An intelligent investor will opt for a monthly income investment plan, more so for those who want to add to their current or retirement benefits. In South Africa, investors can use varied and diverse options to get some returns every month. These investments range from conservative savings accounts and fixed deposits to dynamic ones such as investments in real estate and dividend-paying shares. Understanding the various options available in investments will help you make a decision that will secure a stable and continuous income stream.

Investments that Pay Monthly Income in South Africa

South Africa offers a myriad of investments that provide the most options for those seeking monthly income generation. One such investment is in bond funds. In this investment, investors pool their money together to invest in diversified portfolios of government and corporate bonds. The interest paid on these funds makes the source of income stable on a month-to-month basis.

Real estate investment is equally venturous. One can garner monthly rent by buying rental properties. Besides, there is an option if one desires to invest in income-yielding real estate but detests the sleepless nights associated with property management. REITs can do this job. They should give the shareholders a substantial part of the earnings as dividends.

Moreover, we have money market funds that deal with low-risk, short-term debt instruments based on a bias toward T-bills and commercial papers, ensuring high liquidity and safety while ensuring interest payoffs every month. The Stanlib Money Market Fund is one of the key players—the most reliable ones, too—in South Africa’s market regarding returns and stability.

Exchange-traded funds are other considerable options. These cases, such as Satrix Property ETF and Satrix Dividend Plus, are in a portfolio of securities with monthly dividend payers. These funds are traded on the stock exchange and combine mutual fund benefits with the flexibility of trading stocks.

Another source of monthly income can be the stocks that involve dividend payments. When an investor invests in firms with a strong record of paying dividends, he will receive multiple paybacks regularly. Such companies include utilities, consumer goods, and telecommunication companies; they rarely change their dividend payout policy.

Another area that has picked up includes peer-to-peer lending sites. These platforms match borrowers with lenders to provide interest to investors on the loans they raise. However, this can be more lucrative with the higher risk of borrower default.

High-yield savings accounts value safety and earning interest. Although the returns may be less than other investments, this alternative is beautiful to conservative investors since their money remains safe and liquid.

Don’t forget Mutual funds with regular payouts. These provide regular pay-outs to their investors every month. They are investment portfolios managed by professionals who invest in various assets that generate steady income with the possibility of capital appreciation.

Preferred stocks are hybrid securities, with features from both bonds and common stock, by having fixed dividend payments. They provide claims on the assets ranking higher than those in common stocks; therefore, they willingly attract risk-averse investors seeking regular income streams.

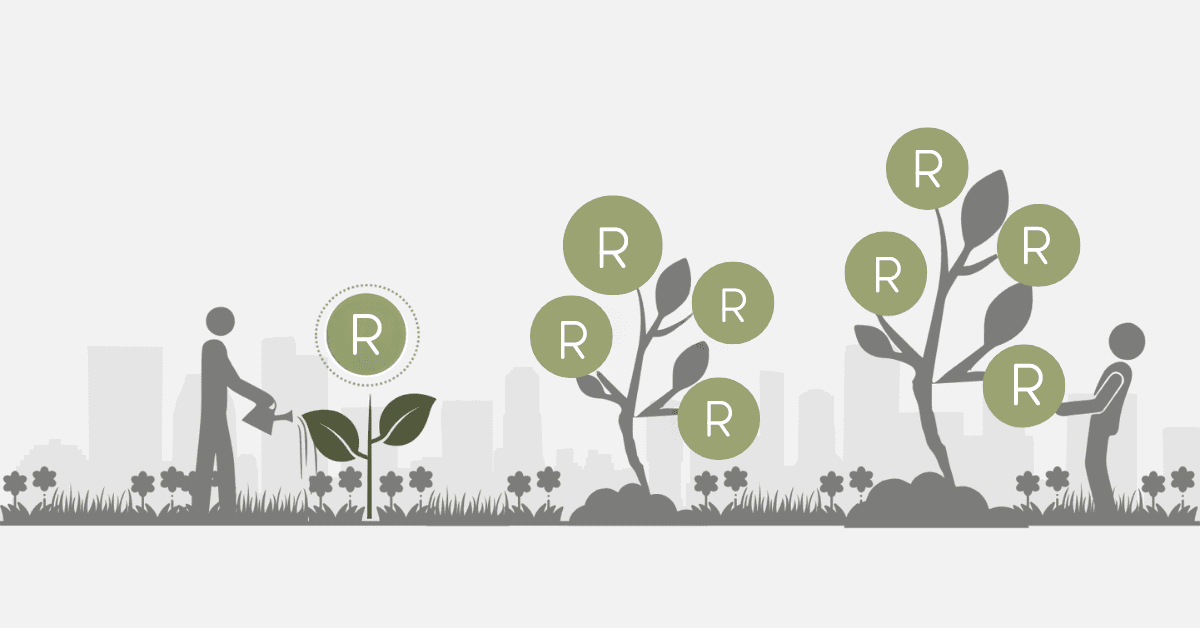

Rental property remains one of the most stable platforms for creating monthly income streams. It’s pretty straightforward for any investor to be more in sync when establishing steady cash flows through renting properties to earn rental income and appreciate the same property.

Royalties from intellectual property, such as books, music, and patents, are another source of passive income. In this case, investors draw royalties whenever the properties they own rights to are used or sold.

Finally, annuities denote an income stream guaranteed to the investor, usually in retirement. They are insurance products that ensure financial security in old age.

What is the Best Investment to Get Monthly Income?

Of many available options, real estate tops the list of the best for generating monthly income. There are plenty of features and characteristics that make real estate so compelling. First, it offers an appreciable tangible asset with statistical chances of appreciation over time, hence prospective capital gains apart from the rental income. Secondly, rental properties can produce steady and predictable cash flow if they are located in areas with high demand instances.

In addition, real estate investments have tax benefits by deductions on interest paid for mortgages and property depreciation to help maximize returns. Direct investment into rental properties and indirect through instrument REIT shall ensure a steady and probably worthwhile monthly source of income.

Which Investment Has the Highest Return in South Africa?

Historically, one of the most substantial return performances in South Africa can be achieved by dividend-paying stocks. These belong to well-established companies that frequently share a portion of their profits with shareholders as dividends. High returns from paying dividend stocks may be credited to several variables. First and foremost, such companies are usually characterized by good financial health and stable cash flow tides, enabling these firms to maintain and increase dividend payments.

Second, investors benefit from capital appreciation as these stocks will appreciate over time. Last but not least, reinvestment of dividends can substantially add to overall returns due to the power of compounding. Telecommunications, banking, and utility companies usually lead in terms of return on dividend-paying stock; hence, they gain increasing attention as an income investment.

Which Bank is Best for Investment in South Africa?

Regarding banking, Capitec is usually considered one of the best banks in South Africa in which to invest. Capitec has various savings and investment products that can meet the different needs of investors. Their savings accounts are beautiful, with interest rates ranging as high as 9.92 percent per annum on fixed-term savings. What makes this much more attractive to the person who wants to increase his money safely is its high return.

Capitec’s flexible savings options also help investors earn interest from their day-to-day banking accounts with the bank, thus concentrating liquidity and growth potential in one place. Investment management with Capitec has also been facilitated through its very user-friendly digital banking platform. Added to these is its competitive transparency on fees and customer-driven banking approach, which make Capitec one of the highly sought-after South African investors eyeing secure and yield-competitive investment products.

![What are ETF [Exchange-Traded Funds]?](https://www.searche.co.za/wp-content/uploads/etf.webp)