If you are a homeowner or aspire to own a home it is much of genuine concern to understand the work of these mortgage lenders. You also must know how well your credit score can allow you to get a montage loan.

Checking your credit history

For them to know what you possess on your credit score and your creditworthiness, that check must be done on your credit history before approving any loan.

Mortgage lenders do these checks upon request, to ensure that individuals seeking home loans are financially disciplined.

Some may ask, how far do they go with these checks? What are the nitty-gritty of these mortgage loans? Well, we are about to find out more.

Do mortgage lenders look at credit history?

What would matter if not your credit history and credit score? All your credit scores for years have been recorded on your credit history. Your credit history holds all your financial credibility for some time.

Mortgage lenders focus a lot on credit history. They need to assess if you have been diligent with your debt and also do not pose a risk borrower to them.

Once you are trying to secure a home, it becomes mandatory for mortgage lenders to look at your credit history to ascertain if you are likely to pay back the home loan on time and right.

How far back do mortgage lenders check credit history

Mortgage lenders can quickly look at one of your credit reports to see information about your finances when you are seeking a home loan.

This is one of many things that can affect your ability to get a mortgage. This is another thing that can affect your ability to get approved.

If you have been turned down for a mortgage because of your credit history or are worried that having bad credit will keep you from buying a home, you should be looking to find ways to make your credit better.

Once you apply for a mortgage, it becomes necessary for the lender to look at your credit report and look at the last six years of your financial past.

If you want to get a mortgage, most lenders will look at your credit report from up to 6 years ago. This is because bad things about you will stay on your credit report for 6 years.

Most lenders will look at your most recent credit action because they think that shows the most accurately how your finances are right now. This means that if you have been good with money over the last two to three years, it will be seen as a good thing and can help you get a home loan.

How long is credit report good for mortgage?

