One of the leading ways South Africans make long-term wealth is through investment in mutual funds and stocks. Of course, both might give promising returns, but they come with different characters in terms of benefits, risks, and gains that may be expected. Your choice between mutual fund and stock investments, as related to the subject under discussion, will be guided by factors, including your risk tolerance, financial goals, and investment knowledge.

Mutual Funds vs. Stocks – Benefits

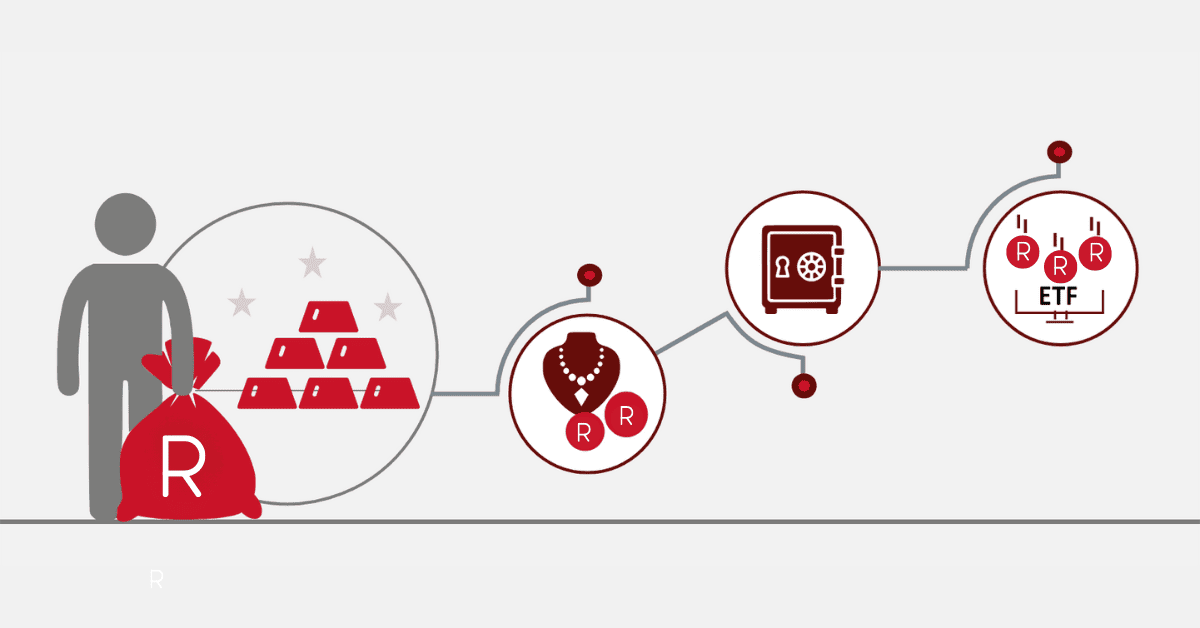

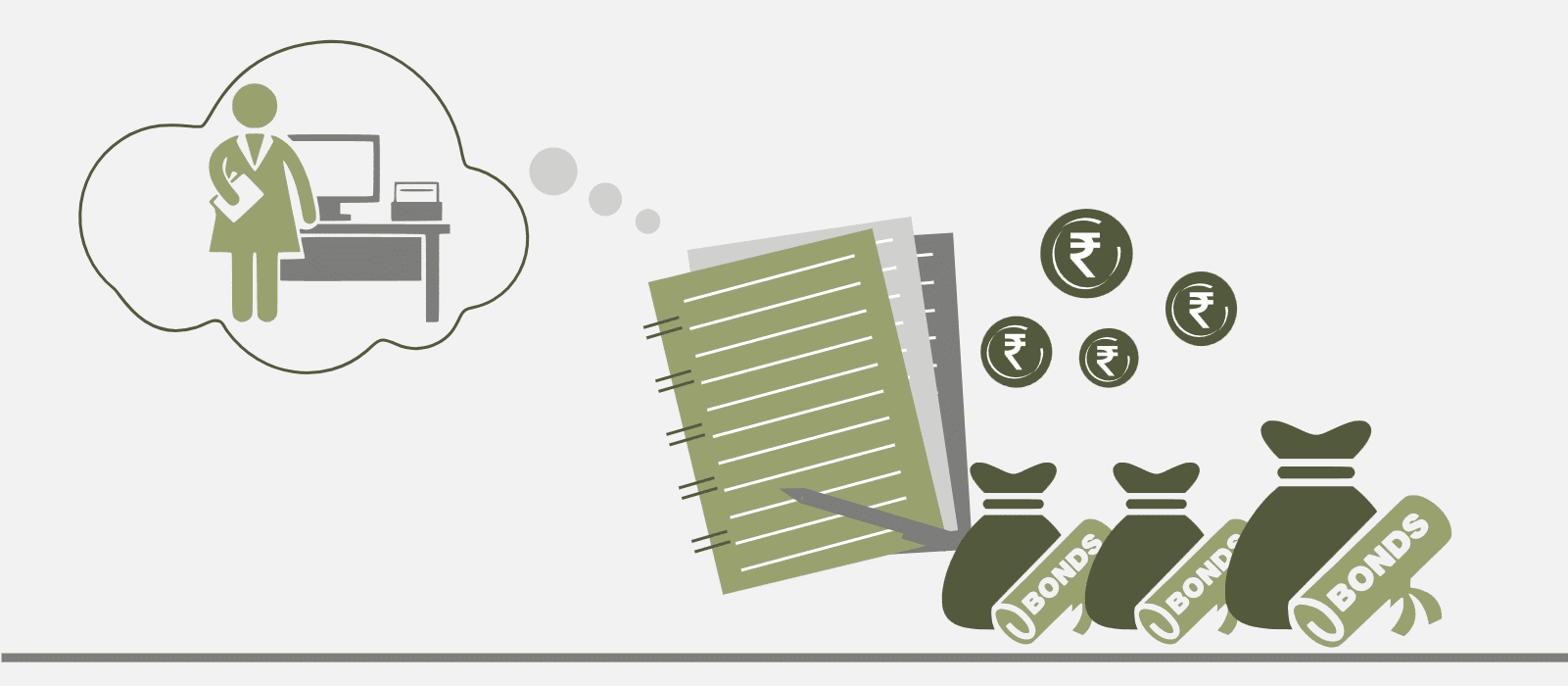

There are separate advantages for mutual funds and stocks that could attract different categories of investors. Mutual funds have the added benefit of diversification. As more money pools in a mutual fund from more investors, the corpus is invested in a host of stocks, bonds, or both. This diversification cushions the fund against the poor performance of any one security since the risks get dispersed. Also, mutual funds are professionally managed and fit those investors who want to stay very hands-off. Even less knowledgeable investors can gain from it due to its long-term growth potential, whereby decisions on buying and selling are put in the hands of the fund manager.

