Are you a business owner in South Africa? If so, registering for Value Added Tax (VAT) is important in ensuring that your business is legally compliant. Fortunately, registering for VAT is now easier than ever with the help of SARS eFiling. This guide will walk you through registering for VAT on SARS eFiling, including the necessary documents and how long the process typically takes. So, let’s get started and get your business registered for VAT!

How do I register for VAT on SARS eFiling?

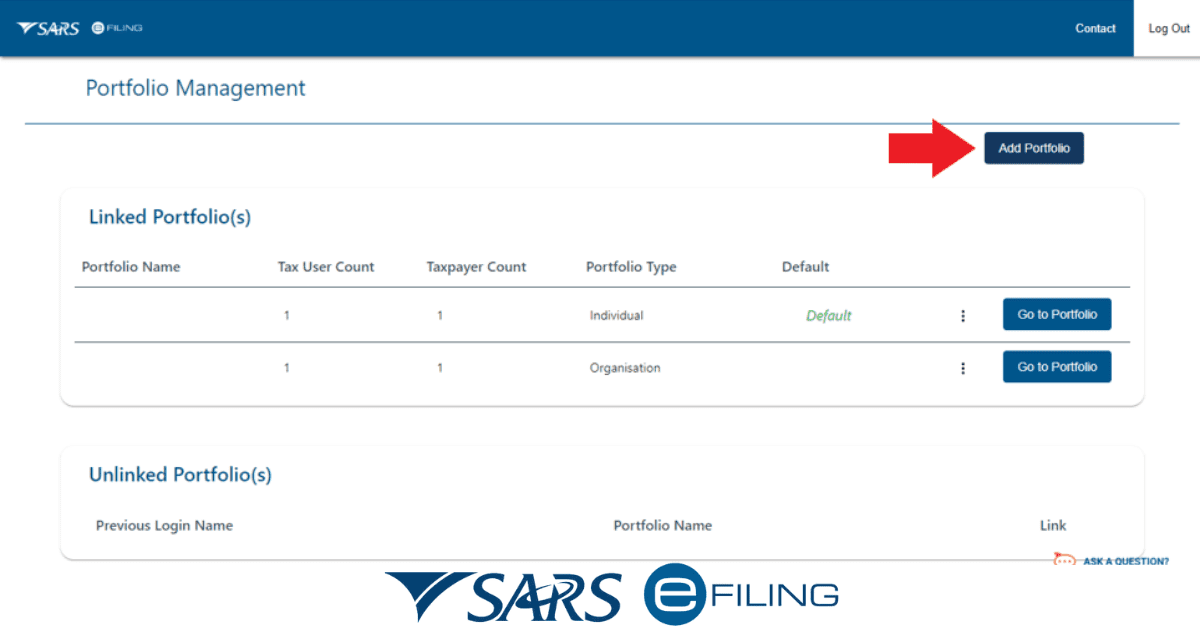

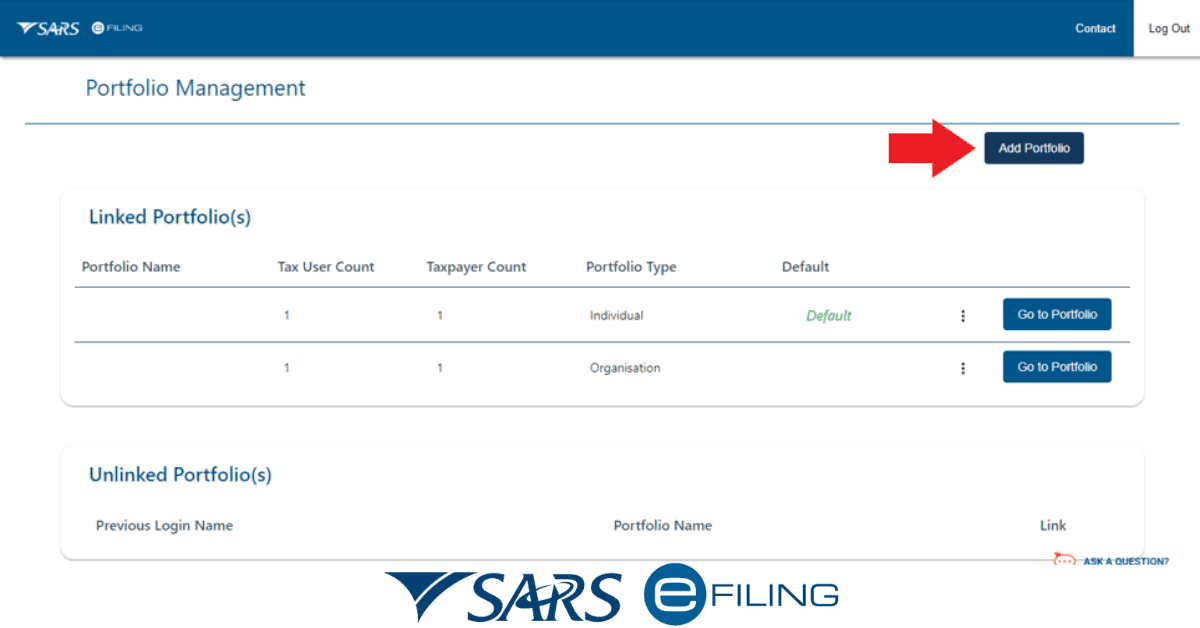

Registering for VAT on SARS eFiling is a simple process that can be done from the comfort of your home or office. All you need is a SARS eFiling profile, and you can start registering for VAT.

To begin, log into your eFiling profile, navigate to SARS Registered Details on the left menu, and select “Main SARS Registered Details.” From there, select “My tax products” and then “Revenue,” and choose “VAT” from the left menu. Finally, click “Add new product registration” or “Addition VAT branch registration” and fill out the form with your particulars, trading name, liability date, and business activity code.

It’s important to ensure that all the information you provide is accurate and up-to-date, as any discrepancies could result in delays or even rejection of your VAT registration application. Once you’ve completed the form, simply submit it, and SARS will process your application.

Alternatively, you can also make a virtual appointment with SARS to register for VAT in person. However, registering on eFiling is much faster and more convenient.

Whether you’re starting a new business or need to register for VAT for an existing one, eFiling is the quickest and easiest way to get the job done.

Can you get a VAT registration certificate on eFiling?

SARS eFiling makes it simple to get your VAT registration certificate, a crucial document in the VAT registration procedure. Besides this, SARS will send you a confirmation message once your VAT eFiling registration has been processed properly. This confirmation will be proof of registration until you obtain your VAT registration certificate.

If you have an eFiling account, you can get your VAT registration certificate by clicking the “SARS Registered Info” link. Click “Notice of Registration,” then “VAT,” to proceed. Your VAT registration certificate will subsequently be generated and available for printing or downloading to your computer.

Remember that proof that your company is authorized to charge and collect VAT from clients requires that you always have a valid VAT registration certificate. Also, if you want to create a business bank account, apply for government tenders, or get certain licenses, you’ll need this certificate.

