One thing that you can never take from the South African government is how their social security agency treats the lives of their citizens.

There have been so many interventions and initiatives made to support individuals who, for some reason, maybe in dire need.

The South African government has created policies, ideas, and systems to protect individuals and also support them in the long run. These innovative ideas create a liberating environment for many South Africans. When we look at the inception of UIF, we see how supportive this scheme has been. While PAYE has also given enough to the government to cushion the vulnerable in hard times. Not only that, but PAYE is all about taxes, and these taxes are used to provide infrastructure and solve other socio-economic problems.

These policies and systems include PAYE, UIF, and many more.

In this blog post, we will discuss what PAYE and UIF entail. Give you a background on their differences and registration processes.

In this article, we will give you precise and concise information on how to update PAYE on the UIF database, explain the difference between PAYE and UIF, and provide other related information.

How To Update PAYE On The UIF Database

It is evident that the South African government seeks to establish a robust system, including a progressive tax system through PAYE and the unemployment insurance fund.

Although these two are different, they are born from one institution. South African citizens who acknowledge their inclusive activity in a system will always be ready to support it. Also, when these individuals understand that the system will help them both in the short run and the long run, they provide enough supportive information.

Many individuals who wish to update PAYE on the UIF database but cannot do it can follow these simple steps and complete the process.

These systems are interconnected to connect affiliated initiatives and keep records for future reference. This process is more linked to the employer than the employee. However, as an employee, it is not wrong to learn and understand how to update PAYE on the UIF database.

A simple guide on how to update PAYE on the UIF database

- Click this link to download the UI.8 form – https://www.labour.gov.za/DocumentCenter/Forms/Unemployment%20Insurance%20Fund/UI-8_application-for-registration-as-an-employer.pdf

- Complete the form and submit it via email or in person at the nearest SARS office

- Ensure to add your SARS certificate and any other relevant registration documents

- Send the filled form with all documents to this email: newui8registrations@labour.gov.za

- Forms submitted in person must be well-signed and stamped.

Are PAYE and UIF the same?

If you ever thought PAYE and UIF were the same, then here is how to differentiate the two.

UIF, which is the unemployment insurance fund, is a requirement in South Africa. This scheme provides short-term financial support to people facing unemployment challenges. Although it focuses on unemployment, there are certain categories or qualifications from which one can derive UIF benefits. The UIF is all about benefits but comes with a little sacrifice. The sacrificial aspect involves ensuring your details are registered, and your required contribution is made.

With UIF, employees who work more than 24 hours per month are required to make their contribution after registration. This contribution constitutes at least 1% of your gross monthly salary and 1% from the coffers of your employer.

Now, looking into PAYE, this is considered the “pay as you earn” scheme. If you are employed, you are obligated to pay a portion of your gross salary as tax to the government of South Africa. The PAYE tax is a progressive tax rate that aims to promote equality among the employed population. In this case, your tax rate increases as you earn more. Individuals who earn more will have to pay more taxes as compared to individuals who earn less.

Certainly, you have understood how BOHT works, and although these two may have some links, UIF and PAYE are not the same. They are both governmental institutions that serve their citizens, but the policies, rules, and regulations are not the same.

How do I register for PAYE and UIF?