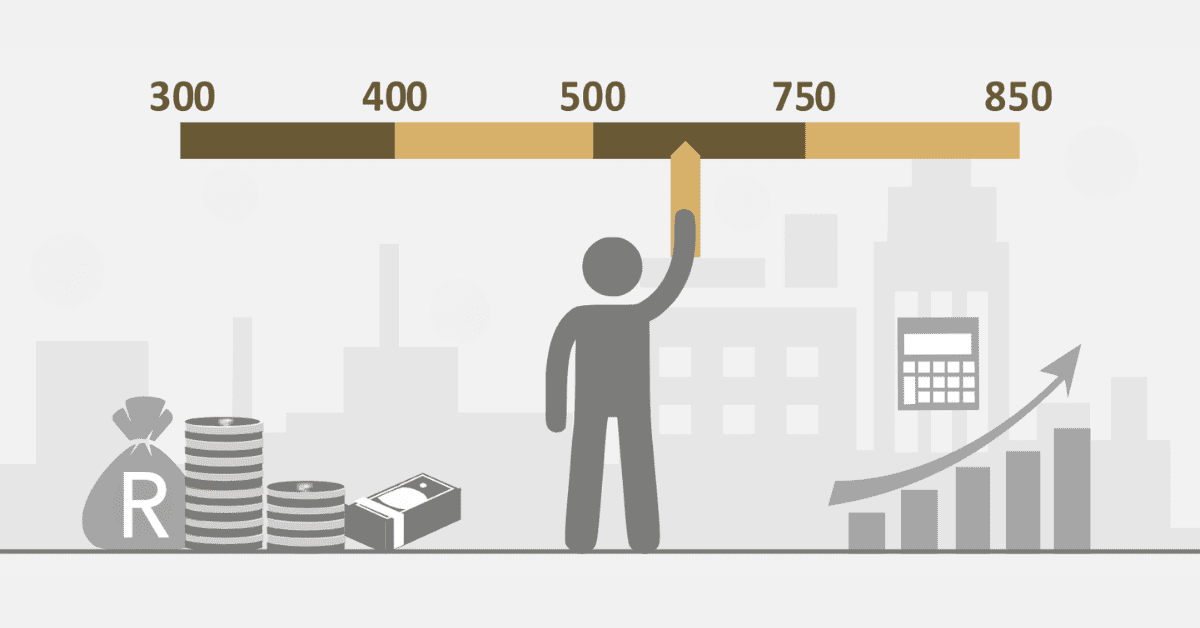

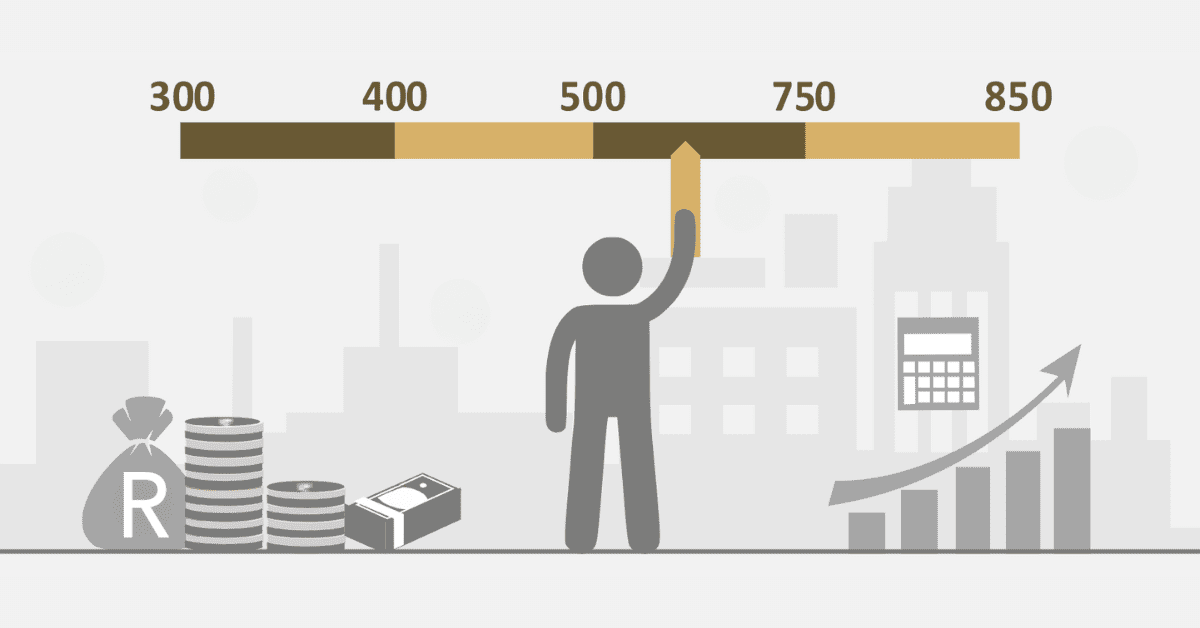

Your credit report is one of the key things that can open the opportunity for a mortgage. Each and everyday people find reasons to improve their credit score. While others also lack the discipline to build their credit score.

A credit score is not built overnight; it requires consistency and some number of years.

When someone prepares to go in for a mortgage, whether you have the money or not; once you are on credit, there is a need for your credit report to be checked.

Between 5 to 6 years can be considered enough time for a credit report to be good for a mortgage. Once you prepare for a mortgage, the least time most mortgage lenders may consider could be 5 years.

How long after credit check can I get a mortgage?

It could take not less than 6 weeks to get your mortgage after your lenders have checked your credit history. The 6-week period is for the lenders to evaluate your credit history and look for all valuable information to confirm your approval for the mortgage.

These 6 weeks can be translated into a 45-day period which can be considered enough for all the right checks for the mortgage.

However, the timeline can also depend on the amount for the mortgage, the number of credit and your credit history. These can have a minor influence on the timeline of the credit check before securing the mortgage.

How many times does a lender check your credit?

There are several factors that mortgage lenders will check when they look at your credit history, and each of these checks can be different.

There are two checks for credit; which are soft inquiry and hard inquiry. With each serving its own purpose and process.

Should you have 5 mortgage lenders checking your credit at the initial stage of the mortgage processing, it is considered as one inquiry.

When a mortgage is being processed, lenders can check your credit for not less than 3 times. Your credit is first checked during the pre-approval process. Once the application is ongoing, your lenders can look into your credit should there be any discrepancies.

The last check may occur from the credit bureaus to confirm any forfeited or existing debt. This is to understand your credit history level and creditworthiness before the mortgage is approved.