It is highly recommended that you receive your VAT registration certificate on eFiling as soon as possible to avoid delays or complications with future transactions.

What documents are needed to register for VAT?

Reg istering for VAT can be complex, and ensuring you have all the necessary documents is crucial to avoid delays or penalties. The documents required for VAT registration

It’s important to note that you’ll need a copy of the ID of the public officer allowed to transact with SARS regarding VAT, as well as a copy of the trust deed and authority letter for this person. These documents can be submitted electronically on SARS when you register or at a SARS branch.

When submitting your documents, it’s important to ensure that all the information is accurate and up to date. If there are any discrepancies, it can lead to delays in your registration process or even rejection of your application. By having all the necessary documents ready and double-checking the information, you can help ensure a smooth VAT registration process.

How long does it take to register for VAT in South Africa?

In South Africa, registering for VAT can be done quickly and easily by either eFiling or visiting a local SARS office. You will likely get your VAT number immediately if your application has no problems or discrepancies.

Any problems with your application, such as missing materials or mistakes, could cause a delay in processing your request. Also, SARS may need to contact you for clarification or to obtain supporting materials when processing your application.

It’s also important to note that receiving a VAT registration certificate could take extra time. Your Notice of Registration will be available on eFiling, but it may take 21 business days for the actual certificate to be issued and mailed to you.

The total time it takes to register for Value-Added Tax in South Africa can vary based on the thoroughness and quality of your application and the provision of any supplementary information or documents. Hence, before starting the registration procedure, ensure you have everything you need.

Conclusion

In conclusion, registering for VAT on SARS eFiling is a relatively straightforward process that saves you time and effort. With just a few clicks and some necessary documentation, you can quickly obtain your VAT registration certificate and start doing business with peace of mind. Remember to have all your documents in order and up to date to ensure a speedy registration process. You can always contact SARS for assistance if you encounter any challenges during the registration process. Don’t let VAT registration be a daunting task. Embrace the convenience of technology and register on eFiling at any time.