Investing is one of the best financial strategies to add extra income in the form of profit after specific periods. In South Africa, various related opportunities can bring a steady income. These ventures offer a stream of recurring revenue to individuals, especially those who are retired or simply in need of extra financial stability. The secret to successful investing lies in an understanding of different types of assets, their possible yields, and the risk each of them carries. The focus of this article is to show various ventures that produce a monthly income in South Africa.

Investments that Pay Monthly Income in South Africa

Bonds

These are debt securities that a government/corporation issues when it borrows money. In their acquisition, one issues a loan to protect interest at regular intervals and the eventual repayment of the bond’s face value upon maturity. Popularly referred to as RSA Retail Bonds, South African government bonds are very much liked by investors because of their safety and attractive interest.

Dividend Stocks

Dividend stocks are those companies that pay out a portion of their earnings to shareholders. Usually, the dividends are paid regularly. South African companies typically have excellent dividend payouts regularly.

REITs

These businesses own, manage, or finance real estate that creates rental income. Shareholders in this structure get at least 90% of the company’s earnings in dividends every fiscal year. Therefore, it provides a good way of earning an income every month.

Rental Properties

These are some properties where one invests in and gets the return in the form of rent from real estate. In South Africa, residential and commercial properties provide lucrative rental income opportunities.

Money Market Funds

Simply pooled funds that invest in short-term, high-quality debt instruments, these options are invested for stability in value and to distribute dividends reflecting short-term interest rates. They are considered a safe investment that offers a lot of liquidity and gives an investor a steady income.

Real Estate

This investing is merely the act of purchasing property with the prime intention of making returns, which can either be made from the collected rents or through capital gains once the property is sold. The real estate market is fully developed across all parts of South Africa, presenting complete and accurate opportunities for residential, commercial, and agricultural land.

Business Income

This would give one a monthly return if the company proves viable. This could come from self-employment or an investment made into another business. The potential income from the investment in a business varies with the type of business and the success rate.

Savings Accounts

This is usually safe, and one would surely get a good return through interest. One could find high-interest savings accounts in South Africa, giving the possibility of a monthly income through some banking institutions.

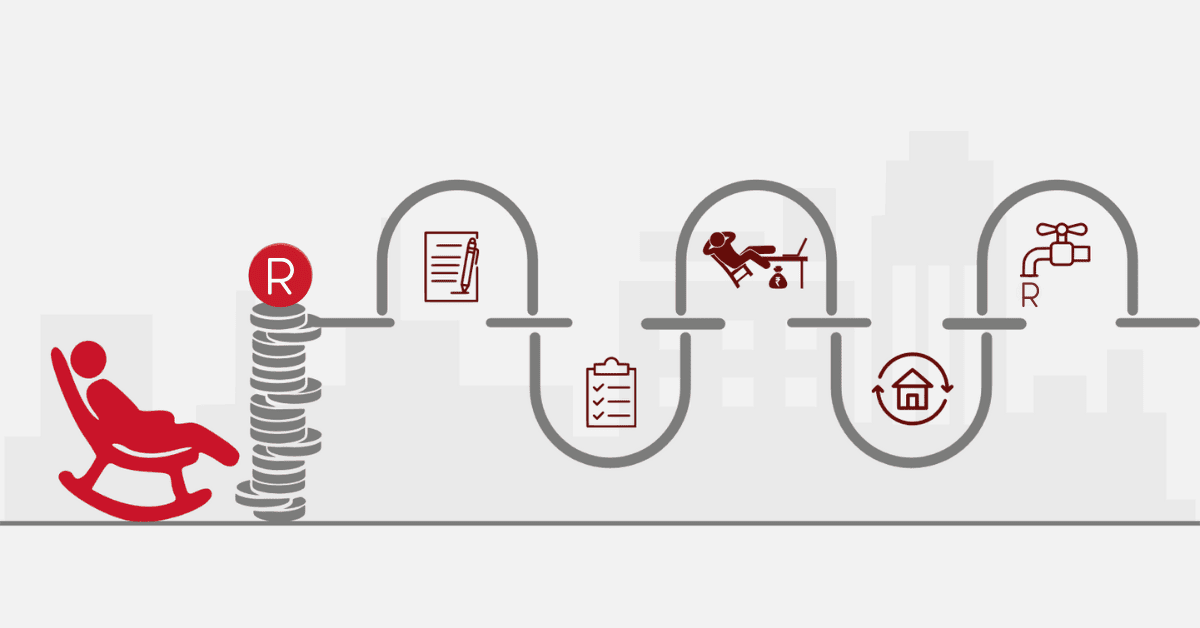

Annuity

This is a financial product, primarily for retirees’ income stream, which pays out a fixed stream of payments to an individual. They are created and sold by financial institutions, which will accept and invest funds from individuals and, upon annuitization, will issue a stream of payments later.

Certificate of Deposit

It is a time deposit with a bank that has a preset fixed term and is most often with an associated interest rate. It is a safe investment but might return with a better interest rate than a regular savings account.

Dividend ETFs

These are exchange-traded funds investing in dividend-paying stocks. They are income-generating ventures and offer the probability of capital appreciation. You can get several of them on the Johannesburg Stock Exchange.

Preference Shares

They are equity security that pays a fixed dividend. These shareholders have more claim to earnings and the firm’s assets than ordinary shareholders. Companies in South Africa usually make wide use of these shares to raise capital without diluting voting rights.

Can I Invest Money And Get Monthly Income?

One can invest resources and, ultimately, get a fixed monthly income. Such is commonly equated to income investing. Income investments pay dividends or interest to the owner, and these earnings can be readily withdrawn as cash. One type of income investment is dividend-paying stocks, bonds, REITs, and tenancy properties.

What Is An Investment That Pays Out Monthly?

Funds that pay out monthly offer fixed recurrent income to the investor. These incomes are usually in the form of dividends or interest. Sample investments that can provide you with a monthly income are bonds, dividend stocks, REITs, and rental properties.

Which Investment Gives The Highest Return Monthly?

The monthly investment that can be the most profitable usually depends on market conditions and the strategy towards investment. Meanwhile, some investments were/ARE known to have high yields. Such investments comprise dividend stocks paying companies, REITs, and rental properties. It’s essential to mention that investments having a high return potential also carry a higher risk. Consequently, it is vital to diversify the securities in your portfolio and to consider your risk tolerance while choosing the investments.