Borrowing cash to invest is a good, attractive option in SA. This is because one is presented with an opportunity to increase wealth by investing capital availed through debt. On the downside, this approach involves a hefty dose of leveraging and, thus, attendant risks and complications. While it might amplify gains, it also amplifies losses. Thus, it’s pivotal to understand how this works and the associated risks and disadvantages before making any decisions.

Is Borrowing for Investment a Perfect Idea?

In summary, borrowing to invest can be equally good just as it’s risky, depending on an individual’s financial situation and risk tolerance. In South Africa, leveraging can work in your favor if the returns from your investment are more than the cost of borrowing, such as the loan’s interest. However, it starts giving problems where the investment fails to turn up as expected, thus compelling you to repay the debt.

Can You Take Out a Personal Loan to Invest?

The answer is ‘yes,’ but this usually carries plenty of risks. These advances are widely available in South Africa from banks, credit providers, and fintech companies. You may use those overdrafts to invest in various assets, ranging from equities to property, or even to initiate a business. However, their interest percentage is often higher than other borrowing forms, such as home loans or margin credits.

How Does Borrowing to Invest Work?

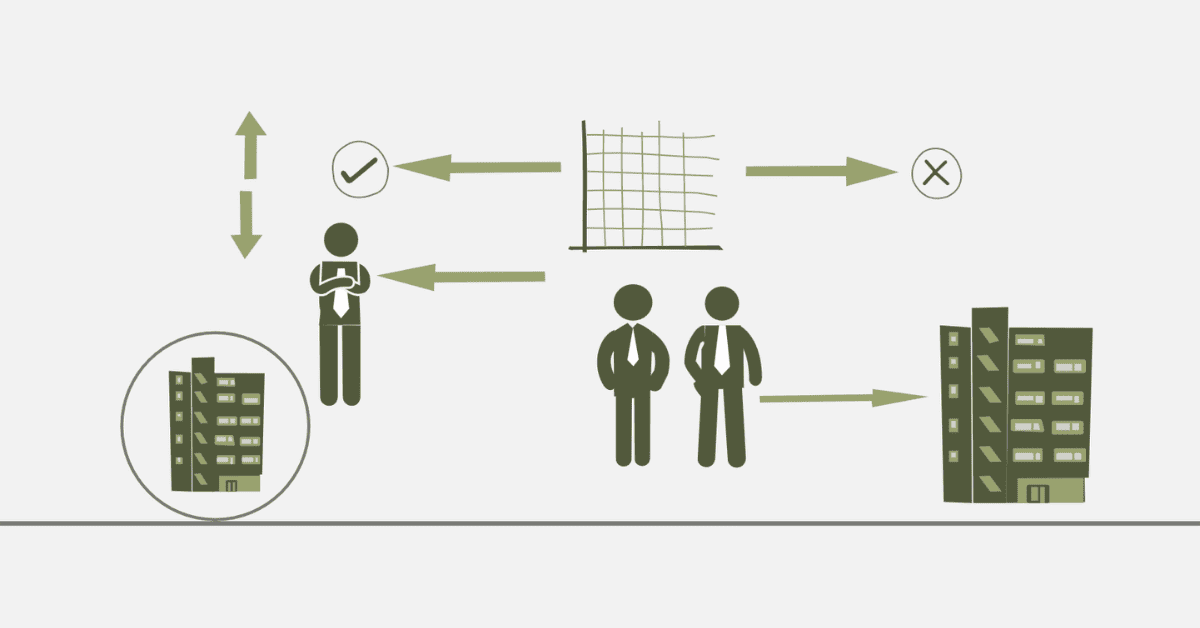

Borrowing to invest could be referred to as leveraging, where one incurs debt to receive returns on investment of money borrowed. This is a widespread strategy in South Africa for stock market investments, property investments, businesses, and even sometimes ordinary people. In general, the process goes this way:

- Lending Money to Invest: The very first step in investment through borrowing is availing of credit. This could be a personal loan, margin loan, ubiquitous investment in the stock market, and sometimes even a home equity loan. Loans can be approved against either your assets or on an unsecured basis, depending upon your creditworthiness and the policies adaptable by the lender.

- Investing the Loan: You will invest the loan money, once available to you, in various assets comprising shares, property, and bonds. Ideally, you want to select investments from which returns will likely be achieved over the interest you pay on the loan. Most investors in South Africa borrow to invest in property due to possible long-term appreciation and earnings from rentals. The same could be said about the stock market, which might provide suitable areas for capital growth.

- Paying Interest and Repaying: While your investment hopefully appreciates or generates income, you must repay the loan. In the case of a personal one, the debt repayments usually encompass monthly installments of both interest and capital. If you have taken out a margin credit or other financing forms tied to your investment’s performance, your repayments may vary depending on market conditions.

- The Goal: Income After Expenses. The entire rationale behind borrowing to invest is to return more than the expense of your borrowing. In other words, if you borrow at 10% and your investment returns at 15%, you realize a net gain of 5% after accounting for and paying the interest on the loan. This can accelerate wealth creation, but it only works if your investment outpaces the cost of borrowing.

What Are the Cons of Borrowing for Investment?

While there is the potential to increase gains, even for many people, the drawbacks/risks associated often outweigh the benefits. Some of the major disadvantages include:

- Higher Debt: When you are borrowing to invest, additional debt is accumulated and has to be returned, regardless of the eventual performance of an investment. You might still have much debt service if your investments do not return enough money.

- Interest Paid: The interest percentage shelled out on the loan would bleed the investment returns. When your credit carries a high interest rate, and the return on your venture becomes low or even negative, it may put you in an unfavorable monetary position.

- Market Risk: By nature, investment bears risks. The risks are higher, especially in volatile equity and real estate markets. The borrowing amplifies this risk. If the market goes south, you would have lost the borrowed money but would still be legally liable to return the loan amount.

- Pressure and Stress: Debt and investment management is very stressful. The pressure of seeing that your investment is performing to cover loan repayments may be good enough to drive one to make poor decisions, such as selling at a loss to make up or taking on more risk to recover.

Are There Any Risks to Borrowing Money?

Of course, there are. The SA market has considerable risks associated with borrowing cash for investment, which every capitalist should carefully consider. A few of the significant risks associated with this type of strategy in the South African context include the following:

- Market Volatility: This is one of the significant risks. No matter your investment in stocks, property, or whatever else, there is no guarantee that its value will shoot up. If there is an economic downturn, then the value of your investments nosedives to less than what you borrowed.

- Interest Paid: The interest rates in South Africa are variable; sometimes, monetary policy changes within the South African Reserve Bank may change the economy. Conversely, if you borrow at fixed or floating rates, a hike in interest rates increases your repayment costs and takes away whatever gains from those investments.

- Liquidity risk: Some ventures, such as property or long-term equity, cannot quickly convert into cash. If you have to service debts in the short term and your ventures happen to be non-liquid, you might be stuck in a financial predicament.

- Economic uncertainty: The South African economy struggles with growth, unemployment, and inflation. These can dampen the investment markets, meaning the returns you relied on to repay your loan are lower than expected.