IRR is an indispensable tool in multi-step investment analysis, especially in South Africa. It’s a way for investors to comprehend and ascertain the relative profitability of various projects or investments. Other than simple metrics, such as Return on Investment, it considers time value concerning money with fluctuating cash flows over periods.

IRR helps a business or investor compare different projects to determine the best financial return one can expect from them. This broad-based guide examines how to calculate IRR, what it means, how different it is from ROI, and finally, what a good IRR will be.

How to Calculate the IRR

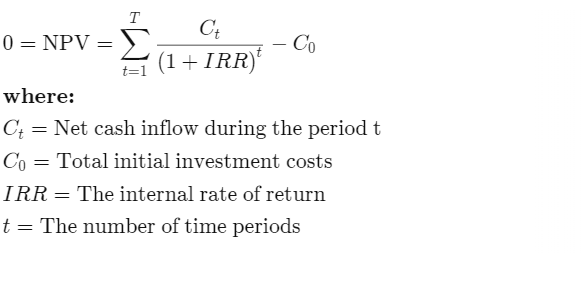

The underlying principle of return rate computation involves finding the discount rate at which all cash flows’ net present value equals zero. IRR, in its pure sense, is an interest rate at which the present figure of a series of cash inflows equates to the present cost of the outflows.

The method for computing this value is cumbersome because it’s calculated as the solution to an equation. It is usually figured out by trial and error or using financial calculators or software like Excel. The formula is:

In South Africa, firms often apply IRR to assess infrastructure or building projects. Take, for example, a housing estate. A real estate development firm would compute the IRR in developing a residential complex from forecasted cash flows over some years. If the IRR is greater than the company’s capital cost, that would signal it to be viable and profitable. Given the inflation rate in South Africa, these need to be deflated cash flows to outline the value in real economic terms. With modern financial tools, IRR calculation is relatively easy; hence, there is more scope for investors to make informed decisions.

What Does IRR Tell You?

The internal rate of return is an excellent indicator to show the profitability of an investment. It helps investors within a country understand if their investment will meet the required set financial objectives that were aimed to be achieved. In this regard, the IRR comes as a percentage that identifies the estimated annual income a specific investor can have upon investing in a project.

If, for instance, a SA local mining firm realizes an IRR of fifteen percent, this would mean that the project is expected to realize a return of 15% per annum on the venture capital. Investors can compare the IRR to the company’s required rate of return. This could be predetermined by projected inflation and risk to decide whether or not this project targets set monetary goals.

The IRR is also important for the level of risk in the said investment; the IRR may be high but with an increase in a high level of risk. Such a project would attract investors to balance between return on investment against uncertainties. Again, most industries or sectors are seasonal; therefore, South Africa will obtain cash flows at different times, and the cash flow timing will increase significantly when the cash flows are in the earlier stages.

What is the Difference Between IRR and ROI?

Internal rates of return and returns on investments sound like two mostly confused words. However, they hold different meanings and uses. The ROI, in its case, is easier to calculate; moreover, it provides the percentage one has returned from an investment in a particular period. Also, it does not consider the time value of money. The formula for deducing the same is expressed as:

- ROI = (Present Value – Cost of Investment/Cost of Investment)x100

On the other hand, IRR takes time value into account; therefore, it beholds the performance of an investment more subtly. ROI is helpful in simple analyses, such as deciding whether to purchase or sell something short-term in South Africa’s vibrant retail market. IRR is better applied to long-term investments, such as infrastructure projects, where the timing of cash flows is relevant.

For example, let one investor from South Africa use an approximation of immediate gain or loss with the help of ROI when buying bonds. At the same time, IRR will be more suitable for a long-term property development project. Calculations of IRR are more complicated, but they are a complete picture, especially for those kinds of investments whose cash flows change significantly.

IRR thus provides a better understanding of investment performance over time. Hence, it is a better tool in SA’s mining, real estate, and agriculture industries.

What’s a Good Internal Rate of Return?

This rests on many factors, including the nature of the venture. Therefore, a good IRR in SA should be an IRR that is more than inflation and offers a return above the investor’s required rate of return, which may be between 8% and 15%, given the industry involved.

For example, in estate investment, a property development project would view an IRR of 12% to 18% as good. This shall be some rate representative of the effect of inflation on the economy besides a corresponding risk such as policy changes or fluctuations within the market. However, an IRR of 10 percent could still be attractive to its renewable energy industries in South Africa due to the lesser risks because of the incentives given by the government.

Investors also have to consider the risk profile of a project in an attempt to determine where an IRR is considered “good.” A high-risk venture-say, a tech start-up in SA, requires a much higher IRR, 20% or more, to justify the investment. In contrast, a stable, governmentally-backed infrastructure project may provide a much lower IRR but significantly less risk. Hence, while there may not be an across-the-board answer, what constitutes a good IRR in South Africa is to comfortably outstrip the investor’s required rate of return and adequately compensate the investor for associated risks with the project.