At some point in life, you need to obtain a loan to buy a home, get a loan to start a business, or borrow money to buy a car. A good credit score will help you qualify for the loan and get a competitive interest rate. However, having a good score can be a daunting task, especially when you are still new to the world of credit. While the credit card system is one of the easiest ways to build your credit score, it is not the only option that works. Read on to learn how to improve your credit score without a credit card.

Is It Possible to Build a Credit Score Without a Credit Card?

Yes, it is possible to build a credit score without a credit card. Although a credit card helps you build a credit history, you can still achieve this feat through other methods. All you need to do is to exercise financial discipline to demonstrate to lenders that you are capable of handling your finances. This leads to the growth of a positive credit score.

How to Improve Your Credit Score Without a Credit Card

If you are still fresh from college, your credit score might be insufficient to help you qualify for a credit card. However, other methods can help you build your credit history. First and foremost, you need to have a bank account to begin the journey of building a credit score. Credit bureaus collect financial information used to calculate credit scores from banks and other financial institutions.

Once you open a bank account, you can use it to perform different transactions, which leads to the development of your credit score. For instance, you can use your debit card to pay your rent, bills, and other utilities. Make sure you make timely payments to build a good credit history. The service providers can report your account to collection companies if you make late payments, which leads to a negative credit rating.

If you have an outstanding student loan, you should repay it once you get employment. The lender will first send a letter of demand, but if you are not yet gainfully employed, there would be no way you can repay the loan. Once you start repaying your loan, you should not miss a payment since this information will go into your credit history.

If your bank offers an overdraft facility, you should use it responsibly. By developing a healthy relationship with your bank, you can qualify for a personal loan or other small amount you can repay. Never miss a payment to build a mutual relationship with your bank. This is the best way to start building your credit score.

Additionally, you also need to open an account with a clothing store like Edgars where you will obtain a retail card. Your payment history on this account will contribute to your credit score. Maintaining your account by making timely payments can go a long way in helping you build a formidable credit history.

Another option you can consider to improve your credit score without a credit card is to enlist the services of a co-signer. If you are still single, you can ask your parents to obtain a loan on your behalf, you will be responsible for repayments. If you default on your loan repayment, the co-signer will be liable. Before choosing this option, make sure you borrow the money you can repay to protect your relationship. Whatever option you choose, remember to start small.

How Long Does It Take to Build Credit Without a Credit Card?

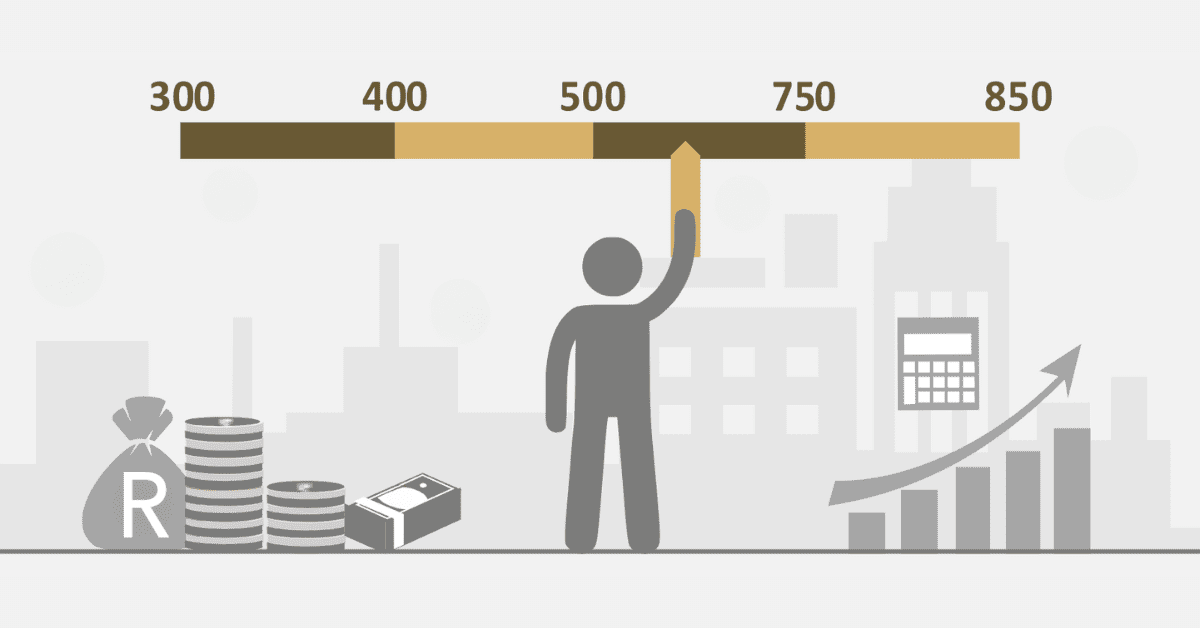

It takes commitment and time to build credit without a credit card. You should start by educating yourself on how credit ratings work. The process of building a credit score from scratch can take anything from six months up to 18 months. If there is some activity on your account, it will generate enough history that can be used to calculate a FICO score.

What Happens to Your Credit Score if You Don’t Use a Credit Card?

If you already have a credit card, inactivity can lead to the closure of your account or your credit will be limited. At first, it does not hurt your credit score if you don’t use your credit card for a long time. However, if the lender notices that your credit card has been dormant for a long time, it may be eventually closed. The credit company will not inform you about this decision. To be safe, you should use your credit card at least once every month.

Once your credit card has been deactivated, your credit score is likely to be affected. The impact of a closed credit card may be used to demonstrate that you are an irresponsible borrower who cannot maintain credit. This negatively impacts your credit score.

Additionally, your credit history will be shortened once your credit card is closed. The length of your credit history is one of the major factors considered by credit bureaus when they calculate credit scores. Lenders can check your history to see if you’re not a high-risk borrower. A long credit history contributes to a good credit score. On the other hand, if your credit card is closed, your credit utilization rate will be affected. Therefore, you should try to keep your credit card active.

Building a credit score from scratch can seem like a daunting task, especially without a credit card, but it is possible. Everything has a beginning, so you should not stress. By following these tips, you can build a healthy credit score in about six months to two years.