A credit score is used as a measurement of your financial health. Lenders also use it to determine your creditworthiness and interest on loans. A good credit score also comes with several benefits, such as easy approval by landlords, favorable insurance premiums, and you can even use it to make money. This article explores how you can use your credit score to make money.

How do you use your credit score to make money?

The following are the credit score ranges used in South Africa to determine your creditworthiness.

650 +: Excellent credit. You can get credit easily at a low interest rate.

600 – 650: Very good credit. You can get the best loan at a favorable rate.

550 – 600: Good credit. With this score, you can get a good loan deal at an acceptable rate.

490 – 550: Sub-prime. You may face challenges to getting credit and charged higher interest rates.

490 and below: Poor credit. People with this credit score usually do not qualify for loans.

When you have a good credit score and above, it means that lenders will treat you as trustworthy. You can use your credit score to make money in several ways, as explained below.

With a good credit score, you will qualify for credit cards that offer bonuses and other packs including the following:

- Sign-on bonuses

- Gift cards

- Cashback

- Discounts on certain products and services

These offers will help you save money

Owning a home is everyone’s dream in South Africa. When you have a good credit score, you will qualify for a mortgage that comes with a favorable interest rate. When you repay your mortgage loan, you will be able to build equity in your home by driving down the total amount you owe for the property. You can convert your equity into cash if you want to improve your home or use the money for other purposes. Additionally, the value of your house appreciates over time, so you can sell it for a higher price to get more money.

A good credit score can help you access a loan to buy investment property. When you invest in property, you will become your own boss by generating passive income from monthly rentals. Property investment comes with long-term security since you can use it as collateral in other business transactions. It also acts as a hedge against inflation. The value of property appreciates over time instead of depreciating.

People with good credit scores can obtain business loans to start their businesses. However, it takes a few years for your business to be profitable to give you healthy returns. When utilized properly, the borrowed money can generate healthy profits, which helps you repay the loan together with interest. Starting a business venture is one effective way of securing your future financial health.

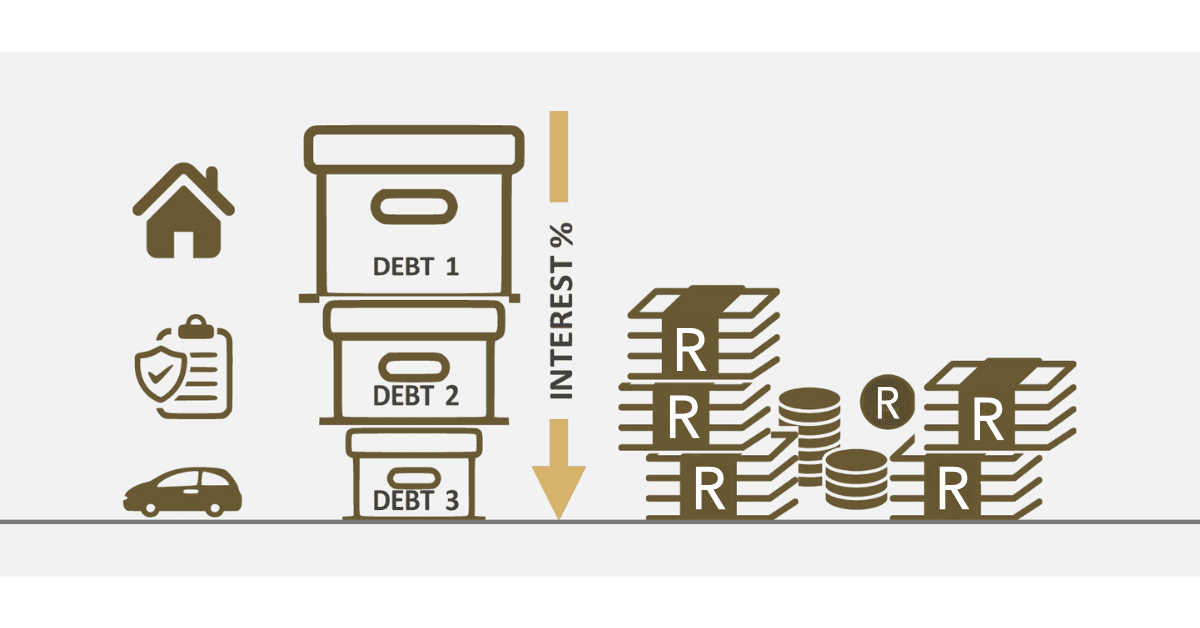

When you get the best loan deal at a favorable rate, you can save money on interest charges. Getting low insurance premiums because of your good credit record also helps you save money that can be channeled toward other uses.

