree with, or upload supporting documents requested as needed.

What Does it Mean When SARS has Issued Correspondence?

Receiving an email or SMS indicating you have SARS correspondence is not a reason to panic! Many of these notices and letters are simple maintenance and admin related to your tax activities on the platform. It is important to review your SARS correspondence carefully, however, and to respond promptly to any requests for information or action. This will prevent penalty fees or delays on actioning requests due to insufficient information.

SARS correspondence can be related to many tax topics, including:

- Tax assessments: If SARS has issued an assessment of your tax liability, they will send you a formal notice indicating the amount of tax that you owe and the due date for payment.

- Refunds: If SARS owes you a tax refund, they will send you a letter or statement indicating the amount of the refund and the estimated date it will be processed.

- Inquiries or audits: If SARS has any questions or concerns about your tax affairs, they may send you a letter requesting additional information or requesting that you provide the information needed for an audit.

- Tax Underpayments: If you owe further money on an income tax return, you will be notified with the reference details, accounts, and deadline to do so.

- Penalties or interest: If you have failed to comply with your tax obligations, SARS may send you a notice indicating that you are subject to penalties or interest charges.

- Supporting Documents:If SARS require supporting documents from you, they will request it in the correspondence section.

How Can I Get my Confirmation Letter from SARS Online?

With the more modern digital tax system, you don’t always need to receive a confirmation letter from SARS at all. This confirmation letter is simply proof that you are a registered taxpayer in South Africa and should not be confused with the now-defunct Tax Clearance Certificate (TCC) or the Tax Compliance Status System (TCS), which replaced it. Most parties, like employers, will be able to verify your tax number digitally instead.

However, should you require a confirmation letter/Notice of Registration (IT150), you can request it online via eFiling. Simply click the ‘Notice of Registration’ button on your eFiling homepage to initiate the request. It will be delivered to your SARS Correspondence tab and can be downloaded from there to provide to third parties, too.

How do I Access my SARS Documents?

You can access all SARS documents, be it tax returns or SARS correspondence, via the eFiling platform. We have already covered how to access SARS correspondence you receive. To see your returns, do the following:

- Log in to your SARS eFiling account.

- Click on the “Returns” tab at the side of the page.

- In the “Returns History” section, click on the year for which you want to access your documents or the tax type you wish to display

- This will take you to a page that displays all of your tax returns for that year, as well as any supporting documents that you have uploaded.

- Current returns you are working on/have not submitted will be available in the ‘Returns Issued’ tab. You can also request a new return for upcoming deadlines here.

To view a specific document, click on the corresponding link to display it. Typically, correspondence linked to it will be displayed on the main page, too, such as ITA34s issued for an income tax return. This is found at the top of the page.

How do I Check my SARS Outstanding Returns?

It is important to file all of your tax returns on time to avoid penalties and other consequences. Depending on the version of eFiling you are using, you can see outstanding returns either:

- Under “Returns Issued” from the left-hand panel. You may have to click differing tax types to see outstanding returns here. The return date will go red when overdue.

- Or the “Returns” tab at the top of the page. For this option, you will see ‘Outstanding Returns” to see a list of any tax returns that are overdue or still required for the current tax year and prior years.

Remember that this information may not be wholly complete. You may not have asked for a return that is, in fact, outstanding, or you may have not registered for the tax type needed. If you want to check everything regarding your tax affairs, try the SARS Call Center. They will be able to assist you more holistically.

Staying on top of your SARS correspondence is part of staying tax compliant, so don’t let the notification of a SARS correspondence being issued scare you! It is always better to access the document and see what is happening- it may even be telling you about a refund or simply summarizing tax returns you have filed for the year.