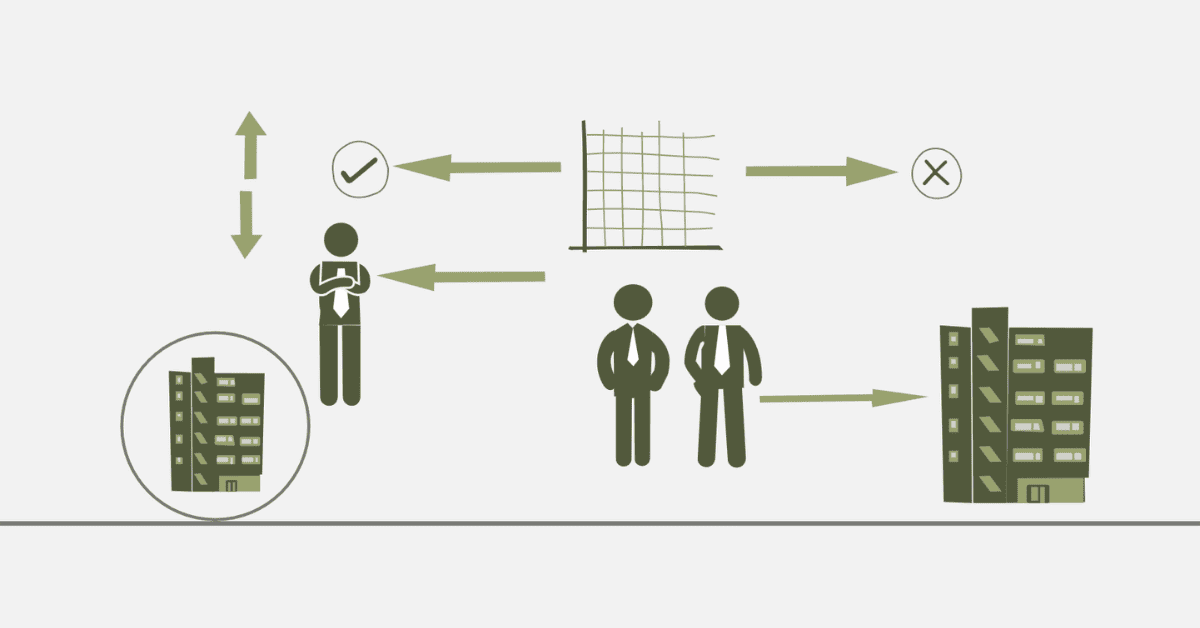

Stocks reflect direct ownership in underlying companies. As such, this will be the kind of investment that will give the investor more control and flexibility. Stocks allow the stockholders to choose which companies they want, perhaps due to their research or preference. In South Africa, if one invests in local companies, huge returns might come whenever the industries grow, especially in strategic sectors such as finance, mining, or telecommunications. Unlike mutual funds, stocks are not managed and, therefore, need no management fees; hence, the only revenues to the investor are profits made through the stock’s appreciation and dividends.

Mutual Funds vs. Stocks – Risks

Like any other investment, mutual funds and stocks have various risks. Such risks must be understood in order to make an important decision about the alternative that will best serve the financial goals. Because of their diversification, the mutual funds business carries less risk than other stock investments. This is because the performing ones within it usually cover the poor performance of one or two underlying assets within this fund.

However, there are also some risks associated with mutual funds. Their values shift by the big market and at the discretion of managers. Management costs, among others, also gnaw into returns over time. Added to this are the additional risks of currency fluctuations and potential volatility in the home market for international mutual fund investments by South African investors.

Stocks are riskier and more volatile. It is not uncommon for companies’ share prices to fluctuate with market forces, company performance, and even exogenous events of change in economic fortunes or geopolitical shock. A classic example would be stock in a mining company based in South Africa, which turns out to be highly rewarding when commodity prices go up but may incur severe losses upon commodity price reversals. In the case of stocks, much more research and knowledge is needed because one wrong move results in a loss worth millions.

Mutual Funds vs. Stocks – Gains

Returns expected both from mutual funds and stocks are highly variable, depending on prevailing market conditions and your investment strategy. The return mutual funds offer is generally stable and long-term since the fund portfolios are usually diversified. They may not provide the high, short-term returns resulting from individual stocks, but they are designed to give growth over time. Depending on your appetite for risk in South Africa, they can be diversified to accommodate local equities, bonds, or international markets. Time can increase the value of your mutual fund investments by reinvesting dividends and interest through the compounding effect.

Stocks yield higher returns, especially for companies or sectors that grew fast. They allow investors to reap the benefits of specific company successes and, many times, are advantageous within a short duration. For example, an early investor in technology or telecommunications in South Africa would have his or her stock price shoot up as that industry develops. Stocks, however, bear the risk of heavy losses if the yields of a particular firm are not satisfactory.

Is it Better to Venture into Stocks or Mutual Funds?

Decisions between the two depend on a few factors, including, among others, your investment knowledge, time you can commit, and fiscal goals. If one is a beginner in investing or prefers being hands-off, mutual funds are better: they are professionally managed, which means they are also diversified and carry lower risks as they spread across classes of assets. Also, mutual funds are more manageable and less frequently monitored; hence, they are more suitable for small investors with little market experience. The mutual fund will expose the South African to some of the local and international markets in a far more diversified manner.

In some instances, if you are more confident in your investment knowledge and prepared for high risks, then stocks can be more in control, with the possibility of higher returns. Direct investing in stocks involves focusing on sectors or companies perceived to do well; hence, there is more flexibility and the possibility of earning more within a shorter period. Whatever the case may be, however, investing in stock requires continuous research, management, and tolerance for higher market fluctuations.

In reality, though, the typical investor will take a balanced approach: You can reap the advantages of diversification and professional management by incorporating mutual funds with individual stocks in your portfolio yet still realize many of those excellent growth potentials of stocks. Overall, the best type of investment will depend on one’s financial goals, risk tolerance, and investment strategy.