Finding out you have a bad credit report and poor credit score can be depressing. There is hope, however! The information on your credit report is regularly updated from a variety of financial sources to show an accurate picture of your creditworthiness right now. While historical data does have an impact on your overall score, there is a limit to how long things stay on the record. Your 16-year-old mistakes with your first credit card won’t still be haunting you when you are ready to retire! Likewise, it means that having a good credit score right now won’t mean you still have that shiny pretty score in the future. Instead of seeing a good credit score as a one-and-done thing, view it as your constant companion on your financial journey. Here’s more in-depth information on how long information stays on your report in South Africa, and what you can do about it.

How Long Does Information Stay on my Credit Report in South Africa?

In South Africa, how long information stays on your credit report is governed by the National Credit Act (NCA). This lays out certain ‘retention periods’ governing how long specific types of information can be shown, both good and bad. Even if you settle an outstanding account that caused a court judgment, for example, the judgment itself will still show until the retention period expires. Likewise, your great payment history to date will only count for so long, especially if it deteriorates.

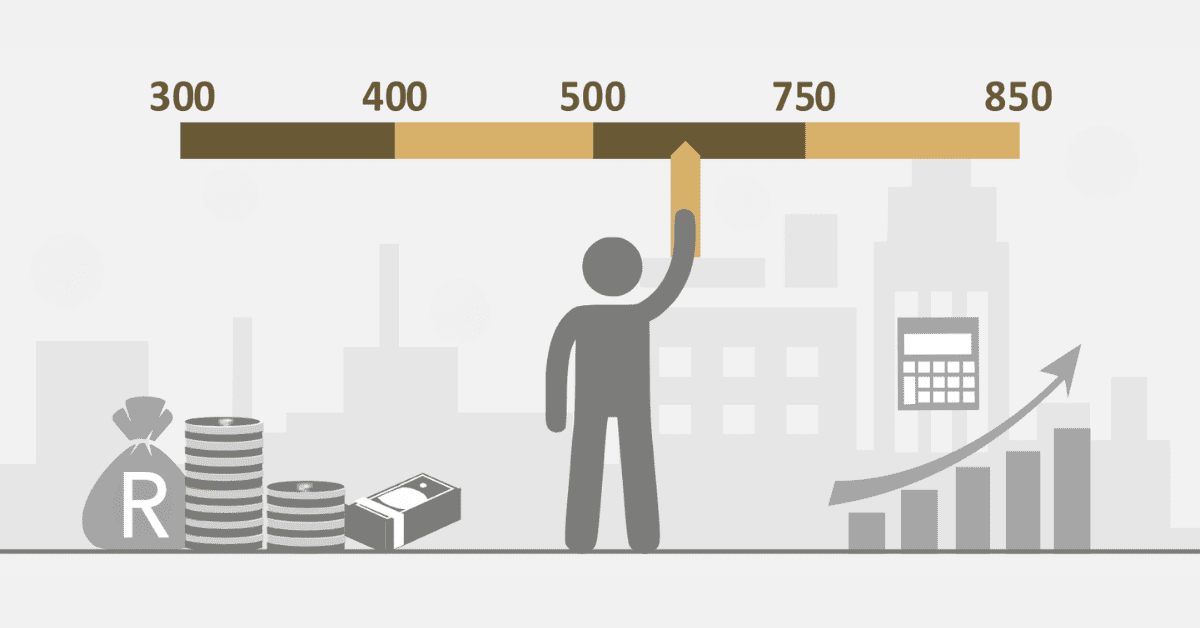

Payment history is an important part of your credit report. It is also one of the most dynamic pieces of information there, changing every 30 days. At least in theory, reporting delays happen! Commonly, credit reports will show a rolling 12-month picture of payments and whether they were on time for every credit line. Credit utilization, or how much of a specific credit card or access loan you have used, is also updated every 30 days and has no lingering impact past that. Other positive aspects of your credit use can have an impact for anything from 1 to 5 years before it falls off.

How Long Does Negative Information Stay on My Credit History in South Africa?

So that’s the good stuff. However, few of us have only good behavior on our credit reports. If that’s you, congratulations! If you are worried about negative information staying on your credit history, however, there is some more good news. The credit score/report system isn’t intended to punish you for past mistakes, but rather accurately show how well you use the credit you already have. This lets lenders decide if you are a good risk or not.

So how long specific negative information stays on your credit report will hinge on how bad the situation was. Simple things like a missed payment here and there will soon fall off as it is replaced with fresh data, within a year. If you default on a credit line, it will show on your report for up to 2 years. Only the worst-case scenarios- like bankruptcy rulings and court judgments- will linger for the full 5 years.

How Do I Clear My Bad Credit History in South Africa?

Clearing a bad credit history takes time, diligence, and strategic pl anning, but it can be done. And quicker than you may think. Start by obtaining a full copy of your credit report from a reputable credit bureau. Even better if you can get several reports from the main bureaus, for a clearer understanding of your credit position in their eyes. If you know you have a bad credit score, don’t rely on third-party information for this step. Rather get a report directly from the bureaus. This ensures it is as fresh and error-free as possible.

Scrutinize the report for inaccuracies and discrepancies, ensuring that all the information aligns with your financial activities. If you spot errors or potential fraud, dispute them promptly with the relevant credit bureau. It’s also not uncommon for remedied accounts to stay on your report longer than they should. This can also be raised with the bureaus. This should clear up any false or outdated information on your credit report and could give your score a quick boost, too.

For legitimate negative entries, you need to get serious about fixing them. You may need to comply with a court order, approach a debt consolidation company to get a handle on your credit and reduce your overall payments, or negotiate with each lender to find a payment plan or alternate solution. For some of these solutions, it will still take time before the positive impacts show on your report. But the sooner you start, the quicker those good results will arrive.

Now you need to improve your behavior with credit for long-term improvement. You can’t continue to be irresponsible and magically bluff your way into a good credit report! Consistent, on-time payments, settling outstanding debts, and avoiding accruing further negative information will contribute positively to your credit report over time. Don’t hesitate to get professional advice or help if you need it. Remember, patience is key, as the impact of negative information gradually diminishes over the 5 years.

How Long Does it Take for Credit to Expire in South Africa?

Most negative items will expire from your credit report within a year to two years. Only major issues like bankruptcy and court judgments will linger for the full 5 years. Most good credit behavior will impact your account for at least 2 years, with some positive elements also lasting for 5 years.

How Long Does a Closed Credit Card Stay on Your Credit Report?

If you choose to close a credit card, it will immediately move from an active credit line to a historical one. Here it will linger for 5 years to show lenders a picture of your previous good financial behavior. If you are forced to close a credit card due to poor management or a default, how long it impacts your credit report will depend entirely on how severe the issue was and the way it was solved. Defaults will actively show for 2 years, and judgements for 5. After 5 years, however, the card will fall off of your credit history either way.

Your credit report history isn’t forever. It is possible to rehabilitate previously bad credit, and just as possible to mess up good credit. So instead of viewing good credit history as something you only need when applying for credit, rather view it as an ongoing part of your overall financial health.