How Can I Use My Good Credit Score?

You can use your good credit score to improve your financial position by saving money on lower interest rates on loans or getting fair insurance premiums from insurers. With these benefits, you will not waste money on meeting your financial obligations. Your credit score will also help you get better credit card rates and rewards, which you can use to your advantage.

Other benefits of good credit include credit card offers such as cashback, sign-on bonuses, gift cards, airline miles, travel points, and discounts on specific products and services. More importantly, you can use your good credit score to obtain a mortgage and become a homeowner. Thereafter, you can use your home to build equity, which helps secure your financial future.

Can I Cash Out My Credit?

It is possible to withdraw cash using your credit card, but this is expensive. However, you need to understand your credit card terms and conditions first. Other credit cards come with limits and this can affect you when you want to withdraw cash. When you reach your limit, you will not be able to access additional money until you repay what you owe.

What Are 2 Advantages of a Good Credit Score?

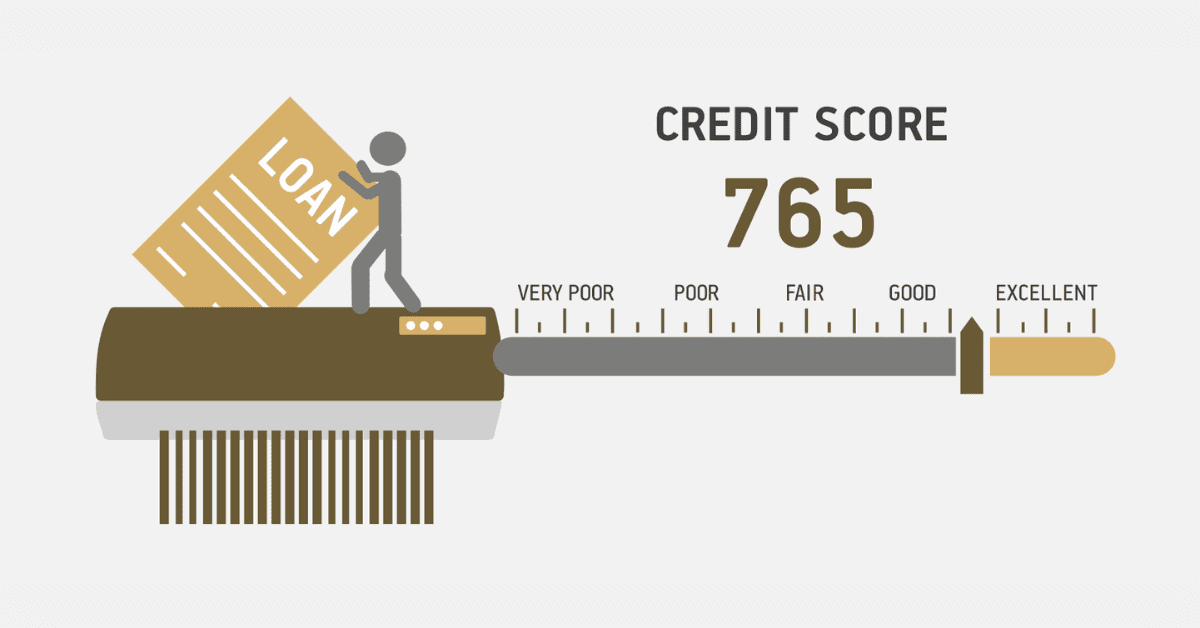

A good credit score allows you to borrow money from different lenders at favorable interest rates. For instance, you can apply for an auto loan, business loan, mortgage, or any type of personal loan from different lenders. A high credit score is a sign that you are trustworthy and capable of repaying your loan. However, a poor credit score will impact negatively on your financial status. Many lenders usually decline loan applications for applicants with low credit scores. If you are lucky enough to get loan approval with a bad credit score, you are likely to be charged a high-interest rate.

Another advantage of a good credit score is that it helps you get lower insurance premiums from insurers. When you have a high credit score, you can save money on car insurance because insurers will consider your track record. Poor credit scores are often associated with financial indiscipline, and insurers will take this into account. If you have a lower credit score, insurers will consider that there will be a chance of you filing a costly insurance claim. As a result, people with poor credit scores are often charged high insurance premiums.

Maintaining a good credit score comes with many benefits. Apart from getting loans at lower interest rates, your credit can help you save a lot of money. You can make money using your good credit score in different ways. For example, you can obtain a loan to buy investment property, which will generate passive income in the long term. Alternatively, you can get a loan to start a business that generates more revenue once you start operations. Remember to use your loan wisely to enjoy steady income generation.