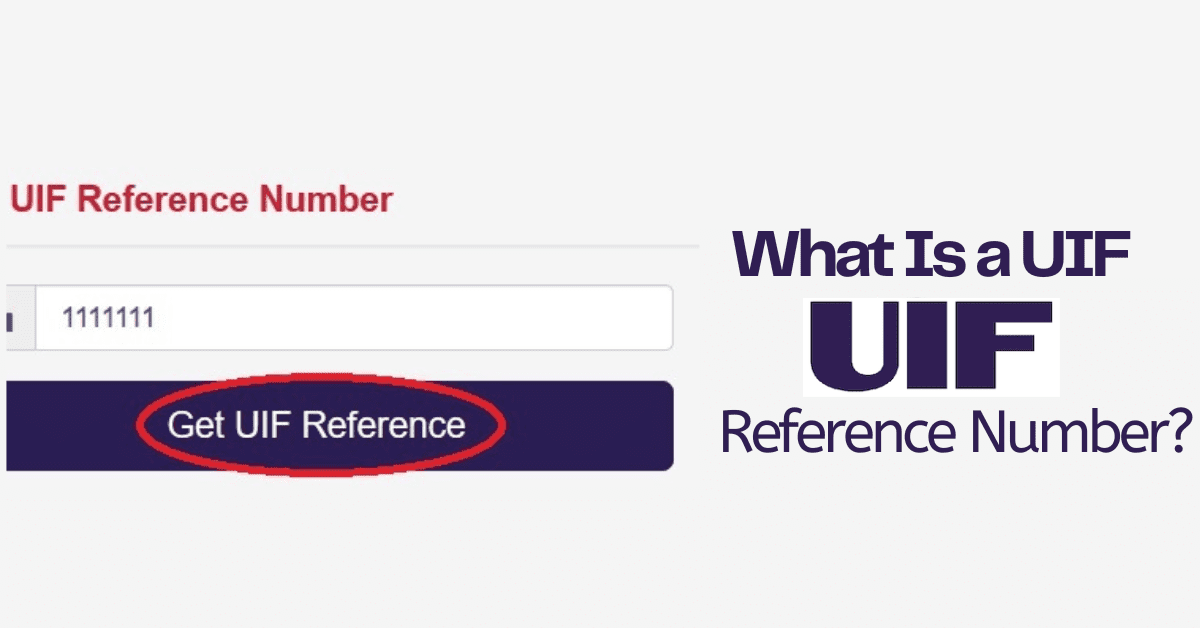

It can be simple for an employee to register for both PAYE and UIF at the same time. Once you do it, different identification numbers are allocated for all relevant payments and contributions.

To register for UIF, you can submit your company details, which include staff size, company location, business profile, etc., to SARS. The details submitted will also be used to create a PAYE number during the process.

These details are shared within the systems.

But to ensure your UIF registrations, you can submit the same details to the Department of Labour after the PAYE process has been completed.

You are required, as an employee, by law, to submit your details to SARS for PAYE registration within 21 days of registering your business.

Regarding UIF, you are required to do this as soon as you have employees working under you.

How do we calculate PAYE?

There are two ways to calculate employees’ taxes that the tax authority (SARS) accepts.

Periodic method: this method is used to calculate taxes separately on every single payslip using the monthly tax tables. It looks at the monthly income separately.

Averaging/annual equivalent method: this method considers the employee’s total income for the entire tax year up to the current date and uses an annual equivalent to calculate taxes.

The above methods can be used to determine the tax an employee will pay.

Using the assumption below, you can have an idea of how to calculate PAYE in South Africa.

Preambles.

Tax year: 2026

Monthly salary: R 10,000

Employee's age: 30

Supposing the Employee has no additional deductions or tax credits

In South Africa, tax rates are based on a person’s taxable income and change with their age. Let’s say that the employee is in the 18% tax bracket for the sake of this case.

Applying the right tax rate to the taxable income tells you how much tax you have to pay. But before we can figure out how much tax we owe, we need to look at the tax levels and apply any rebates that apply.

So, let us look into the tax liability of the employee

R10,000 x 12 months = 120,000

Determine these factors Tax threshold Primary rebate Secondary rebate Tertiary rebate

Tax liability Income x 12 months = ?? If the taxable income falls above the tax threshold, you subtract the tax threshold from the taxable income and vice versa. Table income - Tax threshold = ???

Using 18% of the tax rate

Tax rate x Taxable income = Payable tax

Assuming the period is 12 months within the year Tax liability divided by the number of periods which is 12 = The actual tax to pay