What have you heard about credit scores and car insurance? Is there a direct relationship between car insurance and credit score?

This blog will be a great guide for those who may need to learn about credit scores and car insurance.

When figuring out insurance rates and fees, credit scores are often taken into account by insurance companies. Insurance rates tend to be lower for people with better credit. For this reason: it shows responsible money management and a lower chance of making claims. Someone with bad credit, on the other hand, might have to pay more for insurance because they are seen as more of a risk. Along with driving records, age, location, and other relevant factors, insurers use credit scores to figure out how much of a risk a person is and how to set their rates.

Let us find out more about how credit score affects car insurance. This will give you an instructive thought when planning to buy car insurance.

Does your credit score affect your car insurance rate?

Certainly, your existing credit score can affect your car insurance rate. There is a direct relation between car insurance rates and credit scores.

Do not confuse yourself, car insurance and car insurance rate are two different things although one precedes the other. You get to get a rate for your car before your insurance is processed.

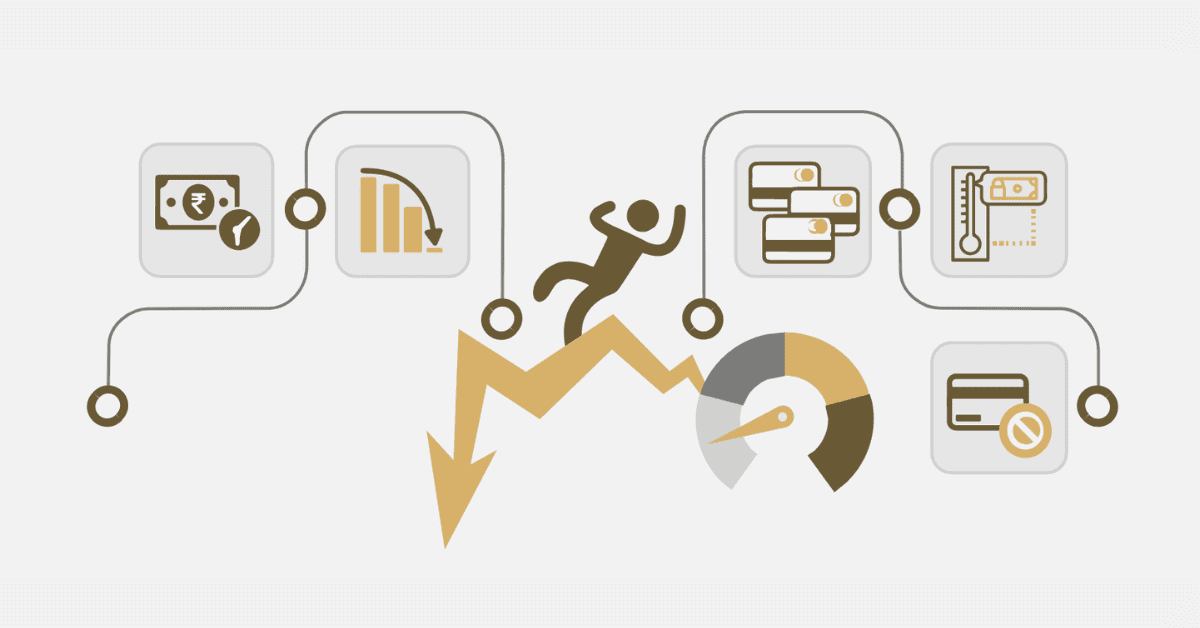

Once you seek an insurance rate, insurance companies will inquire about your credit score. Once your credit score is below the minimum, you may have to pay a higher insurance rate or premium. This confirms your credit score has a direct effect on your insurance rate.

How your credit score affects your car insurance

A lot of insurance companies use your credit score as one of the things they use to figure out how risky it is to insure you.

The numbers show that people with higher credit scores usually make fewer claims. A good credit score makes you seem like a more responsible person in general. You pay your bills on time, you probably follow the rules of the road, and you are not as likely to ride your car through a ditch.

If your credit score is excellent, insurance companies may offer you lower rates because they see you as less of a risk. If you have bad credit, on the other hand, they might be a little wary because they think you are more likely to make claims in the shortest possible time.

When you think of your credit score, you can compare it to your insurance rate. The better it looks, the better things go.

Companies that offer complete car insurance base their rates on several things, such as your age, your driving record, and the type of car you drive.

In South Africa, car insurance companies divide their customers into two groups based on their credit scores: those who are low risk and those who are high risk. Customers with better credit are seen as less of a risk, so their insurance rates can be lowered. People with lower credit scores, on the other hand, are seen as high risk and have to pay more for insurance. It is important to note that the insurance heads set the rates for third-party insurance for vehicular machines, and credit score is a major factor in setting these insurance rates.

What is the best credit score for car insurance?

Considering the categories and variations in credit score many people are always looking to negotiate better for car insurance.

The negotiations although may go well, a higher part of it depends on your credit score. Do you have a good credit score to secure the best insurance for your car?

