While there are certain circumstances under which you do not need to file a tax return in South Africa, it is still good practice to do so if you are earning an income. Many people fail to realize that filing a tax return when you don’t ‘have to’ can actually be very beneficial to you, not the taxman. While it is natural to be a little wary of all things tax-related, especially as a ‘Joe Normal,’ you may be hurting yourself doing so. Luckily, you have us to help. Here are some good reasons why you should file your tax return, whether or not SARS insists you do.

Reasons you Still Need to File Your Tax Return

Here are some key reasons to file your tax return, even if you are not technically obliged to do so:

- Missed Deductions and Refunds: For most employees who work for one company, your company will deduct PAYE directly from your salary every month. This covers the maximum tax you could owe. It may not take into account things like your private medical aid, additional medical tax credit, private pensions and RAs, and other deductions due to you. Additionally, if you don’t work for that company for the full 12-month period, you will have overpaid tax on your salary. Filing your tax return means you can leverage these additional deductions and get a refund on the PAYE paid.

- Credit History: For some types of lending, you need to provide information on your tax compliance status. You can’t do this if your returns aren’t up to date and correctly filed- even if they were null returns or returns where you neither owed tax nor got a refund.

- SARS Oversight: If you have been a regular taxpayer and suddenly fall off the grid, SARS is bound to ask why. You may have a good reason- perhaps you are unemployed this year- but no one wants a bunch of attention from the taxman, especially if they are going to say you are non-compliant for it.

- Retirement and Other Funds: When you retire, are retrenched, or opt to take money out of a pension fund, you must also be tax-compliant. No records, no payout!

- A Good Record is a Complete Record: If your filing record is unbroken, SARS has no reason to think you are trying to hide funds from them. After all, life is expensive and someone has to be funding your lifestyle, right? Filing a tax return, even if it is for 0 bucks for the period, ensures you always appear as a compliant citizen with nothing to hide. And that means less attention from the revenue service.

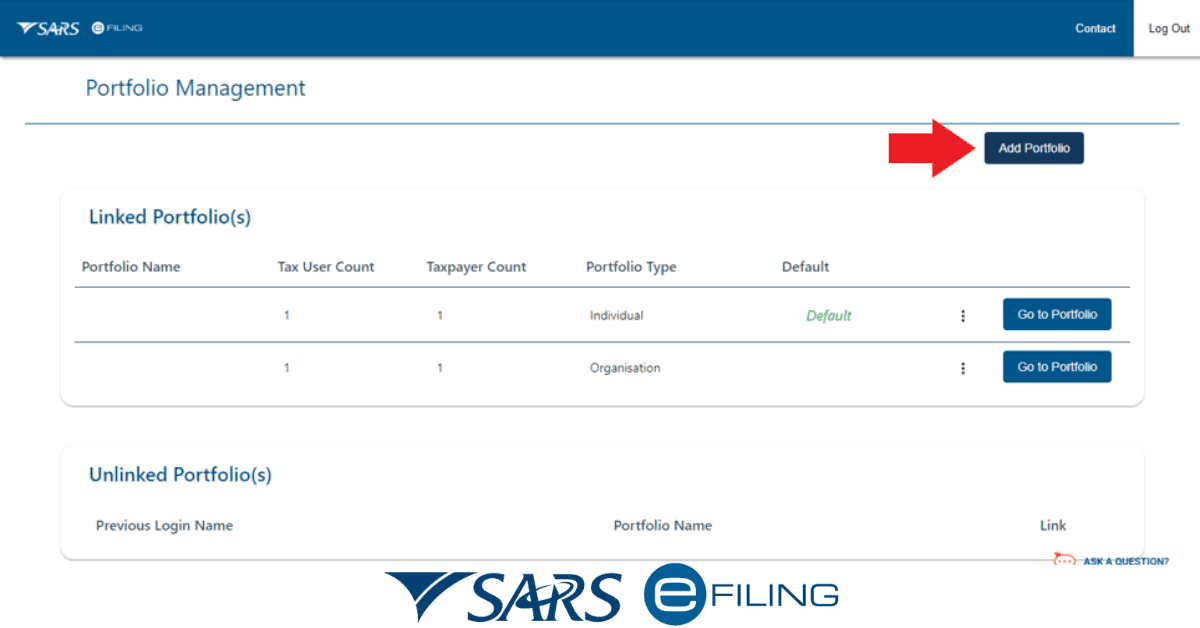

How Do I Know If I Have To Submit A Tax Return?

If you are working and earning an income from any source, the chances are you have to submit a tax return, even if no one tells you that directly. If you are confident you have only one income stream, and your employer is deducting PAYE from it, you might be exempt from needing to submit a tax return- but then you will miss out on the chance to leverage your deductions for a tax rebate.

Do I Need To File A Tax Return in South Africa?

If you earn no income at all, then you will not need to file a tax return in South Africa. For anyone earning an income, however, it is a good idea. While you can technically skip out on submitting one if PAYE is deducted from your earnings, you only have one (local) employer, and you earn under R500,000 a year; there are many good reasons (again, your deductions due) to submit one.

If you make income from more than one source, including rental, piece-work, and freelance activities, have investments that yield dividends or interest, have foreign interests, or make any capital gains during the year, you need to file a tax return. Remember, simply filing a return doesn’t mean you owe tax it is an administrative step.

Who Is Not Required to File A Tax Return?

In South Africa, you don’t have to submit a tax return under certain circumstances. These are where:

- Your dividends and investments from savings don’t pass R23,800

- You have no taxable capital gains/losses above R40,000

- You don’t earn rental income or other non-employment income

- You don’t receive allowances (including company cars) from your employer

- You don’t make income that hasn’t been subject to PAYE

- You don’t earn income as a business, contractor, or freelancer

- You have no money/assets worth more than R250,000 outside of South Africa

- You don’t have multiple employers or income streams

As we’ve already noted, however, many people who meet these criteria would benefit from filing an income tax return. SARS just won’t make you- provided you are confident you meet all those criteria.

What Happens If You Don’t Submit A Tax Return in South Africa?

Initially, if you fail to file a tax return in South Africa (and you should have), you will only face some admin penalties. These start at R250, but go as high as R16,000, income-dependent. Additionally, the balance of the money you should have paid will earn interest from the point it was due. However, both these admin penalties and interest can add up quickly if you are not careful. If you continue to not submit a tax return, this will eventually escalate to criminal proceedings against you. At the end of the day, you will face hefty charges and potentially a criminal record- and still have to submit and pay your tax return! It’s not worth evading it.

There are plenty of good reasons to file a tax return, even as a ‘simple’ or low-income earner. It is always best (and mostly to your advantage) to file a tax return yearly.