Keeping your SARS information up-to-date is essential for compliance with South African tax rules and regulations. It guarantees that your tax returns are handled efficiently and on time, preventing delays or complications that outdated data may cause. You can prevent penalties or fines for noncompliance by routinely updating your information.

Updating your SARS details online is a quick and easy process that can be done through the SARS eFiling website. In this post, I will take you through the process in a step-by-step guide to make it simple for you to keep your details up to date and stay compliant with the tax laws and regulations of South Africa.

How to Update My SARS Registration Details Through Efiling?

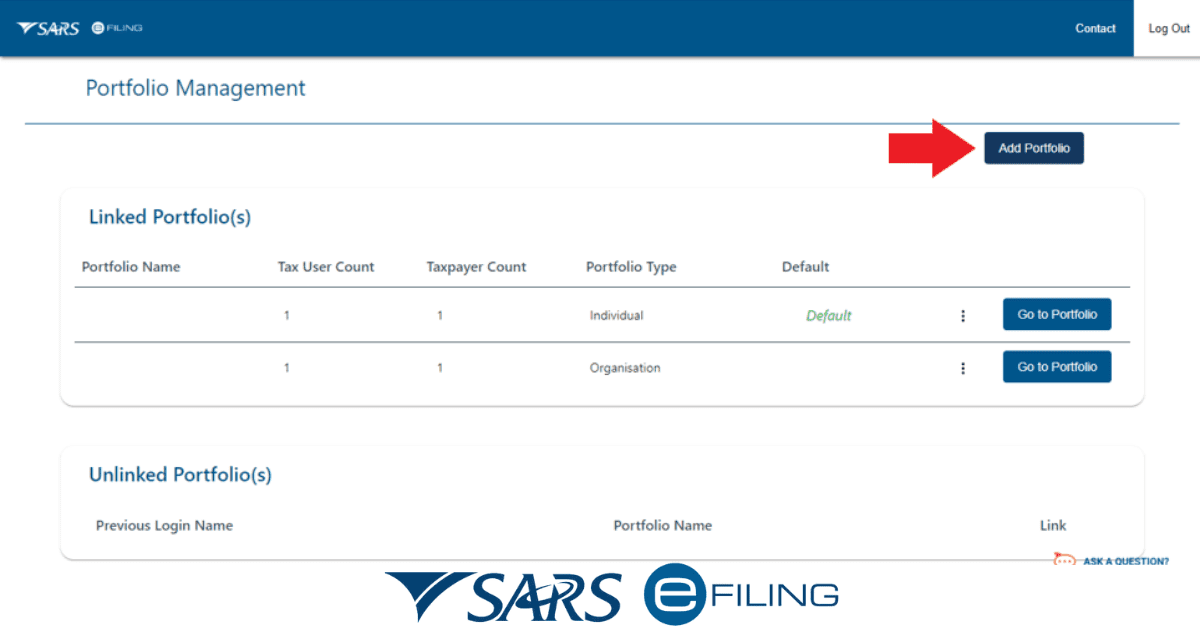

Updating your SARS registration details online is an easy process that can be completed in just a few simple steps. If you are registered for SARS eFiling, you can use the following guide to update your details:

- Log in to the SARS eFiling website using your login credentials.

- Login and navigate to the “Home” tab and select “SARS Registered Details” and “Maintain SARS Registered Details.”

- On the next screen, you need to click “I agree” to access your SARS registered details. This will open up an Adobe form displaying your current information. If you have trouble viewing the form, make sure you have the latest version of Adobe installed on your browser or try accessing the website using a different browser. If you still face difficulties, contact SARS directly at 0800 00 7277 for assistance.

- Once the form is open, select the relevant tab on the left to update your details.

- Please fill out the form with your updated information and review it to ensure everything is correct.

- Once you are satisfied that the information is accurate, click “Save” and “Submit Form” to complete the process.

When you follow these steps, you can ensure that your SARS registration details are up-to-date, avoiding delays or issues with your tax returns. Remember that keeping your information current is crucial for compliance with the tax laws and regulations of South Africa.

How to Upload Supporting Documents (Relevant Material) On Efiling?

Submitting supporting documentation to the South African Revenue Service (SARS) is a crucial part of the tax filing procedure. These papers validate the information on your tax return and guarantee that your taxes are computed accurately. SARS may need several documents.

Some of the documents you can upload include the following:

- IRP5/IT3(a) Tax Certificates

- Certificates for local interest income, foreign interest income, and foreign dividend income

- Retirement Annuity contributions

- Medical aid certificates

- Logbooks for travelling allowances

- Other documents related to income or deductions

To add supporting documents, please follow these steps:

- Login to eFiling

- Select “Returns” and “Returns History”

- Choose the applicable type of tax (e.g. ITR12, Employees Tax)

- Select the specific return or declaration for which you need to upload supporting documents

- Click “Open” to open the work page.

- Scroll down and click the “Supporting Documents” link

- Select “Browse” and navigate to the correct file directory

- Select the document(s) to be uploaded

- Verify the file information and click “Upload.”

- The uploaded documents will be displayed on the work page. Click “Submit to SARS” to send the supporting documents.

You can upload up to 20 files at a time on eFiling without submitting them to SARS. You can upload more files in another session. However, you should only submit the files once you have uploaded all the necessary documents. Once you submit the documents, you will not be able to upload any more files.

How to Change My Name And Address In Income Tax Portal?

As an eFiler, you can change certain sensitive details such as bank details, name/surname, or registered name for companies

To change your name and address in the income tax portal, follow the steps below;

- Log in to your Efiling account.

- Click on the “SARS Registered Details” icon under “My profile.”

- Users of Tax Practitioner and Organization portfolios must select the correct legal entity from the taxpayer list.

- The screen for maintaining SARS registered details will appear.

- Confirm that you are authorized to change the registered details of the company or individual. By selecting “I agree,” you confirm that you are authorized to perform maintenance on the company or individual’s registered details. Selecting “I do not agree” will prevent you from continuing with the functionality.

- The message “Saved Details” will appear if SARS has received updated information for the legal entity.

- Click on the “Display Latest Form” to view the latest information at SARS.

- If the registered representative for the legal entity is activated, you will get a message containing information about your registered details.

- Click on the “Continue” button, and the RAV01 form will display.

- You can now change your name and address from the RAV01 form. Click on save when you are done, and your details will be updated.

How to Change My Address With SARS Online?

It is possible to update your physical address and postal address on the SARS eFiling system by utilizing the RAV01 form found on the “Maintain Details” tab. This form enables you to make changes and update the address information on file with SARS. The process is completed entirely online and can be done by following the steps outlined below;

- Login to your SARS eFiling account.

- Click on “Home” -> “SARS Registered Details” -> “Maintain SARS Registered Details.”

- Click on “I agree.”

- A form will open up displaying your SARS Registered Details. If the form doesn’t open, ensure you have the latest Adobe plugin installed or use an alternative web browser such as Internet Explorer, Chrome, Firefox or Safari.

- Select the relevant tab to update your physical residential and postal address on the left menu.

- When you are done filling in the new details, click “Save” and “Submit Form.”

After updating your physical residential and postal addresses on the SARS eFiling system, a verification process will be initiated. SARS will either confirm that your address information is correct or ask you to visit a nearby branch to verify your information. SARS may also send an email at a later time for verification purposes.

How Can I Change My SARS Tax Number Online?

Your SARS tax number cannot be changed online. Changing a tax number is typically done in person at a SARS branch office. You need proof that you are who you say you are and that your situation has changed, which is why you need a new tax number. It’s best to talk to SARS directly to find out the exact steps and requirements for changing your tax number.