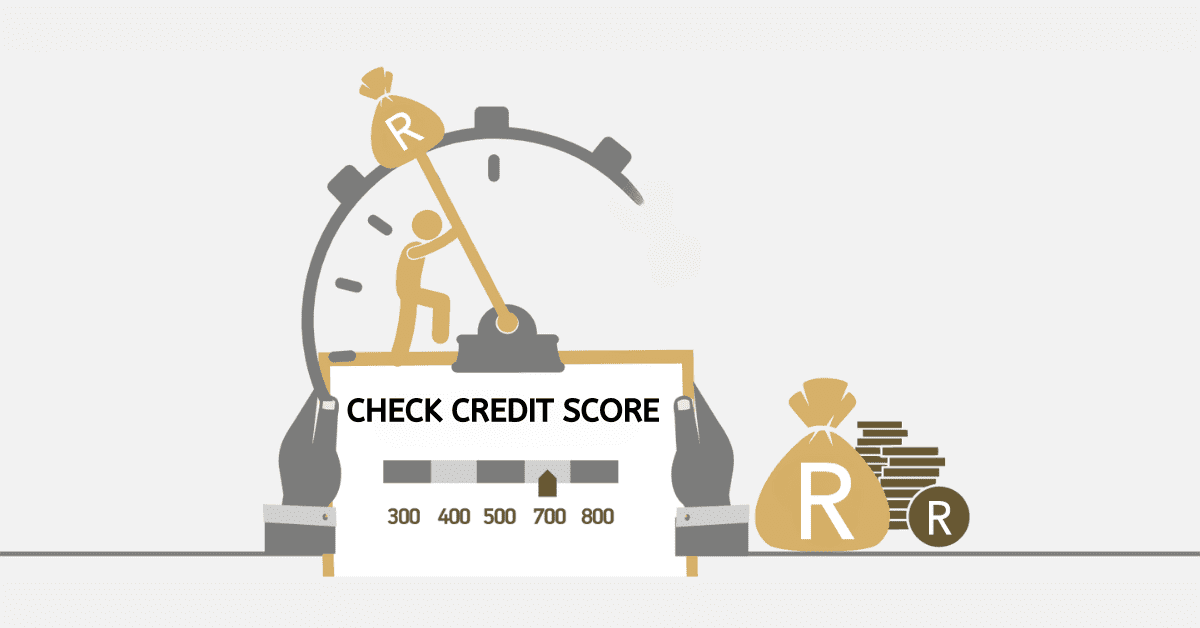

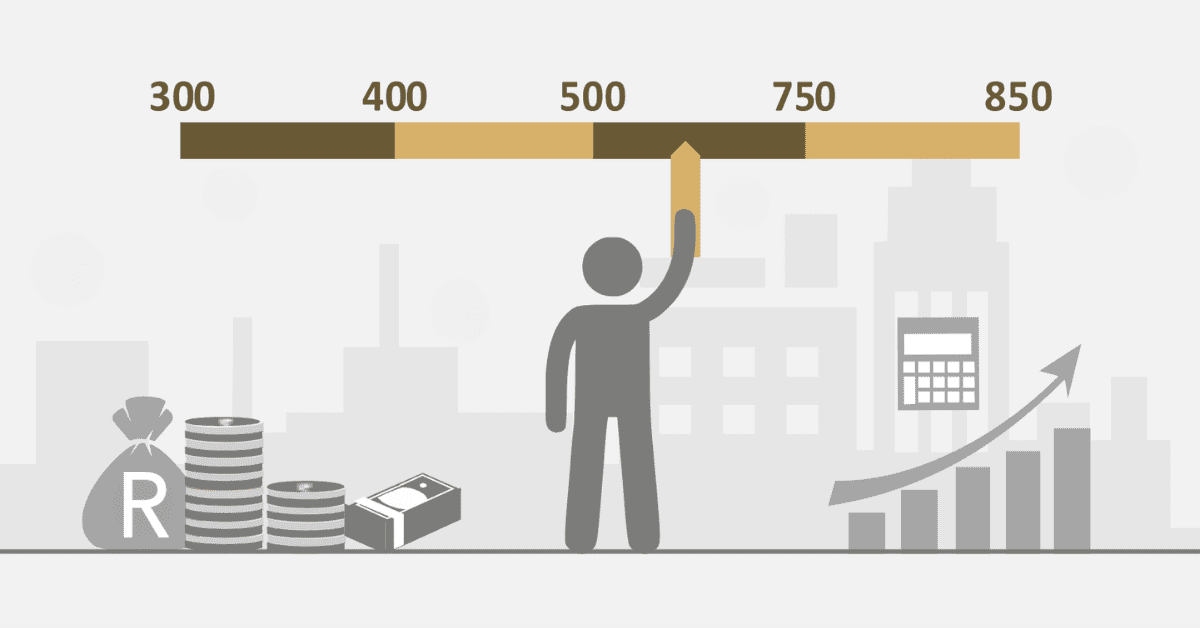

When it comes to the best credit score for car insurance, any credit score above 800 will be considered.

Of course, the benchmark is high but the focus is on the best credit score. When you have a credit score of 800, your chances of securing loans become easy.

Does your credit score affect your car?

If it is just concerning your car and not part of a particular service then there is no effect of credit score on your car.

However, some may argue that your credit score has an indirect effect on your car. But the reality is that your car has no link with your credit score unless there is a particular service you seek for your car.

How is a credit score used in insurance?

Almost all insurance companies look at your credit score before giving you a premium. Someone with a good credit score likely pays a very low premium, while someone with a poor credit score pays a high premium.

These parameters have been set by the insurance companies to define who gets a good insurance rate.

When you request insurance, the company will look into your credit score, which could be a soft inquiry. Once the credit bureau provides the necessary details, the insurance company will assess your credit score and see where you fall.

The category to which you may belong will be used to calculate as a factor for your insurance.